It’s about to get a little more expensive to live in Alexandria. The City Council on Saturday (April 23) will set the real estate tax rate and likely increase the stormwater utility fee for residents by 5%.

In real terms, that means residents could expect to pay between $445 and $477 per year more in real estate taxes, as City Manager Jim Parajon’s proposed budget maintains the current tax rate at $1.11 per $100 of assessed value.

The $1.11 rate, approved by Council for fiscal year 2022, was a 2 cent reduction from the real estate tax rate of $1.13 in FY 2021.

In February, City Council approved a real estate tax ceiling of $1.115, a .45% increase, which gives them wiggle room in the budget process. Council could raise the tax to that rate to fund a project or initiative, but the increase is not accounted for in Parajon’s budget.

The public hearing is at 9:30 a.m. at City Hall.

Additionally, Parajon is proposing an increase to the stormwater utility fee, which would mean residents would pay $294, a $14 increase. Last year, the fee was boosted 100%, from $140 to $280, as Alexandria continues to remediate serious flooding issues.

The budget will be adopted on May 4.

(Updated 8:30 p.m.) As part of an upcoming overview of the budget, Alexandria’s City Council will be considering an increase in the stormwater utility fee (item 16).

The fee is scheduled to increase from $280 to $294 for the stormwater utility fee bill due Nov. 15 this year.

The increase is scheduled for second reading and a public hearing at the meeting on Saturday, April 23, with the final passage of the ordinance scheduled for Wednesday, May 4.

The increase is more modest than last year’s increase, which doubled the stormwater utility fee from $140 to $280 by November. The aim of last year’s fee increase was to help accelerate the timetable for needed stormwater projects.

The City Council is also scheduled to consider budget add/delete proposals as well as the establishment of the real and personal property tax rates, also scheduled for final approval in May.

While such a major change is unlikely to occur this year, Alexandria’s City Council recently considered ideas proposed by the Budget and Fiscal Affairs Advisory Committee (BFAAC) that could dramatically shape budgets in the future.

Amy Friedlander, vice chair of BFAAC, presented budget-related recommendations to the City Council at a work session yesterday (Wednesday), including two that raised eyebrows on the Council.

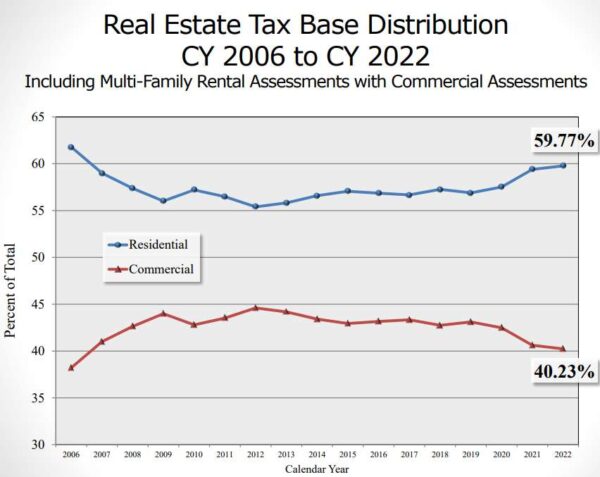

“We encourage City Council to keep the residential tax rate at current levels and that we recommend the council considers establishing a goal for the differentiation between the residential and commercial tax bases,” Friedlander said, “as well as considering perhaps decoupling residential and commercial rates. I know that’s a big policy change, but it’s something to think about as you proceed through the year.”

The city’s real estate tax rate — recommended in the City Manager’s budget to remain at the current $1.11 per $100 of assessed value — is the same for both residential and commercial properties. However, as Alexandria residential real estate owners could attest, the tax rate remaining the same is still an increase for local property owners as assessed values continue to increase substantially.

“The burden on the residential tax base is increasing due to increased assessments,” Friedlander said. “If there were possibilities to alleviate that pressure, decoupling the two of them might be one of them.”

Reception on the City Council was mixed, with some concerns that breaking the tax rate into two parts could put undue pressure on commercial properties or negatively impact renters, who get grouped into the commercial tax base.

“Obviously giving us more flexible tools is great,” McPike said. “My concern would be: if we’re raising commercial tax rates, that includes a lot of rental properties. While renters don’t pay property taxes directly, those get rolled into the rents they pay, so I wonder if there might be some sort of regressive impacts to that approach. That would be a concern of mine, but I think in general flexibility could be something that outweighs that.”

Mayor Justin Wilson called the suggestion “tricky.”

“There are winners and losers on any of these things,” Wilson said. “If the state gave us more flexibility there would be more options available, but practically speaking our choice is: do we fund our match for NVTA using the commercial setaside or use it funding a real estate tax that everyone pays. Today we do it with everyone paying it, we could do it with commercial paying it only, but that obviously has implications. When we talked about this last time we were concerned about small businesses with triple net leases where this goes directly to their bottom line.”

The other proposal that stirred discussion on the City Council was going back to a five-year Capital Improvement Program (CIP) to avoid situations where eventual costs far outpace initial estimates in the CIP.

Friedlander said BFAAC recommended potentially reevaluating the total timeframe of the CIP to include projects ready for implementation only with other projects too far in the future to properly plan out — what comprises the majority of the later side of the CIP — put into a separate category. The city had five-year CIPs prior to 2009, Friedlander said, but switched to 10-year CIPs for the 2009 budget.

“That’s also a big thing,” Friedlander admitted. “Consider: is there a different way of planning, of labeling projects, of describing them that would better illustrate to the community. ‘This is something that’s going to happen right now and is going to be done shortly’ versus ‘this is something that’s going to be more long term.'”

Wilson said it’s a conversation that’s come up recently on the City Council in relation to projects requiring large investments with unclear costs.

“We’ve had this conversation of late, particularly when it comes to schools,” Wilson said. “[These are] projects put on the CIP years out and as it gets closer the numbers are violently off and we have to have reconciliation or worse where we’re throwing projects two years out and then saying ‘quick, we have to do this.’ It doesn’t work as well as perhaps it should.”

Wilson also said the predictability of costs and planning can vary depending on the department. Road paving, for instance, is precise for around three years but vague beyond that, while school projects are usually put on the CIP far ahead of the actual costs.

“Part of why we went to a 10 year CIP is to use it as such,” Wilson said, “where we could say ‘you need a new elementary school, and we have it in year 9.’ It’s coming, but we still have to get there.'”

Councilmember Sarah Bagley said that either way, the city should do more to communicate the differences between financial plans and construction plans.

A tax rate add/delete hearing is scheduled for April 23 with final budget adoption is scheduled for May 4.

Alexandria will argue against a rate hike by Virginia American Water, even though the increase will go into effect on May 1.

The average water bill in Alexandria will go up about $94 per year, which the utility says covers infrastructure upgrades cross Virginia, including the replacement of a 3,800-foot-long water main in Alexandria that was installed in the 1950s.

Virginia American Water filed for the $14.3 million in rate increases with the State Corporation Commission (SCC) in November.

“The company is requesting this increase based on $137.6 million in infrastructure investments from May 2020 through April 2023,” Barry Suits, Virginia American Water president, said in a statement. “Through these investments we continue to upgrade our infrastructure and deliver high-quality water and wastewater service and fire protection to approximately 339,000 people in Alexandria, Dale City, Hopewell and the Northern Neck.”

Bill Eger, the city’s energy manager, said that the proposed rates in Alexandria are increasing faster than what the city wants or expects, and that before the SCC hearing the city will send out a press release detailing how residents and business owners can publicly comment.

“At that point in time the public can provide comments in order to state their case about why this rate case is important to them, including whether or not the costs that are being suggested are too much too little,” Eger told Council. “I suspect most would say it’s probably too much.”

Virginia American Water last increased rates in 2018, after proposing and implementing a $6.6 million increase in rates statewide. That rate was later reduced to just a $1.2 million increase after being litigated with the SCC, and residents and businesses were issued refunds.

Mayor Justin Wilson told Eger that he appreciates the effort to lower rates.

“We appreciate all of your work, understanding this and then fighting for our ratepayers,” Wilson told Eger. “It’s very important.”

This year’s budget could include a one-time measure meant to keep the vehicle tax from skyrocketing.

In his monthly newsletter. Mayor Justin Wilson outlined a unique set of circumstances that, if left unchecked, could see Alexandrians’ vehicle personal property tax skyrocket.

“Alexandria’s second-largest General Fund revenue is the vehicle personal property tax,” Wilson said. “As a local tax assessed on vehicle owners annually, based on an assessed value, there is perhaps no tax more hated in the Commonwealth of Virginia.”

Wilson said in Fiscal Year 2021, the city collected $36.5 million from vehicle owners to provide for a total of $60 million of total general fund revenue.

The tax on vehicle is generally fairly steady, but Wilson said changes in the vehicle market has caused that value to increase dramatically and, with it, the associated vehicle personal property tax.

According to Wilson:

Now, the City Council is grappling with a challenging aberration in this revenue source. Under normal circumstances, the valuations of vehicles do not increase. In 2018 and 2019, only about 1% of Alexandria’s registered vehicles increased in value.

Yet, the pandemic has caused chaos in the used car market place. Last year, many Alexandrians saw increases in the value of their cars. This year, this phenomenon was projected to continue, as the City Manager’s proposed budget assumed an 8.5% increase in revenues.

Wilson said the current estimates are that vehicle values would increase by an average of 26% for 87% of the vehicles in Alexandria.

“This is extraordinary,” Wilson said. “To protect taxpayers, the City Manager has brought to the Council a proposal for one-time relief for vehicle owners.”

The proposal from City Manager Jim Parajon would have the city assess only 77% of the Fair Market Value of vehicles to counter-balance the Covid related upswing in value. The proposal would provide no 2022 tax for vehicles assessed at $5,000 or less, and cars valued higher would still have a smaller amount of relief from the tax.

“This proposal provides all vehicle owners with tax relief, while reserving the greatest relief to vehicles with the lowest valuations,” Wilson said. “It is hopeful that the used car market will get back to normal next year. Council will determine their approach to this proposal later this month.”

Alexandria’s City Council set the maximum real estate tax rate at a half-cent higher than the current rate, with officials saying that 2022’s hardships make any higher burden on residents untenable.

The City Council voted unanimously for the real estate tax rate to be set at no higher than $1.115 per $100 of assessed value, a slight increase from the current $1.11. While the eventual real estate tax rate could be lower than $1.115, it won’t be higher. Additionally, the city won’t increase the tax rate on personal property or business-tangible property.

Even so, most homeowners in Alexandria will still see taxes go up thanks to higher assessments, and the drop in tax revenue from hotels puts an even greater strain on the residential tax base.

At the current rate, the average residential tax bill is expected to increase by $445 or 6.5% compared to last year’s bill. At the maximum rate of $1.115, that residential tax rate bill would increase an average of $477 or 7%.

City Manager James Parajon’s proposed budget maintains the current tax rate. The additional half-cent provides some flexibility, but not as much as some on the Council would hope for with the city already facing calls for more funding to environmental and affordable housing needs.

“That half-cent is going to go quickly,” said City Council member Canek Aguirre, “so I hope everyone has an idea of where they’re going to find this money from.”

The new maximum rate was unanimously approved. A virtual public hearing on the real estate tax rate is scheduled for Saturday, April 23, and final budget adoption is scheduled for May 4.

“I do agree that we need to give ourselves the flexibility in order to make the decisions over the coming months and take into account any new information we get through our work sessions,” said City Council Member Alyia Gaskins. “At the same time I too and leaning more conservatively. I really do think this is going to be a hard time for our residents. I also think that we are in a unique time that we have ARPA funds and additional revenue coming in, so I think being able to think about ‘are we using that in the most strategic way possible.'”

New City Manager James Parajon may be trying to make a good first impression with city residents. His first budget — a continuation of one started under former City Manager Mark Jinks — comes with no new tax rate increase. Even so, with real estate assessments on the upswing, local homeowners can still expect to see taxes go up.

In a meeting today, Parajon joined Budget Director Morgan Routt and other city officials to present the fiscal year 2023 budget to the City Council.

The budget is $829.9 million, or a 7% increase from the previous year’s budget.

“This budget does not contain a change in the tax rate,” Parajon told reporters at a meeting earlier today. “The Council asked to provide an alternative A, which is a modest tax rate increase, and an option B, which is a more substantial rate of increase.”

Those rates, Parajon said, would be a 1 penny per $100 of assessed value increase or a 2 penny increase.

The budget office was also able to save more with $1 million in efficiencies and by ARPA funding — of which $21 million is included in the budget. A large portion of that, Parajon said, will be dedicated to affordable housing.

Though the recommended budget does not change the tax rate, Parajon said the budget is funded largely through revenue growth related to real estate assessments.

“The real estate market did not slow down during the pandemic,” Parajon said. “In fact, we’ve seen significant assessment increases.”

City residents can expect a $14 utility fee increase, though, from an estimated $280 to $294.

“That helps us accelerate stormwater management and flooding mitigation,” Parajon said.

Parajon said residents can expect an average $445 per year increase in their taxes, with assessment growth factored in. Routt said the increases would come out to an average $66 increase per penny — or $511 and $577 for the 1 and 2 penny increases.

Most of the budget increase is dedicated to compensation adjustments for staff:

- Firefighters, medics, fire marshalls: 6% pay scale adjustment

- Police department and Sheriff’s office: 5% pay scale adjustment

- General employees: 4% pay scale adjustment

Parajon said that’s in addition to the annual step increases for all in those sectors.

Josh Turner, President of IAFF Local 2141, said it’s a good step but not enough.

“Though we appreciate the new City Manager’s efforts to fix the pay issues found in our department, this proposal does not do enough to stop the bleeding,” Turner said. “When you’re down by 20 in the fourth quarter, it’s not enough to just score when the other team scores. We need to do a full court press to play catchup.”

Turner said in the last two weeks, the city’s lost an additional three firefighter medics, who left for better pay and working fewer hours in neighboring jurisdictions.

“It takes three years for us to recruit, train and get someone street ready as a firefighter medic,” Turner said. “A six percent increase is substantial, but with Fairfax, Arlington and other jurisdictions offering an even greater increase it puts us even farther behind our competitors. If an Alexandria firefighter makes 70k and gets a 6% increase, but a Fairfax firefighter makes 85k and also gets a 6% increase, the pay gap between the Alexandria and Fairfax firefighters is even higher now.”

Alexandria’s police union said on social media the department is facing a similar dearth of new recruits to make up for those leaving.

Question: What is missing from this picture?

Answer: Police applicants.

We had a test scheduled today for those interested in becoming a police officer.

NOT ONE PERSON SHOWED UP.

This is what happens when the City doesn’t provide a competitive compensation package. pic.twitter.com/dTZYjlJZUD

— IUPALocal5 (@IupaLocal5) February 15, 2022

Meanwhile, Parajon said the recommended budget will fully meet the requests of the ACPS budget, which will include a 10.25% raise for teachers.

The budget also includes a 2.4% increase to the 10-year capital improvement plan (CIP).

“A big portion of that does include funding for initiatives that occurred over this last year, particularly in school construction,” Parajon said. “That includes full funding of the ACPS CIP, which includes the new high school facility at Minnie Howard and the purchase and renovation of an office building.”

The CIP includes $288 million to expand floodwater mitigation efforts, including projects in the Glebe Road area and spot improvements throughout the city. The CIP also includes $200 million to renovate city facilities.

After tonight’s meeting, Parajon is scheduled to present the budget to the public on Thursday, Feb. 17 at 7 p.m. There will be nine work sessions throughout the spring to review the budget. A special public budget hearing is scheduled for Monday, March 7, and a tax rate add/delete hearing on April 23. Final budget adoption is scheduled for May 4.

Putting aside some of the drama of his visit, Gov. Glenn Youngkin spoke in Alexandria last week about a topic that even some local Democrats have expressed support for: eliminating the grocery tax.

Virginia has a 2.5% grocery tax that helps to fund public schools and transportation. One percent of that goes to local governments, while the rest goes to the state. This has created a sort of three-faction divide on the tax that doesn’t break evenly along party lines.

Youngkin and House Republicans have called for the tax to be eliminated entirely. Another version, rejected by the Senate Finance and Appropriations Committee, would have maintained the 1% contribution to localities but eliminated the state portion of the funding. The legislation was rejected in part because some Northern Virginia senators expressed concerns that it could negatively impact some of the state’s wealthier school districts, ABC8 reported.

In a town hall last week, Alexandria Mayor Justin Wilson said that the city has supported eliminating the grocery tax, but that there needs to be adequate replacement revenues to compensate.

We are always happy to welcome @GovernorVA to Alexandria.

Alexandria has long advocated for the elimination of the grocery tax.

The elimination must be funded by sustainable replacement revenues to ensure our local taxpayers don’t end up with the bill.https://t.co/fDU9zFUcKV

— Justin Wilson (@justindotnet) February 4, 2022

Today, I sat down with Virginia parents to discuss my administration’s plan to combat rising inflation and its impact on families. I look forward to working together to address the rising costs of raising a family in the Commonwealth, starting with eliminating the grocery tax. pic.twitter.com/zpzzH5ROwK

— Governor Glenn Youngkin (@GovernorVA) February 3, 2022

Photo via Eli Wilson Photography

An Alexandria couple pleaded guilty to conspiracy in relation to filing false tax claims for their Maryland-based auto body repair shop, and have been ordered to pay $2.2 million in restitution.

Ercin Kalender, 60, and Lizette Kalender, 44, own Butch’s Auto Body in Capital Heights, and were ordered to pay the $2.2 million as part of their plea agreement, according to an announcement from the U.S. Department of Justice.

Between 2015 and 2018, the Kalenders kept two sets of books — one set with actual revenues, and another with lower reports of taxable income that were sent to the Internal Revenue Service.

“The corresponding tax loss to the IRS for the four years was $2,219,602,” DOJ said in a release.

The couple, who were trying to sell the shop in 2018, were busted in a sting operation in 2018. An undercover federal agent posed as a potential buyer and both Ercin and Lizette Kalender revealed a longstanding practice of underreporting revenue and income.

“Further, Ercin explained that while Butch’s filed tax returns showed $2.2 million in gross receipts, the actual gross receipts were closer to $3.1, $4.2, and $3.9 million for the fiscal years for 2015, 2016, and 2017; respectively,” according to DOJ. “Ercin also informed the agent that Lizette also reported sizable W-2 income, which helped them evade scrutiny by the IRS… In 2019, after the Kalenders became aware of the IRS’s investigation, Butch’s reported gross receipts of more than $4.5 million, an increase of more than $2.2 million over the fiscal year 2018,”

Additionally, the couple paid a portion of their employees in cash and falsely reported wages to the IRS.

“In a conversation with the undercover agent, Ercin stated that he paid all his employees’ extra compensation in cash to avoid tax obligations except for one secretary who was not paid under the table,” DOJ reported.

The couple go to court for sentencing on May 26 and face a maximum sentence of five years in prison and three years of supervised release.

In a glimpse at financial assessments for 2022, Alexandria Mayor Justin Wilson said on Twitter that declining hotel revenue — and thus taxes paid to the city — will put more of the city’s tax burden on residents.

The decline of tax revenue for the City of Alexandria is just one part of a difficult financial recovery from the pandemic — one exacerbated by the omicron surge earlier this winter. While sales and meals tax have rebounded slightly, the dearth of hotel funding has even led the city to consider investing in a new hotel.

“In 2019, there were 31 hotel properties in the City of Alexandria worth a total of $753 million,” Wilson said. “Today, those 31 hotel properties are assessed at a total of $464 million.”

That’s a 38% drop in the value of hotel properties in the city.

The tax revenue generated by the City’s travel and hospitality industry significantly eases the impact on our residential taxpayers, so: yes.

— Justin Wilson (@justindotnet) February 2, 2022

Meanwhile, Wilson said average assessments on single-family homes and condos have increased city-wide.

More 2022 Alexandria Assessment Data:

Increases were consistent around the City

The average single-family home increased 6.44% to $896,176 (97% increased)

The average condo home increased 2.81% to $398,470 (65% increased) pic.twitter.com/6CZuS4PIOJ

— Justin Wilson (@justindotnet) February 2, 2022

The real property assessments are scheduled to be reviewed at a City Council meeting on Tuesday, Feb. 8. A report prepared for the meeting indicates that the gulf between the commercial and residential tax base could widen this year.

The report said there’s been a $915.86 million growth in commercial assets in Alexandria, with a 15.36% increase for warehouses and a 10.33% increase for apartments offsetting a 12.5% decline in commercial assets for hotels and 6.47% decline in shopping centers.

On Tuesday night, Council will receive our real estate assessment report.

Our tax base grew by 6.24%, the highest growth in 16 years.

A third of that growth was from new development and the rest from appreciation.

Residential increased by 6.91% and commercial by 5.34%. pic.twitter.com/UaSuLyoYke

— Justin Wilson (@justindotnet) February 2, 2022