Alexandria’s City Council will approve its fiscal year 2025 budget in a little more than a week, and important actions will be taken between now and then.

On Wednesday (April 24), Council will hold a public hearing on the city’s tax rate. Last month, a 4-cent tax ceiling was approved for consideration, allowing city staff and local legislators wiggle room in analyzing funding options in exchange for raising taxes. Each penny added to the tax rate is about $4.7 million, and a 4-cent tax increase would bring in $18.8 million.

This year’s residential taxes are expected to rise due to underperforming commercial real estate assessments, as well as a proposal to raise salaries for teachers in Alexandria City Public Schools.

Alexandria’s commercial property tax rate fell 4% this year, or $736.9 million. The value of the city’s office properties fell 12.38%, from $3.58 billion in 2023 to $3.14 billion in 2024, according to a city report. It’s the second year in a row that office properties dipped in value, dropping 10% last year.

Council will also conduct a budget work session on Wednesday with their proposed budget additions and deletions.

City Council will approve the fiscal year 2025 budget on May 1.

The deadline has now passed for members of Council to propose amendments to the Manager’s proposed budget.

Amendments must have the support of 3 members to be considered during the remainder of the process.

This is the preliminary list of amendments:https://t.co/82LQDifJYN

— Justin Wilson (@justindotnet) April 5, 2024

It’s about to get a little more expensive to live in Alexandria.

On Saturday, City Manager Jim Parajon will present City Council with proposals to increase:

On ambulances, Council will consider raising the cost of basic life support from $600 to $750, which is about as much as neighboring Fairfax and Arlington Counties charge. As for additional levels of treatment, advanced life support (ALS) treatment would increase from $780 to $1,000, and the most advanced treatment requiring life-saving and other measures could rise from $900 to $1,200.

In the meantime, City Council is also considering a real estate tax increase to fund a significant budget request from the Alexandria School Board.

The Manager also wants to raise fees for late personal property tax payments. He’s proposing to increase the late payment penalty from a flat rate of 10% to “a rate of 10% if paid within 30 days 20 after the due date, and 25% if paid more than 30 days after the due date,” according to the proposal.

The city’s personal property tax rate is $5.33 per $100 of the assessed value of vehicles, and $3.55 for vehicles retrofitted to accommodate disabled drivers.

Parajon also wants to increase the stormwater utility fee from $308.7 to $324.10. The increase will help the city pay for infrastructure improvements, Mayor Justin Wilson wrote in April newsletter.

Alexandria City Manager Jim Parajon is asking City Council to increase penalties for late personal property tax payments.

The news comes as City Council considers a real estate tax increase to fund a significant budget request from the Alexandria School Board.

Parajon wants to increase the late payment penalty from a flat rate of 10% to “a rate of 10% if paid within 30 days 20 after the due date, and 25% if paid more than 30 days after the due date,” according to the proposal that Council will receive on Tuesday, April 2.

The city’s personal property tax rate is $5.33 per $100 of the assessed value of vehicles, and $3.55 for vehicles retrofitted to accommodate disabled drivers.

The following residents can get an exemption on personal property taxes:

- Active-duty U.S. military personnel and their spouses

- Antique car owners

- Member of Congress and their spouses

- Foreign diplomats

- Disabled U.S. military veterans

Personal property tax bills are mailed in the summer and payments are due Oct. 5.

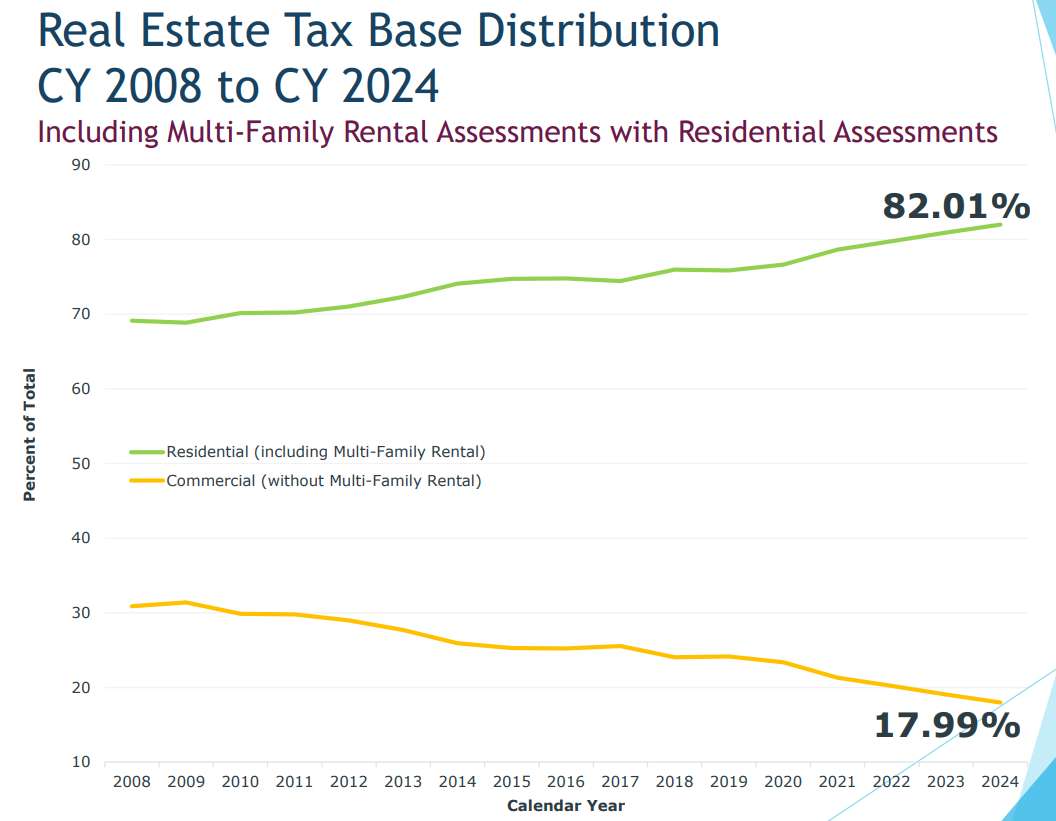

Depending on how you cut it, the residential tax base comprises either 82% of the city’s revenue or 62% — but either way, Alexandria leaders said that’s a precarious balance for a local government’s budget.

It’s an issue that came up in both the city budget discussion and an update on the Potomac Yard Arena development at a City Council meeting last night.

The incongruity in those numbers comes from multi-family residential developments, which are required by state law to be classified as commercial developments. If multi-family residential were classified with the rest of residential developments, the residential tax base would comprise 82% of the city’s revenue.

The gulf between how much of the city’s revenue comes from residents vs commercial property has widened over the years and City Manager Jim Parajon said it puts the city’s financial security at risk.

“The imbalance between commercial and residential is a risk factor in this and future year’s budgets,” Parajon said. “A healthy Alexandria economy must include quality commercial growth to avoid greater tax burdens placed on residents or cuts to services.”

Director of Finance Kendel Taylor said earlier in the meeting that for 29 years city leaders have been talking about that gulf and watching it widen.

“When we talk about doing something from a catalytic perspective, changing our tax base to have more commercial tax base… with outsiders paying revenue for services to relieve pressure on people living in our homes and apartments, this is what we’re talking about: changing the trajectory of this chart,” Taylor said.

At the meeting last night, Parajon proposed a general fund operating budget of $911.3 million as well as a $2.33 billion 10-year capital improvement program for FY 2025-2034. The budget comes with no proposed changes in real estate tax, personal property tax or other tax rates. However, even the tax rate remaining the same will mean a roughly $30 per month tax increase for the average Alexandria residential household.

The budget fully funds the Superintendent’s Alexandria City Public Schools (ACPS) operating budget and 10-year CIP. It does not, however, include an additional $11 million requested by ACPS, which Parajon said would require cutting services and programs or raising the tax rate by two cents.

One smaller item of note was $250,000 to step up the city’s cybersecurity. The Alexandria Library was hit with a cyberattack last year and Parajon said the city’s faced multiple attempted hacks.

“This continues to be a threat to the city,” Parajon said. “This past year there were numerous examples of people trying to hack into our system. The ITS Director did a great job defending [the city] but they need more tools.”

According to a release from the City of Alexandria, there will be more budget hearings at:

On Thursday, February 29 at 7 p.m. at Charles E. Beatley, Jr. Central Library, City Manager Parajon will present the proposed FY 2025 Budget to the public.

To ask questions and provide feedback, please attend the following public meetings:

- Monday, March 11: FY 2025 Budget Public Hearing

- Saturday, March 16: Budget Public Hearing

- Saturday, April 13: Add/Delete Public Hearing

- Wednesday, April 24: Tax Rate Public Hearing

This summer, Alexandria is offering real estate tax exemptions for homeowners who install solar energy equipment in their homes.

The 2023 Solarize Alexandria program started this month and ends on August 31. It includes a free assessment, as well as discounts for tax-deductible olar equipment.

“The goal is to increase the deployment of solar power generation in our residential communities,” Mayor Justin Wilson wrote in his July newsletter. “In addition to reducing emissions and reducing your power bill, the City of Alexandria provides a real estate tax exemption for qualifying solar installations.”

The city is partnering with the Northern Virginia Regional Commission and the Local Energy Appliance Program.

The equipment would collect and use solar energy for “water heating, space heating or cooling or other applications which would otherwise require a conventional source of energy,” according to the tax exemption form.

The solar energy systems that would qualify for the tax exemptions are:

- Solar heating and hot water systems

- Passive solar energy systems

- South-facing windows used as solar collectors

Trombe walls (a sun-facing wall designed to collect solar energy and act as a thermal mass for heating the structure)- Greenhouses integrated into the heating system of the structure

- Thermal storage systems

- Movable insulation

- Window shading windows for summer cooling.

How would residents get their money back? The city laid out this example:

The property owner has entered into a contract for a total of $12,000 to install solar energy panels ($8,000 in solar energy equipment and $4,000 for installation). Code Administration has completed their inspections certified the application to the Assessor. The $12,000, in this example, is considered the value of the exemption and would be deducted from the assessed value of the property every year for five years.

(The percentage or formula used is outlined in the Virginia Administrative Code. Many items such as solar panels or hot water systems are at 100% of cost and installation as shown in this example. Where other items such as south facing windows and greenhouses are based on a percentage or formula as stated in the Code.)

The tax savings is calculated as follows: $12,000 divided by 100, then multiplied by the current tax rate. The amount of tax savings over the five year period may vary depending on the tax rate that is in effect for each tax year.

The amount of tax savings over the 5 year period may vary depending on the tax rate that is in effect for each tax year.

Alexandria’s transient lodging, from Airbnb to hotels, famously took a hit back in 2020, but there’s some good news.

At a meeting of the City Council last night celebrating some of the work of Visit Alexandria, Mayor Justin Wilson noted that transient lodging has continued to climb and overall consumption tax revenue now exceeds pre-pandemic levels.

“Given where we were three years ago, that’s an amazing turnabout,” said Wilson.

A monthly financial report (item 14) showed that transient lodging taxes continued to climb dramatically from FY 2022 to FY 2023.

“We are now at 22.5% on transient lodging ahead of where we were last year,” Wilson said, “which is an incredible turnabout for the community and obviously I think speaks to the financial return the tourism industry provides to the taxpayers in the city, but I think it’s broader than that.”

Wilson said tourism is a part of Alexandria’s DNA in ways that are more than just financial

“Three years ago, as many of the businesses in this sector were shut down, so many of our residents realized what they were missing in the rich contributions the travel and tourism industry provides the people that live here,” Wilson said. “They’re a part of our community and a part of what makes this a wonderful place. We’re happy to have ya’ll back, not just for financial reasons.”

Vice Mayor Amy Jackson said Visit Alexandria has helped spotlight some of the best parts of Alexandria and has helped boost the recovery of transient lodging.

The pandemic shone a bright light on our strengths and weaknesses,” said Jackson. “We just kept going through this and we are the place to be. We are where you want to be, where you want to visit, to live, work play and raise a family.”

The value of Alexandria’s total residential tax base has outpaced its commercial tax base, according to the city’s Office of Real Estate Assessments.

Over last year, the city’s overall real estate assessments increased 3.82%, or $1.7 billion, to reach a total of $43.88 billion, according to a report that the City Council will receive at its legislative meeting tomorrow (Tuesday) at City Hall (301 King Street).

The city’s residential tax base increased by 5.32%, or $1.24 billion, for a total of $24.6 billion. The average value of a single-family home value increased by nearly 4.6% to $940,375, and the average value of a condo in the city is $407,616, an increase of roughly 3.5% over last year. The city’s multi-family rental apartment market base also increased almost 5.4% this year, for a total of $9.89 billion.

Mayor Justin Wilson touted the assessments in a series of tweets. Some residents challenged this, saying the city’s assessments don’t line up with decreases in single-family home sale prices tracked on real estate websites.

To give you some more color on this year: the volume of single-family sales went way down. The volume of condo sales did not decrease as much.

So condos as a share of overall residential sales increased. Condos have lower values, which dragged down the median.

— Justin Wilson (@justindotnet) February 9, 2023

For every zip code in Alexandria — except 22305 (Arlandria) and 22312 (Lincolnia) — there was either a negative year-over-year change in sale price or no change, according to the website Redfin, which tracks median sale prices.

Wilson said Redfin’s estimates are wrong and the city’s full assessment data will be posted this coming Tuesday (Feb. 14) to examine.

Alexandria’s commercial tax base also increased just under 2%, for a total of $355.5 million.

While most commercial properties saw moderate increases, the value of office buildings in the city fell 10%. Additionally, a number of properties were and are being converted to residential use. The city’s overall equalized commercial office property tax base fell 1.8%, or nearly $66.2 million, from $3.65 billion in 2022 to $3.6 billion this year.

According to a city report:

There were seven sales of office buildings in 2022. Of those sales, one traditional commercial office building indicated intentions of conversion to residential development, [while] another plans to upgrade the current office building

- 1801 Beauregard Street, with 135,087 square feet, reportedly intends to convert its space into 95-to-105 rental units

- 515 King Street, with 82,800 square feet, intends to add additional amenities and develop coworking spaces

- Empty office buildings at 801 N. Fairfax Street, 625 Slaters Lane and 635 Slaters Lane are being converted into condominiums

- 4900 Seminary Road is being converted into 212 multifamily rental units

- Conversions have been proposed for 901 N. Pitt Street, at Transpotomac Plaza and at 1101 King Street

The overall value of Alexandria’s 22 hotels increased by 2.6%, or $12.8 million, from $497.5 million in 2022 to $510.3 million this year.

Assessment notices will be sent to property owners this Wednesday (Feb. 15), and residents have until March 15 to request a review of their assessment with the Office of Real Estate Assessments, followed by a June 1 deadline to file an appeal with the Board of Equalization.

As for trends, last year there was a nearly 27% decrease in the volume of single family home sales, and a 13% decrease in condo sales compared with 2021, according to the city.

The median sale price of residential properties in the City of Alexandria declined for a second year (in 2022) from $588,750 to $544,875. The median rose from $517,250 to $608,000 from 2019 to 2020. The decline is still attributable to a greater number of condominium properties (typically sold for less than single-family properties) in the sales sample than in years prior to 2020.

More 2023 Alexandria Assessment Data:

*26.71% decrease in the volume of SF property sales

*12.56% decrease in condo sales

*median sale price of residential properties declined for 2nd straight year

*$2.44B in new growth last 5 years pic.twitter.com/bZAKmEAt3F

— Justin Wilson (@justindotnet) February 9, 2023

More 2023 Alexandria Assessment Data:

The commercial tax base increased by $355M.

$322M of the increase was from new development, of which $302M was residential multi-family development (rental housing). pic.twitter.com/ShjZo9uI3x

— Justin Wilson (@justindotnet) February 9, 2023

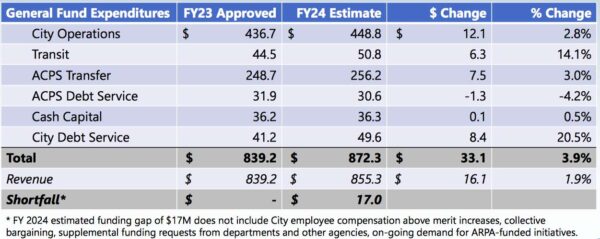

Alexandria’s revenue tax is growing, but too sluggishly to keep pace with the expenditures — leading to a $17 million shortfall as the city heads into budget season.

That estimate, from Mayor Justin Wilson’s monthly newsletter, is slightly lower than the estimate from a City Council meeting in November, but still presents a substantial challenge for city leadership attempting hold off on a tax rate increase.

Wilson said Alexandria’s budget is built around real estate taxes, which are growing but with some worrying signs.

“In Virginia, the structure of municipal finance is heavily reliant on real estate taxes,” Wilson wrote. “Consequentially, in Alexandria the real estate market, both residential and commercial, dictates our budgetary fate. Last year, we saw the healthiest growth in our real estate tax base in over 15 years. Yet, in the past year, mortgage rates have more than doubled. It’s hard to imagine that such an increase will not eventually impact our real estate market.”

Real estate tax revenue is projected to increase by 1.2% — which Wilson called a “return to the anemic growth that characterized much of the last decade and a half.”

Wilson said residential taxpayers are already paying more due to appreciation in the residential tax base, and adding a tax rate increase on top of that would add an even greater burden to local residents.

“I believe we should again work to avoid a rate increase while protecting the core services our residents depend on,” Wilson wrote. “Last year was the 6th budget in a row without a tax rate increase and I am hopeful we can continue that pattern.”

And yet, the city will have to find a way to close the $16.1 million shortfall. That shortfall is mostly attributed to an increase in city operations, the annual transfer to Alexandria City Public Schools and city debt service.

“With these revenue estimates and expenditure estimates, this brings us to a projected revenue shortfall of $16.1 million,” Wilson wrote. “Given that our local budget must be balanced, that shortfall must be resolved with either spending reductions, tax increases or some combination of the two.”

City Manager Jim Parajon, who warned City Council last month that “the budget is going to be tight,” is scheduled to present a budget to Council on Feb. 28.

Alexandria’s annual budget process wrapped up this week with a $839.2 million fiscal year 2023 budget approval and special tax relief for car owners.

Meanwhile, an uptick in opioid overdoses among children has Alexandria City Public Schools considering adding Narcan to schools and city officials issuing warnings about counterfeit Percocet.

Top Stories

- The “Chew Grape” house in Old Town is on the market for $1.1 million

- Public tour of Alexandria’s abandoned power plant planned for next week

- Gang robs man of wallet at night in Arlandria

- DNA links Alexandria felon to gun stolen nearly eight months ago

- Tax relief for Alexandria car owners approved

- Police: West End abduction and robbery was over $100

- Here’s how to celebrate Cinco de Mayo in Alexandria

- Waterfront flood mitigation plan returns with slashed budget

- Superintendent scolds majority of School Board over School Law Enforcement Advisory Group proposal

- Alexandria ranks third in national dog-friendly city ranking

(Updated at 1:45 p.m.) The Alexandria City Council unanimously adopted City Manager Jim Parajon’s $839.2 million fiscal year 2023 budget on Wednesday night (May 4), and despite giving all city employees raises, Mayor Justin Wilson says inflation will likely mean more raises in future budgets.

“We’re staring into a significant inflationary environment that pinches our employees very hard, just like it pinches everyone hard,” Wilson said. “We’re going to have to continue to have this conversation every year about how we make sure we invest in the level of compensation and benefits required to not only attract but retain the best and the brightest in the city.”

The budget is an 8.9% increase from the FY 2022 budget, and includes a 7% raise for firefighters, medics and fire marshals; a 6% raise for Police Department and Sheriff’s Office staff and a 4.5% raise for general city employees. That’s in addition to annual merit increases for city staff.

City residents can expect to pay an additional $445, or 6.5%, in real estate taxes, although Parajon’s budget maintains the current tax rate at $1.11 per $100 of assessed value. There are a number of other new fees, such as a $294 stormwater utility fee, which is a $14 increase over last year’s doubling of the fee from $140 to $280 to shore up flooding issues.

Council also approved Wilson’s proposal to increase annual residential and commercial refuse collection fees to $500 citywide (from $411 for commercial and $484.22 for residential collection). The $315,000 from the collected fees will fund a curbside food waste collection pilot.

This was the first budget for Parajon, who started work in January.

“This is a team effort and the fact we were able to put together what I think is a budget that truly is going to help a lot of people in the city,” Parajon said.

Councilman Kirk McPike said that he was proud to raise employee compensation, and that there is more work to do. McPike and his fellow new Council members Sarah Bagley and Alyia Gaskins were supportive of a 10% raise for AFD staff in February, as the department has struggled with recruitment, retention and compensation for years.

“I think that as a council we’re committed to doing more to help our firefighters and our police have the support that they need to give us the protection that the people of Alexandria deserve,” McPike said.

The budget also fully meet the requests of the Alexandria City Public Schools budget, which includes a 10.25% raise for teachers.

Council also unanimously approved the 10-year $2.73 billion Capital Improvement Program, which includes $497.8 million in investments for a new high school, renovations at 1705 N. Beauregard Street and two elementary school expansions.

The budget moves nearly $800,000 in Alexandria Police Department funding for School Resource Officers at Alexandria City Public Schools to a reserve account to fund six full time employees.

The budget includes:

- $1.85 million for police body worn cameras

- Expansion to Dash line 30

- $95,000 to hire a social equity officer

- An additional Alexandria Co-Response team (ACORP), costing $277,000

- $200,000 in reserve funding to support Metro Stage construction

- Purchase of 4850 Mark Center Drive — the future home of the Department of Community and Human Services, the Alexandria Health Department and a West End service center

Alexandria City Council Adopts Fiscal Year 2023 Budget: https://t.co/ODqov4d4n7

— AlexandriaVAGov (@AlexandriaVAGov) May 4, 2022