Just Listed highlights Alexandria City properties that came on the market within the past week. This feature is sponsored by the Jen Walker Team (Licensed in VA) of McEnearney Associates REALTORS®.

Welcome Back!

Jen Walker here with The Jen Walker Team! We are a real estate group based out of Alexandria, Virginia. I, along with my rock-star team members, Sue Kovalsky, Micki MacNaughton, Adrianna Vallario and Nancy Lacey, have more than 40 years of experience in real estate and sold over $145 million in 2023.

Welcome to 110 W Nelson, the gorgeously curated home in the desirable Del Ray neighborhood! New from the ground up (2022), there is no shortage of space in this 6 bedroom, 4.5 bathroom, over 4K sqft home which features both a main and upper level primary suite!

With 10ft soaring ceilings, the main level offers a traditional layout and plenty of space for entertaining or relaxing. The expansive kitchen features white shaker cabinetry, stainless appliances, and a large peninsula with plenty of seating and storage. The great room is the perfect place for gathering indoors around the gas fireplace, or open the tall sliding doors and enjoy the lovely Spring evenings on the back porch while overlooking the beautiful yard! A coveted main level primary suite features a perfect private balcony, ensuite bathroom with a tiled shower, and a large walk-in closet including a stackable washer/dryer for convenience.

Walk upstairs past the built-in bookshelves (and storage seats!) to 4 generously sized bedrooms, 2 full bathrooms, and a spacious laundry room! The upstairs primary suite is a true oasis featuring a walk in closet, huge ensuite bathroom and a large soaking tub. The lower level is full of surprises including built-in locker shelving in the mudroom area and a mudroom closet with built-in cubbies. Continue downstairs to an expansive lower level where the soaring ceilings continue, and a ton of storage! The large recreation room offers plenty of space for a family room, game room, or playroom. An exercise room with sliding doors has plenty of ceiling height for all the equipment, and also plenty of natural light to use as a home office. Don't miss the 6th bedroom with a lovely bathroom, perfect for a guest room or au-pair room.

Home is more important than ever and this one checks every box! Ideally located in the heart of Del Ray near plenty of shopping, dining, schools, playgrounds, and endless community events, you will love living in this amazing community! Welcome home!

Open: Sunday, April 25 from 2-4 p.m.

110 W Nelson Avenue, Alexandria 22301 — $2,000,000

Click here for additional Just Listed properties in Alexandria and call The Jen Walker Team to schedule a home tour at 703-675-1566 or email [email protected].

Happy House Hunting!

In our highly competitive Alexandria market, the Jen Walker Team has the insider knowledge to connect you with homes that are not even public yet. With more than 40 years of experience, the Jen Walker Team has the expertise to answer questions, calm fears, and streamline your transaction. Want to see other homes not featured in this article? Contact our team today!

Please note: While The Jen Walker Team provides this information for the community, they may not be the listing agents of these homes. Equal Housing Opportunity.

McEnearney Associates Realtors®, 109 S. Pitt Street, Alexandria, VA 22314 #WeAreAlexandria

Address: 1211 Wilkes Street

Neighborhood: Old Town Village

Type: 3 BR, 2 (+1 half) BA townhouse — 2,780 sq. ft.

Listed: $1,849,000

Noteworthy: Charleston style home with courtyard entrance patio

With impeccably updated style, this almost 2800 sf home not only has intimate cozy spaces for everyday living, but its open layout and indoor outdoor living design make it an entertainer’s dream.

Step into the welcoming Charleston style home with a courtyard entrance patio perfect for hosting neighbors. An open bright living space creates an air of comfort and sophistication with traditional architectural details including impressive columns at the entrance to the formal living room, crown molding and sparkling hardwood floors in the gracious dining room, and a custom designed fireplace surround in the family room with built-in cabinets and a bay window overlooking the front courtyard.

Step through to the gourmet kitchen with every amenity — large island with seating, custom cabinets with lighted upper display, expansive quartz counters, stainless steel appliances including a double wall oven and wine refrigerator, and a built-in breakfast nook with views through the glass door to a second private patio. Upstairs open the French doors into the primary suite with soaring cathedral ceilings, a spa bath out of a magazine, two custom designed walk-in closets, and a private balcony with Trex deck. Two spacious secondary bedrooms share an updated hall bath.

Just four blocks from King Street’s eclectic shops and acclaimed restaurants and only a quick walk to Metro and Whole Foods, this wonderful Old Town Village community boasts a saltwater pool, clubhouse, and gym. Every detail has been thoughtfully designed to make this a very special place to call home.

Listed by:

Lisa Groover — McEnearney Associates

[email protected]

(703) 919-4426

This week’s Q&A column is written by Darlene Duffett of McEnearney Associates Realtors®, the leading real estate firm in Alexandria. To learn more about this article and relevant Alexandria market news, contact Darlene at 703-969-9015 or email [email protected]. You may also submit your questions to McEnearney Associates via email for response in future columns.

This week’s Q&A column is written by Darlene Duffett of McEnearney Associates Realtors®, the leading real estate firm in Alexandria. To learn more about this article and relevant Alexandria market news, contact Darlene at 703-969-9015 or email [email protected]. You may also submit your questions to McEnearney Associates via email for response in future columns.

Question: Should I buy now, or should I wait based on the interest rates?

Answer: The decision to buy a home is a significant milestone, often accompanied by excitement, anticipation, and many questions. A major consideration in today’s real estate market is whether to wait for lower interest rates or to purchase now with the current rates.

Understanding the Interest Rate Landscape

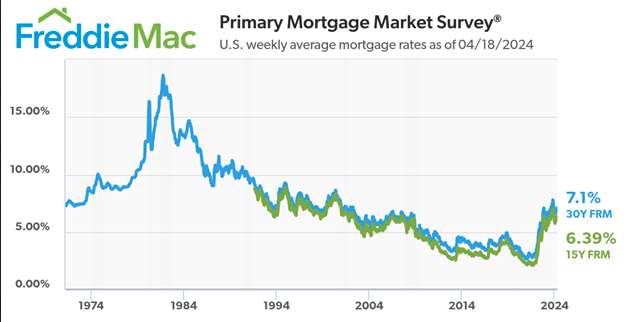

Interest rates are influenced by a complex array of factors, including economic conditions, inflation, government policies, and the Federal Reserve’s actions. The Fed has been raising rates since early 2022 to bring down inflation and over the past year we have seen first-hand that when the Fed funds rate rises, interest and mortgage rates tend to follow. This has led many potential homebuyers to wonder if they should wait for rates to drop further or secure a mortgage at the current rate. Listening to my parents and their friends speak of their rates in the 1970s and 1980s gives me ponder as to how they did it. Historically the average rate on a 30-year mortgage peaked in 1981 to just over 18% and bottomed out in 2021 to just under 3%. In October, rates hit a 23-year high of 7.79% for a 30-year fixed loan, according to Freddie Mac.

The Case for Waiting

Proponents of waiting for lower interest rates argue that patience can lead to significant savings over the life of a mortgage. A lower rate means reduced monthly payments and overall interest costs. For first-time homebuyers or those with tight budgets, even a small reduction in interest rates can make a noticeable difference. It can also impact the amount of home you can afford, allowing you to consider properties in a higher price range.

The Risks of Waiting

However, waiting for lower interest rates carries risks. No one has a crystal ball to know exactly when rates will drop—or if they will drop at all. By waiting, you risk potentially jumping back into the market when everyone else who has been sitting on the side lines jumps back in too, creating a super competitive market where you risk waiving contingencies and might find yourself competing with more buyers, leading to bidding wars and higher prices.

The Case for Securing a Mortgage Now

Securing a mortgage now provides certainty in an uncertain market. It allows you to move forward with your home purchase without worrying about fluctuations in interest rates. This stability can be particularly valuable if you’re planning to stay in your new home for a long time, as it shields you from future rate increases. Additionally, acting now can give you more flexibility in negotiations with a smaller buyer pool. With a pre-approved mortgage, you can make competitive offers, potentially giving you an edge over other buyers who are waiting to speak with a lender.

The Case for a Renter to Step into Home Ownership

I would be remiss to not mention that renting is equivalent to paying 100% interest and investing in another individual’s property. Home ownership provides stability and security as you do not need to worry about rent increases. It provides the potential for appreciation and building equity. There are tax benefits as mortgage interest payments and property taxes may be tax deductible. Studies show that homeowners have a much higher net worth than renters do. (Consult your tax preparer for more information.)

The Case for Buying Down the Interest Rate for the Life of the Mortgage

Buying down the interest rate, often called a mortgage rate buydown, is a strategy used by homebuyers to reduce their long-term interest costs on a loan. This involves making an upfront payment, known as “points” or “discount points” to the lender at the time of closing in exchange for a lower interest rate over the life of the loan. Each point typically costs 1% of the loan amount and can reduce the interest rate by a set fraction, typically 0.25%. While this increases the upfront costs of purchasing a home, it can result in significant savings over the loan’s term. This approach can be particularly beneficial for those who plan to stay in their home for many years, as the reduced interest can lead to considerable long-term savings. However, the decision to buy down an interest rate should be carefully evaluated against other financial goals and priorities.

The Case for a 2-1 Buydown

The 2-1 buydown is a mortgage financing option designed to make the initial years of a loan more affordable for borrowers. In a 2-1 buydown, the interest rate is temporarily reduced by two percentage points in the first year and by one percentage point in the second year. By the third year, the interest rate reverts to the original fixed rate for the remaining term of the loan. The cost of the buydown is typically funded by a lump-sum payment made by the borrower or seller at closing. Some might use this as a tool to purchase now and refinance if mortgage interest rates go down. This option could be a good tool, but buyers should be very cautious as future planning for the higher-cost monthly payment is a serious reality.

Making the Right Decision

Ultimately, the decision to wait or act depends on your personal circumstances. Consider your financial situation, the local real estate market, and your long-term plans. If you’re unsure, give me a call and we can look at all the current numbers and use our cutting-edge tools at McEnearney Associates along with a trusted mortgage professional to provide valuable insights tailored to your unique situation.

Darlene Duffett is a real estate agent with McEnearney Associates Realtors® in Old Town, Alexandria. She is licensed in Virginia and Washington, DC. She has built a reputation of partnering. with her friends and clients through the homebuying process and loves working with first time home buyers. If you would like more information on selling or buying in today’s complex market, contact Darlene at 703-969-9015, [email protected] or visit her website DarleneDuffettRealEstate.com.

If you would like a question answered in our weekly column or to set up an appointment with one of our Associates, please email: [email protected] or call 703-549-9292.

McEnearney Associates Realtors®, 109 S. Pitt Street, Alexandria, VA 22314. www.McEnearney.com Equal Housing Opportunity. #WeAreAlexandria

Just Listed highlights Alexandria City properties that came on the market within the past week. This feature is sponsored by the Jen Walker Team (Licensed in VA) of McEnearney Associates REALTORS®.

Welcome Back!

Jen Walker here with The Jen Walker Team! We are a real estate group based out of Alexandria, Virginia. I, along with my rock-star team members, Sue Kovalsky, Micki MacNaughton, Adrianna Vallario and Nancy Lacey, have more than 40 years of experience in real estate and sold over $145 million in 2023.

Welcome to 110 W Nelson, the gorgeously curated home in the desirable Del Ray neighborhood! New from the ground up (2022), there is no shortage of space in this 6 bedroom, 4.5 bathroom, over 4K sq. ft. home which features both a main and upper level primary suite!

With 10ft soaring ceilings, the main level offers a traditional layout and plenty of space for entertaining or relaxing. The expansive kitchen features white shaker cabinetry, stainless appliances, and a large peninsula with plenty of seating and storage. The great room is the perfect place for gathering indoors around the gas fireplace, or open the tall sliding doors and enjoy the lovely spring evenings on the back porch while overlooking the beautiful yard! A coveted main level primary suite features a perfect private balcony, ensuite bathroom with a tiled shower, and a large walk-in closet including a stackable washer/dryer for convenience.

Walk upstairs past the built-in bookshelves (and storage seats!) to 4 generously sized bedrooms, 2 full bathrooms, and a spacious laundry room! The upstairs primary suite is a true oasis featuring a walk in closet, huge ensuite bathroom and a large soaking tub. The lower level is full of surprises including built-in locker shelving in the mudroom area and a mudroom closet with built-in cubbies. Continue downstairs to an expansive lower level where the soaring ceilings continue, and a ton of storage! The large recreation room offers plenty of space for a family room, game room, or playroom. An exercise room with sliding doors has plenty of ceiling height for all the equipment, and also plenty of natural light to use as a home office.Don’t miss the 6th bedroom with a lovely bathroom, perfect for a guest room or au-pair room.

Home is more important than ever and this one checks every box! Ideally located in the heart of Del Ray near plenty of shopping, dining, schools, playgrounds, and endless community events, you will love living in this amazing community! Welcome home!

Open: Sunday, April 21 from 2-4 p.m.

110 W Nelson Avenue, Alexandria 22301 — $2,000,000

Click here for additional Just Listed properties in Alexandria and call The Jen Walker Team to schedule a home tour at 703-675-1566 or email [email protected].

- 2105 Commonwealth Avenue, Alexandria 22301 — $1,050,000

- 2909 Sycamore Street, Alexandria 22305 — $775,000

- 3214 Landover Street, Alexandria 22305 — $774,500

- 3348 Commonwealth Avenue, Alexandria 22305 — $649,900

Happy House Hunting!

In our highly competitive Alexandria market, the Jen Walker Team has the insider knowledge to connect you with homes that are not even public yet. With more than 40 years of experience, the Jen Walker Team has the expertise to answer questions, calm fears, and streamline your transaction. Want to see other homes not featured in this article? Contact our team today!

Please note: While The Jen Walker Team provides this information for the community, they may not be the listing agents of these homes. Equal Housing Opportunity.

McEnearney Associates Realtors®, 109 S. Pitt Street, Alexandria, VA 22314 #WeAreAlexandria

This week’s Q&A column is written by David Howell, Executive Vice President and Chief Information Officer, of McEnearney Associates Realtors®, the leading real estate firm in Alexandria. To learn more about this article and relevant market news, contact David at 703-855-5089 or email [email protected]. You may also submit your questions to McEnearney Associates via email for response in future columns.

This week’s Q&A column is written by David Howell, Executive Vice President and Chief Information Officer, of McEnearney Associates Realtors®, the leading real estate firm in Alexandria. To learn more about this article and relevant market news, contact David at 703-855-5089 or email [email protected]. You may also submit your questions to McEnearney Associates via email for response in future columns.

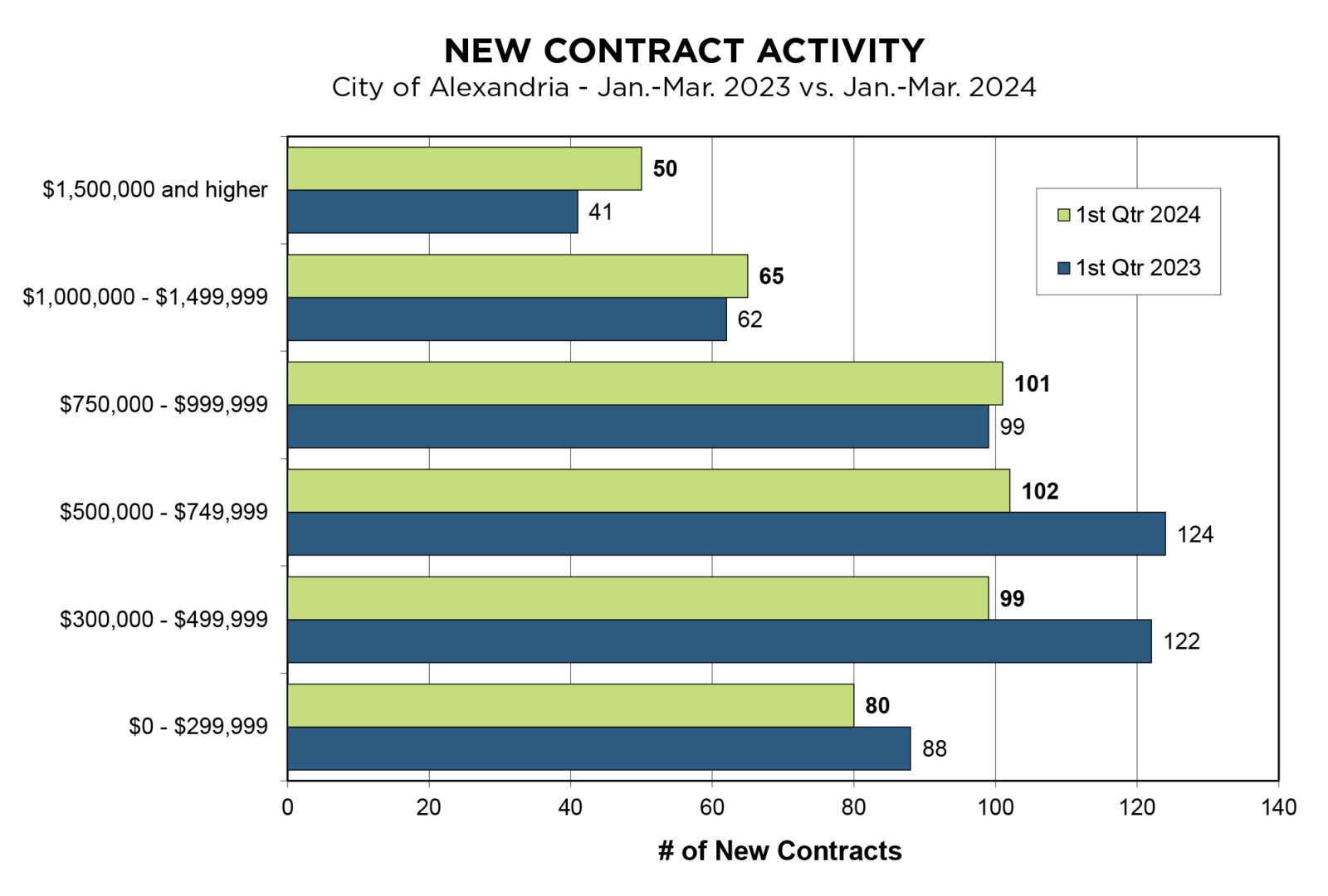

Question: How was the first quarter of the real estate market in Alexandria?

Answer: This week we look at market activity for the first quarter of 2024 compared with first quarter of 2023 for the City of Alexandria and South Alexandria (Fairfax County portions of Alexandria). The charts below show average available monthly inventory, new listing activity by price range, contract activity by price range, contract activity by property type (condos, attached homes, and detached homes), and the average days on the market. We have often discussed the continuing pressures of low inventory on our local market, and the data so far this year shows us how strong those pressures continue to be.

If you are interested in more information, every month on our website we profile the most important market indicators for Northern Virginia — contract activity, interest rates, inventory, affordability, and the direction of the market — in an easy to read and digest summary followed by supporting charts and data.

City Of Alexandria

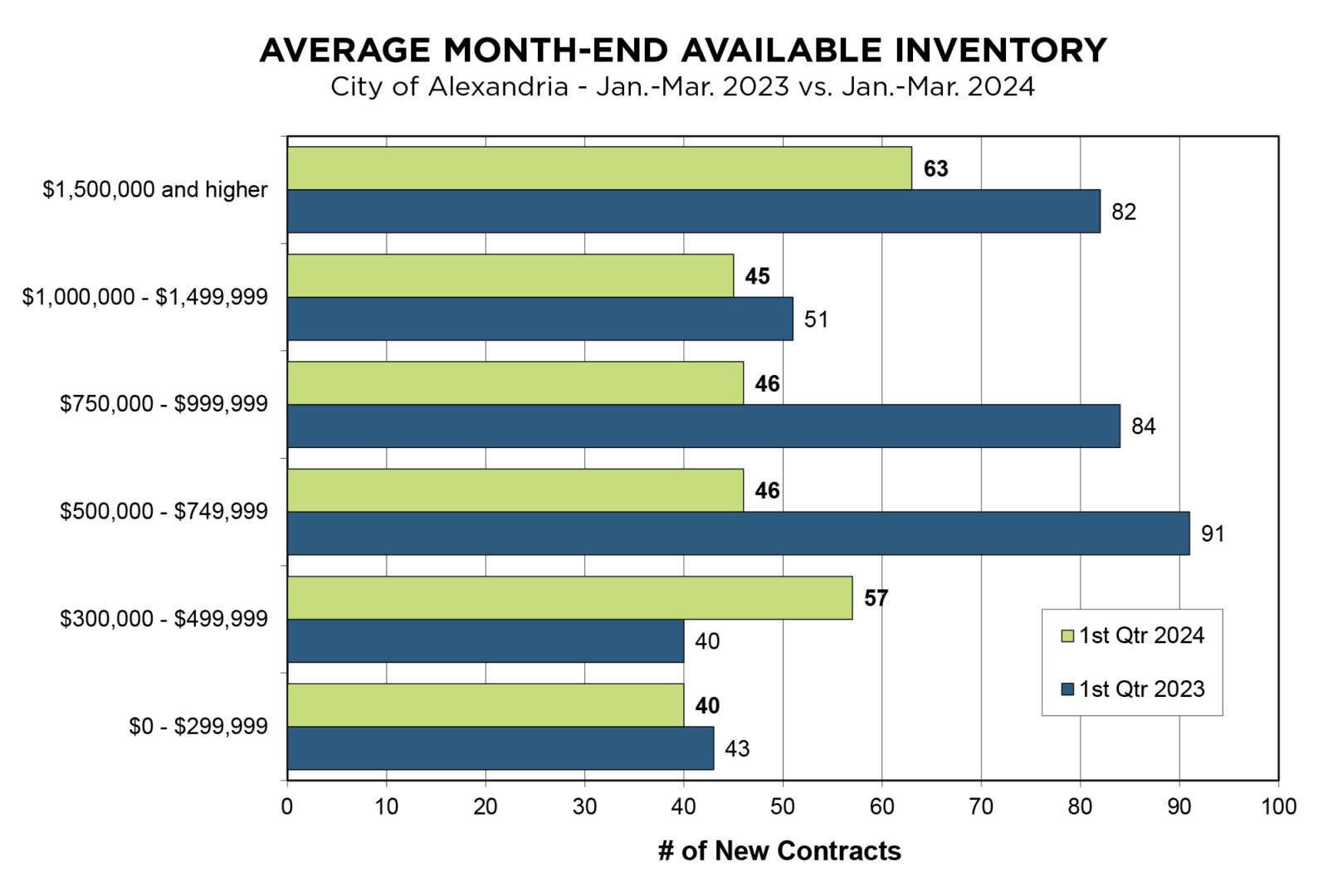

Fully Available Listings by Price Range

- Inventory is the number of available listings on the market at the end of the month.

- The average month-end inventory for City of Alexandria decreased 24.0% for the first quarter of 2024 compared to the first quarter of 2023.

- Homes priced $500,000-$999,999 saw significant decreases.

New Listings by Price Range

- Year-to-date, the number of homes coming on the market decreased 2.4% — which was 14 fewer homes — compared to 2023.

- Half of the price categories we track had increases in the number of listings.

Just Listed highlights Alexandria City properties that came on the market within the past week. This feature is sponsored by the Jen Walker Team (Licensed in VA) of McEnearney Associates REALTORS®.

Welcome Back!

Jen Walker here with The Jen Walker Team! We are a real estate group based out of Alexandria, Virginia. I, along with my rock-star team members, Sue Kovalsky, Micki MacNaughton, Adrianna Vallario and Nancy Lacey, have more than 40 years of experience in real estate and sold over $145 million in 2023.

Welcome to 2607 Valley Drive in the desirable and friendly community of Braddock Heights! This beautiful Cape Cod is the perfect blend of traditional charm and modern updates featuring 3 bedrooms, 2 fully updated bathrooms, and a one car attached garage.

The front porch welcomes you and also offers a place to rest, reset, and watch the incredible Alexandria sunsets at the end of each day. Continue through the front door and enjoy a cheerful living room adorned with built-ins, recessed lighting, wood burning fireplace, and an easy flow to the rest of the home. Across from the living room, french pocket doors open up to a very versatile room, perfect for a spacious dining room, office, or playroom! A hallway leads to a main level bedroom, and a fully renovated and curated bathroom featuring subway tiled shower and hexagon tile floors. Continue to the updated kitchen with tall white cabinetry, quartz countertops, gas cooking, and stainless steel appliances. Enjoy the eat-in kitchen or dine outside on the stone patio overlooking a generous backyard! Walk upstairs to two more bedrooms and another full bathroom. The expansive primary bedroom features a large ensuite bathroom with a marble-top double vanity, bathtub/shower and tile flooring. Don’t miss the bonus room that would make a perfect office nook or dressing room!

Walk down to the lower level that offers a spacious laundry room, tall ceilings and a blank canvas to use as you’d like. Maybe a recreation room or exercise room fits your needs! This home has been meticulously maintained and updated to include the main level bathroom (2023), laundry room update (2023), new siding (2019), chimney liner (2018), Pella windows and sliding door (2017), full kitchen renovation (2016), and more.

Perched in the middle of Alexandria City, this home is conveniently located within walking distance to George Mason Elementary, playgrounds, tot-lots, St Elmo’s Coffee, Great Harvest Bread Company, Pizzaiolo, and more. Head down to Del Ray or Old Town for even more dining, shopping, Farmer’s Markets, and community events. Welcome Home!

Open Saturday, April 13 and Sunday, April 14 from 1-3 p.m.

2607 Valley Drive, Alexandria 22302 — $965,000

Click here for additional Just Listed properties in Alexandria and call The Jen Walker Team to schedule a home tour at 703-675-1566 or email [email protected].

- 831 Wythe Street, Alexandria 22314 — $1,174,900

- 134 Wesmond Drive, Alexandria 22305 — $789,000

- 3002 Landover Street, Alexandria 22305 — $770,000

- 3949 Old Dominion Boulevard, Alexandria 22305 — $699,000

- 680 S Columbus Street, Alexandria 22314 — $1,049,000

Happy House Hunting!

In our highly competitive Alexandria market, the Jen Walker Team has the insider knowledge to connect you with homes that are not even public yet. With more than 40 years of experience, the Jen Walker Team has the expertise to answer questions, calm fears, and streamline your transaction. Want to see other homes not featured in this article? Contact our team today!

Please note: While The Jen Walker Team provides this information for the community, they may not be the listing agents of these homes. Equal Housing Opportunity.

McEnearney Associates Realtors®, 109 S. Pitt Street, Alexandria, VA 22314 #WeAreAlexandria

This week’s Q&A column is sponsored and written by Hope Peele of The Peele Group and McEnearney Associates Realtors®, the leading real estate firm in Alexandria. To learn more about this article and relevant Alexandria market news, contact The Peele Group at 703-244-6115 or email [email protected]. You may also submit your questions to McEnearney Associates via email for response in future columns.

This week’s Q&A column is sponsored and written by Hope Peele of The Peele Group and McEnearney Associates Realtors®, the leading real estate firm in Alexandria. To learn more about this article and relevant Alexandria market news, contact The Peele Group at 703-244-6115 or email [email protected]. You may also submit your questions to McEnearney Associates via email for response in future columns.

Question: How do I make the home selling process less stressful with pets?

Answer: Selling a home can be a daunting task, especially when you have furry family members. Pets are beloved companions, but they can also present challenges when it comes to showcasing your home to potential buyers. Whether you have a dog, cat, or other furry friend, here are some tips to help you navigate the process of selling your home with pets:

1. Address Pet Odors

Oftentimes odors can be difficult to notice in our own homes. For pet owners, it is always a good idea to ensure your home smells fresh and inviting before going on the market. Deep clean carpets, upholstery, and any areas where pet odors or dander may linger. Consider using pet-specific cleaners and deodorizers to neutralize odors effectively. This will also help alleviate any issues with potential buyers who might be allergic to animals. Our team recommends vinegar or charcoal-based deodorizers to our sellers!

2. Repair Pet Damage

Any pet owner knows that those little cuties can sometimes cause damage to your home, such as scratched floors, chewed moldings, or torn screens. Before listing your home, take the time to repair any pet-related damage to ensure your property looks its best.

3. Maintain Your Yard

A well-maintained yard can significantly enhance the curb appeal of your home. Keep your lawn neatly trimmed, remove any pet waste, and repair any wear and tear caused by your pets. Removing visible signs of pet-related items like toys will also help to create a tidy exterior and a positive first impression for potential buyers!

4. Arrange Temporary Relocation

During showings and open houses, consider arranging for your pets to stay elsewhere temporarily. This can minimize distractions and potential allergies for buyers, allowing them to focus on the features of your home without any pet-related interruptions. It will also help to make the process less stressful for your pet — strangers in their home can be confusing! Our team typically recommends that our sellers board their pets, or go out of town with them, for the first weekend their home is active — when it will have the most showings.

5. Neutralize Décor

Finally, while you may love your pet-themed décor, it’s important to remember that not all buyers will share your enthusiasm. Consider removing any décor or pet accessories to appeal to a wider range of buyers. Be sure to clean up toys, and hide food bowls, litter boxes, or any other items that could be distracting to buyers.

Selling a home with pets may require some extra effort, but with careful planning and preparation, you can successfully attract buyers and achieve a smooth transaction. By addressing pet-related concerns proactively and presenting your home in its best possible light, you can increase your chances of selling quickly and for top dollar.

I love supporting the Alexandria community, especially when it’s a great event for families and dogs!

The Peele Group, Hope & Kim Peele, and Nancy Smith, are all longtime Alexandrians with over 30 years of combined real estate experience. When you hire us, you hire our record of success! We are competitive and results focused. Selling your home fast and for top dollar is our top priority. Our team’s listings have sold for an average of 104% of list price, and have an average on-market time of just 11 days. We are proud to work with McEnearney Associates, the Gold Standard in Alexandria Real Estate! Call for a consultation on your home by August 31st and receive $500 towards painting or landscaping when we sell your home for you. See you at Dog Fest!

Hope Peele is a licensed real estate agent with McEnearney Associates, Inc. in Alexandria, Virginia. She grew up in Old Town and currently lives in Del Ray. As a partner with The Peele Group, Hope is dedicated to guiding her clients successfully through the many-faceted process of buying or selling a home. Contact Hope at 703-244-6115.

If you would like a question answered in our weekly column or to set up an appointment with one of our Associates, please email: [email protected] or call 703-549-9292.

McEnearney Associates Realtors®, 109 S. Pitt Street, Alexandria, VA 22314. www.McEnearney.com Equal Housing Opportunity. #WeAreAlexandria

Just Listed highlights Alexandria City properties that came on the market within the past week. This feature is sponsored by the Jen Walker Team (Licensed in VA) of McEnearney Associates REALTORS®.

Welcome Back!

Jen Walker here with The Jen Walker Team! We are a real estate group based out of Alexandria, Virginia. I, along with my rock-star team members, Sue Kovalsky, Micki MacNaughton, Adrianna Vallario and Nancy Lacey, have more than 40 years of experience in real estate and sold over $145 million in 2023.

Welcome to 228 Tennessee Avenue! This turnkey home is located in the sought-after Warwick Village just steps from the Warwick pool and playground!

As you enter, the beautifully renovated kitchen greets you with white marbled quartz countertop and gorgeous navy cabinetry. The kitchen peninsula overlooks the light-filled dining/living room area, creating a perfect space for entertaining or family gatherings. Don’t miss the custom cabinetry for added storage and convenience. Freshly painted in a neutral color, the living area is clean and bright, with the living room leading out to the fenced-in backyard. The backyard features bluestone pavers and garden boxes, providing a serene outdoor space for relaxation or outdoor dining. Upstairs, you’ll find 3 bedrooms and a fully updated bathroom.

Heading down to the finished lower level that features a versatile space, perfect for a guest room retreat, recreation room, or play room! Built-ins provide extra storage for books, movies, and more. Conveniently located on this level is another fully updated and gorgeous bathroom with a pearl-white tiled shower, luxury finishes, and built-ins. Behind folding doors are LG front-loading washer and dryer, as well as a pantry with shelving for added convenience. Notable updates include kitchen renovation 2023, interior sump pump 2024, basement renovation, including egress in 2022, windows replaced in 2021, Roof 2020, Electric panel upgraded in 2018, New boiler in 2018, among many other updates.

This home offers easy access to an array of restaurants, coffee shops, and entertainment options on The Avenue, making it a perfect blend of comfort and convenience. Welcome home!

Open Saturday, April 6 and Sunday, April 7 from 1-3 p.m.

228 Tennessee Avenue, Alexandria 22305 — $774,900

Click here for additional Just Listed properties in Alexandria and call The Jen Walker Team to schedule a home tour at 703-675-1566 or email [email protected].

- 6 Kennedy Street, Alexandria 22305 — $754,900

- 216 E Windsor Avenue, Alexandria 22301 — $950,000

- 2405 Terrett Avenue, Alexandria 22301 — $1,275,000

- 1 E Uhler Avenue, Alexandria 22301 — $2,250,000

Happy House Hunting!

In our highly competitive Alexandria market, the Jen Walker Team has the insider knowledge to connect you with homes that are not even public yet. With more than 40 years of experience, the Jen Walker Team has the expertise to answer questions, calm fears, and streamline your transaction. Want to see other homes not featured in this article? Contact our team today!

Please note: While The Jen Walker Team provides this information for the community, they may not be the listing agents of these homes. Equal Housing Opportunity.

McEnearney Associates Realtors®, 109 S. Pitt Street, Alexandria, VA 22314 #WeAreAlexandria

This week’s Q&A column, sponsored and written by McEnearney Associates Realtors®, the leading real estate firm in Alexandria, is a bit of a departure from our usual format. To learn more about this article and relevant Alexandria market news, contact us at 703-549-9292. You may also submit your questions to McEnearney Associates via email for response in future columns.

Question: Is the cost of homeowner’s insurance on the rise?

Answer: Massive increases in insurance premiums are busting budgets and derailing some home purchases.

If you’re a property owner, you know you need homeowner’s insurance. And if you live in an area that’s been designated as having a higher risk for property damage — such as in a flood zone, an area of extreme weather, or a densely-wooded location — you might expect that your insurance rates will be higher. And, of course, homeowners know that if they file a claim or two over the years that they should pay more at their next policy renewal.

But many homeowners and would-be buyers are finding out that premiums are rising sharply through no fault of their own, if insurance can be secured at all. What was once a standard, perfunctory item on a homeowner’s to-do list has become a lot more complicated as larger insurance companies try to stem losses caused by an increase in claims in areas affected by major natural disasters like wildfires, flooding, tornadoes, and hurricanes. Those costs are being passed down the line to consumers.

“It’s problematic for our buyers and problematic for our sellers,” said Jillian Keck Hogan is a top-producing agent who works in D.C., Maryland and Virginia and has experienced how acquiring insurance can complicate a home sale. She recently represented a seller for a listing that the buyer couldn’t secure insurance for because there weren’t definitive records about the age of the roof. Multiple roof inspectors gave reports that insurance deemed inadequate because the roof, while in sound condition, was past its half-life expectancy.

Roofs can last around 30 years and the average life of most roofs is around 20 years. In order to secure their insurance and proceed with closing on time, the seller chose to split the cost of replacing the roof after closing. Jillian said that education for both buyers and sellers is key. She advises that sellers should gather details about the age of their roof, systems, and utilities before bringing their home to market and be prepared for buyers who may request fixes for big ticket items, while buyers should start shopping for insurance sooner rather than later, and to investigate multiple carriers for rates.

“It ends up being messy if you’re trying to get all of your insurance research done only days before closing,” she warned.

Susie Adib, Senior Producer with Commercial Insurance Associates, said there are many factors that are causing a spike in premiums — in many cases more than 20% — including an increase in severe weather and natural disasters, a carrier’s drive for profitability as set by their combined ratio, and complications from pandemic recovery, including inflation, labor shortages. Many things that are just now working through the insurance pipeline, a process that takes time because of regulatory review at the state level for any changes a carrier makes regarding premium increases. State agencies make sure there are sufficient and affordable options for consumers and local departments of insurance and their resources can be found here for D.C., Maryland, Virginia and West Virginia.

Adib said that much like credit scores, homeowners will have an insurance score that affects how much a policy will cost. This can include factors like how many claims you’ve made in the past, your credit score, and who you’ve been insured with in the past. For example, there many companies that won’t insure a slate or flat roof, historic properties, or homes built before 1900 and if you’ve had a previous insurance carrier that covered those items in the past, it will be a flag to a new carrier that there is a mitigating factor in the property.

What happens if a property is deemed uninsurable? Adib said there are still options. Again, much like credit companies, there is a market for substandard properties where premiums will be higher but at least the home will be covered. There is also the option to exclude coverage for a portion of the home that is at higher risk, for example a roof or liability for a pet. Lenders can also require force-placed insurance, whereby the lender secures the insurance and passes along the costs to the borrower via steep premiums in their mortgage.

“When it comes to insurance, there are so many options,” Adib said. “It’s so important to have an actual person you can talk to — not an #800-number — especially when a claim arises.” She advises homeowners to do timely research to make sure you have that person to go to bat for you when the time comes.

Here are some tips for keeping insurance premiums in check.

- Review your insurance policy every couple of years, especially if you’ve made improvements or renovations to the property. Adib said that shopping for new coverage won’t increase your rate and it’s important to understand how different carriers might evaluate your policy and the premiums you pay. “It’s your policy so make sure it covers what you need it to.”

- Don’t make small claims. The average homeowner makes one claim every seven years and anything above that could impact policy rates. For example, don’t file a claim if you have a $500 deductible and a tree falls on your backyard shed accounting for $700 in damages. Yes, you have insurance for a reason but not all claims are equal. The more claims on a policy the more likely it is to face a surcharge or be at risk for non-renewal.

- Shop replacement costs of your home, which are different from the market value of your home which also includes the value of the land the property sits on. Replacement costs are the amount of money needed to repair a property or replace belongings at current building supply costs. Over time, automatic annual increases driven by roll-on percentages that are driven by inflation can increase expected replacement costs that may not be aligned with actual costs. If you’ve had your policy for a while, it’s worth looking at the suggested replacement costs and see how they compare with other policy quotes. It’s important to note that while a carrier’s premium rates are reviewed and regulated by the state, roll-on percentages for replacement costs are not, even though high replacement costs can increase the premium. A home with a current replacement cost of $500,000 with an annual roll-on percentage of 3% is going to have a lower premium over time than a similar home with a roll-on rate of 6%. “You could be paying a lot more in premiums for coverage you might not need,” Adib said.

- A higher deductible can lower insurance rates, especially if you don’t have a lot of claims on the policy. Owners like low deductibles because they want to reduce how much they must pay out-of-pocket for damages to their property, but lower deductibles mean higher premiums, and deductibles only come into play when a claim is made. Over time, having a $2,500 deductible and a lower annual premium will save more money than having a $500 deductible and a higher premium. Another option is a percentage deductible, but Adib cautions that while this can lower premiums it will mean more money out of pocket if there is a claim.

- Maintain your home in good condition. Look for trees around the property that could cause damage, check the roof for missing shingles or areas of leakage or water absorption, keep up with maintenance on big-ticket appliances like the HVAC and hot water heater. Insurance carriers do conduct inspections on properties they cover — including using spatial imaging to evaluate roofs — and your rates could increase if they find something of concern.

- Consider a local carrier. National carriers have increased volatility in their rates because they cover the entire country, including areas that may be prone to natural disasters. To make up for losses in those areas they must be strategic about rates and be selective about the risk they will accept with new policies, while smaller and local carriers may be willing to take on that risk.

If you’re a current homeowner, take a few moments to review your current policy to check you have the coverage you need on terms that work for you now, as circumstances are likely to have changed if you’ve owned that property for a while. If you’re a buyer looking to secure coverage, pay attention to the condition of the property you’re purchasing and be prepared to negotiate with the seller to make fixes or shop around for an affordable policy.

If you would like a question answered in our weekly column or to set up an appointment with one of our Associates, please email: [email protected] or call 703-549-9292.

McEnearney Associates Realtors®, 109 S. Pitt Street, Alexandria, VA 22314. www.McEnearney.com Equal Housing Opportunity. #WeAreAlexandria

Just Listed highlights Alexandria City properties that came on the market within the past week. This feature is sponsored by the Jen Walker Team (Licensed in VA) of McEnearney Associates REALTORS®.

Welcome Back!

Jen Walker here with The Jen Walker Team! We are a real estate group based out of Alexandria, Virginia. I, along with my rock-star team members, Sue Kovalsky, Micki MacNaughton, Adrianna Vallario and Nancy Lacey, have more than 40 years of experience in real estate and sold over $145 million in 2023.

Fabulous end unit in the heart of Del Ray! Updated and move-in ready, you don’t want to miss this one. With over 1500 square feet over two levels, this home has generously sized rooms and is flooded with light. Enter the sunny living room that is open to the dining room. Gorgeous hardwood flooring takes you back to the renovated kitchen — with sharp subway tile, quartz countertops and tons of cabinetry you will love cooking for friends or making everyday meals in this stunning kitchen. The laundry area is located off the kitchen, situated behind a solid wooden five panel door.

Head outside through the kitchen to the large lot and great, private backyard. Rounding out the main level is a half bath for convenience. Head upstairs, where two bedrooms with ensuite bathrooms await. With ample closets and convenient bathrooms, both of these bedrooms are well-sized and can accommodate king sized beds. Use one as a primary suite and the other as a guest room/office. With “The Ave” just a few steps away, walking to restaurants, shopping, Pilates, coffee shops, the Farmers Market and more will be part of your new routine! Leave your car in the driveway and walk to all that Del Ray has to offer. Welcome home!

Open House: Saturday, March 30 from 1-3 p.m.

113 E Windsor Avenue #C, Alexandria 22301 — $885,000

Click here for additional Just Listed properties in Alexandria and call The Jen Walker Team to schedule a home tour at 703-675-1566 or email [email protected].

- 120A E Raymond Avenue, Alexandria 22301 — $824,900

- 3736 Jason Avenue, Alexandria 22302 — $545,000

- 721 S Lee Street, Alexandria 22314 — $1,995,000

- 301 E Oak Street, Alexandria 22301 — $1,225,000

- 148 Martin Lane, Alexandria 22304 — $869,900

- 204 Pine Street, Alexandria 22305 — $1,025,000

Happy House Hunting!

In our highly competitive Alexandria market, the Jen Walker Team has the insider knowledge to connect you with homes that are not even public yet. With more than 40 years of experience, the Jen Walker Team has the expertise to answer questions, calm fears, and streamline your transaction. Want to see other homes not featured in this article? Contact our team today!

Please note: While The Jen Walker Team provides this information for the community, they may not be the listing agents of these homes. Equal Housing Opportunity.

McEnearney Associates Realtors®, 109 S. Pitt Street, Alexandria, VA 22314 #WeAreAlexandria