This week’s Q&A column is sponsored and written by Brian Bonnet, Senior Loan Officer (NMLS ID# 224811) of Atlantic Coast Mortgage, LLC (NMLS ID# 643114). To learn more about current mortgage rates and the home loan process, contact Brian at 703-766-6702 or email [email protected]. You may also submit your questions to McEnearney Associates via email for response in future columns.

Question: How can the Lender I use give me a competitive edge?

Answer: To say home purchasers are experiencing a competitive market is far more than an understatement. The inventory of homes for sale in Alexandria and Arlington is down approximately 40% from this time in 2019 and that inventory was down significantly from the year before. Most prospective purchasers find themselves competing against others for the limited property which is available.

In order to be an actual buyer and not just a looker, you must be more attractive to sellers than those you are competing against. Obviously, your offer price is a big part of the equation, but assuming you are in the hunt in that regard, there are several other considerations which savvy listing agents suggest their sellers consider. Among them are home sale contingencies, the buyer’s proposed lender, and the proposed settlement date.

When sellers have options, they are almost always inclined to accept an offer that is not contingent upon the sale of another home as opposed to an offer which is. For buyers, the trick is to determine whether it is truly possible to purchase the next home without first selling the existing home.

To be able to do so often requires some sort of bridge loan scenario, and that is a type of financing not provided by most lenders. Generally, bridge loans are provided by a handful of locally based mortgage banking institutions who tend to understand the local real estate market more than much larger or nationally based companies.

Engaging a local company which provides special bridge loan products when you begin to think about purchasing a new home may make the difference between your contract being accepted over that of someone else.

In our local market most applicants are approved for the financing they seek, but not all. In too many cases, prospective purchasers are sent down a path to purchase a home only to be denied the financing they understood they would receive. Often that unfortunate news comes just before the expected settlement date. To avoid this scenario, it is imperative that lenders truly know whether a buyer is going to be able to obtain the financing they need before the contract offer is made.

Wise and experienced listing agents are generally wary of contracts where the proposed lending institution or loan officer is either not known at all, or worse, known to fail from time to time. With two offers on the table at the same proposed sales price, the purchaser who proposes to get their financing from Bank of the World or Skippy’s Mortgage.com will often loose to the offer where the lender is a local lender with a positive reputation.

How quickly a buyer can close the transaction is often a consideration of sellers. If you are the seller, you generally want the transaction settled with the proceeds in your bank account sooner rather than later — even if you are not ready to move out of the home you are selling.

Successful buyers quite often propose settlement dates as soon as two to three weeks after the contract ratification in order to make their offers more enticing. Wise listing agents know that many, if not most, lenders cannot perform that quickly. Again, generally it is the well-known local lender that can process and underwrite an application and be ready for settlement in three weeks or less.

Some people enjoy the process of simply searching for a new home and writing contracts, but if your end goal is to be successful in purchasing a home, you truly need to consider every aspect of your offer and how attractive it may be to the seller. Purchasers should consider the reputation of the lending institution, the nature of the proposed financing and how quickly the lender is able to be ready for settlement. The seller likely will.

If you would like more information to help plan your next move, please contact Brian Bonnet at [email protected] or call 703-766-6702.

If you would like a question answered in our weekly column or to set up an appointment with one of our Associates, please email: [email protected] or call 703-549-9292.

McEnearney Associates Realtors®, 109 S. Pitt Street, Alexandria, VA 22314. www.McEnearney.com Equal Housing Opportunity. #WeAreAlexandria

Recent Stories

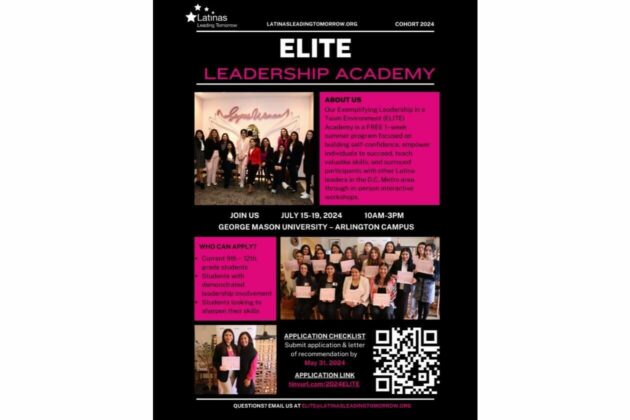

FREE Leadership Sessions will be conducted at the George Mason University –Arlington Campus for High School Latinas. The program runs from Monday 7/15 through Friday 7/19 from 10:00AM to 3:00PM EST each day (1-week).

Las sesiones de liderazgo GRATUITAS se llevarán a cabo en el campus de George Mason University – Arlington para latinas de secundaria. El programa se desarrollará desde el lunes 15 de julio hasta el viernes 19 de julio, de 10:00 a.m. a 3:00 p.m. EST cada día (1 semana).

Our goal is to equip students with the fundamentals of self-promotion and guide them in shaping their personal brand for future success. What sets this program apart is its integration of self-awareness activities and mentorship by seasoned professionals.

Finding a gift for moms can be difficult. Google “Mother’s Day gifts,” and you’ll scroll through endless lists of beauty products, candles and fuzzy robes. Sure, those are sweet, but sometimes it’s fun to surprise loved ones with something a little more, well, practical!

Here’s one idea: Give her a gift certificate for a home cleaning from Well-Paid Maids. It’s the perfect “thank you,” “I love you” or “you’ve got this” for any mom. She can schedule the home cleaning at her convenience and breathe easy knowing she has one less thing to do.

Our cleaners will take care of everything, including vacuuming and mopping as well as cleaning and dusting countertops, tables, mirrors, appliances and more. Sinks, toilets, showers and appliance exteriors also get a good scrub.

Plus, when you buy a gift certificate from Well-Paid Maids, you’re supporting a living-wage cleaning company. That means cleaners get paid a starting wage of $24 an hour and get access to benefits, like 24 days of PTO and health insurance.

Alexandria NAACP, Shiloh Baptist Church, DPC to hold City Council…

The Alexandria Branch of the NAACP, Shiloh Baptist Church, and The Departmental Progressive Club to hold the City Council Candidate Forum for ALL Candidates in the City of Alexandria Virginia. The event is Free of Charge and Open to The