While such a major change is unlikely to occur this year, Alexandria’s City Council recently considered ideas proposed by the Budget and Fiscal Affairs Advisory Committee (BFAAC) that could dramatically shape budgets in the future.

Amy Friedlander, vice chair of BFAAC, presented budget-related recommendations to the City Council at a work session yesterday (Wednesday), including two that raised eyebrows on the Council.

“We encourage City Council to keep the residential tax rate at current levels and that we recommend the council considers establishing a goal for the differentiation between the residential and commercial tax bases,” Friedlander said, “as well as considering perhaps decoupling residential and commercial rates. I know that’s a big policy change, but it’s something to think about as you proceed through the year.”

The city’s real estate tax rate — recommended in the City Manager’s budget to remain at the current $1.11 per $100 of assessed value — is the same for both residential and commercial properties. However, as Alexandria residential real estate owners could attest, the tax rate remaining the same is still an increase for local property owners as assessed values continue to increase substantially.

“The burden on the residential tax base is increasing due to increased assessments,” Friedlander said. “If there were possibilities to alleviate that pressure, decoupling the two of them might be one of them.”

Reception on the City Council was mixed, with some concerns that breaking the tax rate into two parts could put undue pressure on commercial properties or negatively impact renters, who get grouped into the commercial tax base.

“Obviously giving us more flexible tools is great,” McPike said. “My concern would be: if we’re raising commercial tax rates, that includes a lot of rental properties. While renters don’t pay property taxes directly, those get rolled into the rents they pay, so I wonder if there might be some sort of regressive impacts to that approach. That would be a concern of mine, but I think in general flexibility could be something that outweighs that.”

Mayor Justin Wilson called the suggestion “tricky.”

“There are winners and losers on any of these things,” Wilson said. “If the state gave us more flexibility there would be more options available, but practically speaking our choice is: do we fund our match for NVTA using the commercial setaside or use it funding a real estate tax that everyone pays. Today we do it with everyone paying it, we could do it with commercial paying it only, but that obviously has implications. When we talked about this last time we were concerned about small businesses with triple net leases where this goes directly to their bottom line.”

The other proposal that stirred discussion on the City Council was going back to a five-year Capital Improvement Program (CIP) to avoid situations where eventual costs far outpace initial estimates in the CIP.

Friedlander said BFAAC recommended potentially reevaluating the total timeframe of the CIP to include projects ready for implementation only with other projects too far in the future to properly plan out — what comprises the majority of the later side of the CIP — put into a separate category. The city had five-year CIPs prior to 2009, Friedlander said, but switched to 10-year CIPs for the 2009 budget.

“That’s also a big thing,” Friedlander admitted. “Consider: is there a different way of planning, of labeling projects, of describing them that would better illustrate to the community. ‘This is something that’s going to happen right now and is going to be done shortly’ versus ‘this is something that’s going to be more long term.'”

Wilson said it’s a conversation that’s come up recently on the City Council in relation to projects requiring large investments with unclear costs.

“We’ve had this conversation of late, particularly when it comes to schools,” Wilson said. “[These are] projects put on the CIP years out and as it gets closer the numbers are violently off and we have to have reconciliation or worse where we’re throwing projects two years out and then saying ‘quick, we have to do this.’ It doesn’t work as well as perhaps it should.”

Wilson also said the predictability of costs and planning can vary depending on the department. Road paving, for instance, is precise for around three years but vague beyond that, while school projects are usually put on the CIP far ahead of the actual costs.

“Part of why we went to a 10 year CIP is to use it as such,” Wilson said, “where we could say ‘you need a new elementary school, and we have it in year 9.’ It’s coming, but we still have to get there.'”

Councilmember Sarah Bagley said that either way, the city should do more to communicate the differences between financial plans and construction plans.

A tax rate add/delete hearing is scheduled for April 23 with final budget adoption is scheduled for May 4.

Recent Stories

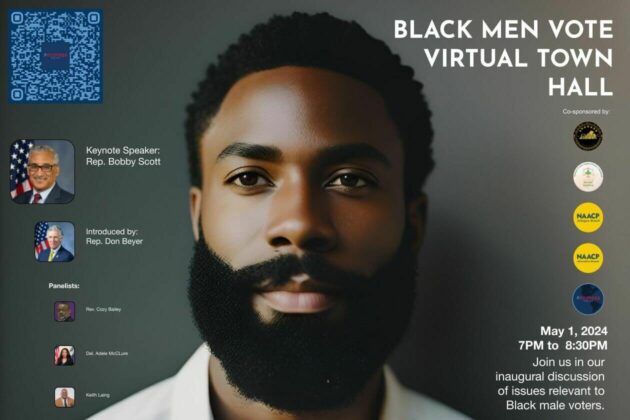

For Immediate Release

Progress for All Announces Inaugural Black Men Vote Virtual Town Hall

Date: April 19, 2024

Il Porto Ristorante is thrilled to announce that a new executive chef has joined our team! Hailing from Sicily, Italy, Chef Giuseppe’s culinary journey began at home, where he was immersed in the rich aromas and flavors of homemade Italian cuisine from a young age. His culinary skills flourished further in Piedmont, Italy, where he had the privilege of learning from esteemed chefs renowned worldwide. Under their mentorship, he refined his craft and developed a unique culinary style that marries classic Italian traditions with contemporary flair. Now, Chef Giuseppe proudly brings his exceptional talents to Il Porto, infusing each dish with his distinct blend of tradition and innovation. Chef Giuseppe is introducing brand new dinner specials and entrees, so make a reservation to enjoy his culinary excellence, today!

Pro Coro Alexandria – To the Sea

Join Pro Coro Alexandria, the chamber choir of the Alexandria Choral Society, this Saturday for our concert, “To the Sea.” Experience a variety of songs from beloved choral classics like “Shenandoah” and “What Shall We Do With A Drunken Sailor?”

Del Ray Kitchen Confidential Design Tour

Please join us for Del Ray Kitchen Confidential – a walking tour of recently renovated kitchens in Del Ray with the experts who make the magic happen! FA Design Build owner Rob Menefee and Design Consultant Melissa Fielding walk us