This week’s Q&A column, sponsored and written by McEnearney Associates Realtors®, the leading real estate firm in Alexandria, is a bit of a departure from our usual format. To learn more about this article and relevant Alexandria market news, contact us at 703-549-9292. You may also submit your questions to McEnearney Associates via email for response in future columns.

Question: Is the cost of homeowner’s insurance on the rise?

Answer: Massive increases in insurance premiums are busting budgets and derailing some home purchases.

If you’re a property owner, you know you need homeowner’s insurance. And if you live in an area that’s been designated as having a higher risk for property damage — such as in a flood zone, an area of extreme weather, or a densely-wooded location — you might expect that your insurance rates will be higher. And, of course, homeowners know that if they file a claim or two over the years that they should pay more at their next policy renewal.

But many homeowners and would-be buyers are finding out that premiums are rising sharply through no fault of their own, if insurance can be secured at all. What was once a standard, perfunctory item on a homeowner’s to-do list has become a lot more complicated as larger insurance companies try to stem losses caused by an increase in claims in areas affected by major natural disasters like wildfires, flooding, tornadoes, and hurricanes. Those costs are being passed down the line to consumers.

“It’s problematic for our buyers and problematic for our sellers,” said Jillian Keck Hogan is a top-producing agent who works in D.C., Maryland and Virginia and has experienced how acquiring insurance can complicate a home sale. She recently represented a seller for a listing that the buyer couldn’t secure insurance for because there weren’t definitive records about the age of the roof. Multiple roof inspectors gave reports that insurance deemed inadequate because the roof, while in sound condition, was past its half-life expectancy.

Roofs can last around 30 years and the average life of most roofs is around 20 years. In order to secure their insurance and proceed with closing on time, the seller chose to split the cost of replacing the roof after closing. Jillian said that education for both buyers and sellers is key. She advises that sellers should gather details about the age of their roof, systems, and utilities before bringing their home to market and be prepared for buyers who may request fixes for big ticket items, while buyers should start shopping for insurance sooner rather than later, and to investigate multiple carriers for rates.

“It ends up being messy if you’re trying to get all of your insurance research done only days before closing,” she warned.

Susie Adib, Senior Producer with Commercial Insurance Associates, said there are many factors that are causing a spike in premiums — in many cases more than 20% — including an increase in severe weather and natural disasters, a carrier’s drive for profitability as set by their combined ratio, and complications from pandemic recovery, including inflation, labor shortages. Many things that are just now working through the insurance pipeline, a process that takes time because of regulatory review at the state level for any changes a carrier makes regarding premium increases. State agencies make sure there are sufficient and affordable options for consumers and local departments of insurance and their resources can be found here for D.C., Maryland, Virginia and West Virginia.

Adib said that much like credit scores, homeowners will have an insurance score that affects how much a policy will cost. This can include factors like how many claims you’ve made in the past, your credit score, and who you’ve been insured with in the past. For example, there many companies that won’t insure a slate or flat roof, historic properties, or homes built before 1900 and if you’ve had a previous insurance carrier that covered those items in the past, it will be a flag to a new carrier that there is a mitigating factor in the property.

What happens if a property is deemed uninsurable? Adib said there are still options. Again, much like credit companies, there is a market for substandard properties where premiums will be higher but at least the home will be covered. There is also the option to exclude coverage for a portion of the home that is at higher risk, for example a roof or liability for a pet. Lenders can also require force-placed insurance, whereby the lender secures the insurance and passes along the costs to the borrower via steep premiums in their mortgage.

“When it comes to insurance, there are so many options,” Adib said. “It’s so important to have an actual person you can talk to — not an #800-number — especially when a claim arises.” She advises homeowners to do timely research to make sure you have that person to go to bat for you when the time comes.

Here are some tips for keeping insurance premiums in check.

- Review your insurance policy every couple of years, especially if you’ve made improvements or renovations to the property. Adib said that shopping for new coverage won’t increase your rate and it’s important to understand how different carriers might evaluate your policy and the premiums you pay. “It’s your policy so make sure it covers what you need it to.”

- Don’t make small claims. The average homeowner makes one claim every seven years and anything above that could impact policy rates. For example, don’t file a claim if you have a $500 deductible and a tree falls on your backyard shed accounting for $700 in damages. Yes, you have insurance for a reason but not all claims are equal. The more claims on a policy the more likely it is to face a surcharge or be at risk for non-renewal.

- Shop replacement costs of your home, which are different from the market value of your home which also includes the value of the land the property sits on. Replacement costs are the amount of money needed to repair a property or replace belongings at current building supply costs. Over time, automatic annual increases driven by roll-on percentages that are driven by inflation can increase expected replacement costs that may not be aligned with actual costs. If you’ve had your policy for a while, it’s worth looking at the suggested replacement costs and see how they compare with other policy quotes. It’s important to note that while a carrier’s premium rates are reviewed and regulated by the state, roll-on percentages for replacement costs are not, even though high replacement costs can increase the premium. A home with a current replacement cost of $500,000 with an annual roll-on percentage of 3% is going to have a lower premium over time than a similar home with a roll-on rate of 6%. “You could be paying a lot more in premiums for coverage you might not need,” Adib said.

- A higher deductible can lower insurance rates, especially if you don’t have a lot of claims on the policy. Owners like low deductibles because they want to reduce how much they must pay out-of-pocket for damages to their property, but lower deductibles mean higher premiums, and deductibles only come into play when a claim is made. Over time, having a $2,500 deductible and a lower annual premium will save more money than having a $500 deductible and a higher premium. Another option is a percentage deductible, but Adib cautions that while this can lower premiums it will mean more money out of pocket if there is a claim.

- Maintain your home in good condition. Look for trees around the property that could cause damage, check the roof for missing shingles or areas of leakage or water absorption, keep up with maintenance on big-ticket appliances like the HVAC and hot water heater. Insurance carriers do conduct inspections on properties they cover — including using spatial imaging to evaluate roofs — and your rates could increase if they find something of concern.

- Consider a local carrier. National carriers have increased volatility in their rates because they cover the entire country, including areas that may be prone to natural disasters. To make up for losses in those areas they must be strategic about rates and be selective about the risk they will accept with new policies, while smaller and local carriers may be willing to take on that risk.

If you’re a current homeowner, take a few moments to review your current policy to check you have the coverage you need on terms that work for you now, as circumstances are likely to have changed if you’ve owned that property for a while. If you’re a buyer looking to secure coverage, pay attention to the condition of the property you’re purchasing and be prepared to negotiate with the seller to make fixes or shop around for an affordable policy.

If you would like a question answered in our weekly column or to set up an appointment with one of our Associates, please email: [email protected] or call 703-549-9292.

McEnearney Associates Realtors®, 109 S. Pitt Street, Alexandria, VA 22314. www.McEnearney.com Equal Housing Opportunity. #WeAreAlexandria

Recent Stories

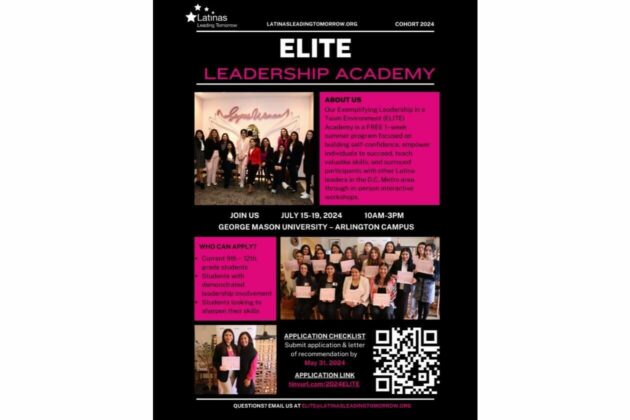

FREE Leadership Sessions will be conducted at the George Mason University –Arlington Campus for High School Latinas. The program runs from Monday 7/15 through Friday 7/19 from 10:00AM to 3:00PM EST each day (1-week).

Las sesiones de liderazgo GRATUITAS se llevarán a cabo en el campus de George Mason University – Arlington para latinas de secundaria. El programa se desarrollará desde el lunes 15 de julio hasta el viernes 19 de julio, de 10:00 a.m. a 3:00 p.m. EST cada día (1 semana).

Our goal is to equip students with the fundamentals of self-promotion and guide them in shaping their personal brand for future success. What sets this program apart is its integration of self-awareness activities and mentorship by seasoned professionals.

Finding a gift for moms can be difficult. Google “Mother’s Day gifts,” and you’ll scroll through endless lists of beauty products, candles and fuzzy robes. Sure, those are sweet, but sometimes it’s fun to surprise loved ones with something a little more, well, practical!

Here’s one idea: Give her a gift certificate for a home cleaning from Well-Paid Maids. It’s the perfect “thank you,” “I love you” or “you’ve got this” for any mom. She can schedule the home cleaning at her convenience and breathe easy knowing she has one less thing to do.

Our cleaners will take care of everything, including vacuuming and mopping as well as cleaning and dusting countertops, tables, mirrors, appliances and more. Sinks, toilets, showers and appliance exteriors also get a good scrub.

Plus, when you buy a gift certificate from Well-Paid Maids, you’re supporting a living-wage cleaning company. That means cleaners get paid a starting wage of $24 an hour and get access to benefits, like 24 days of PTO and health insurance.

Alexandria NAACP, Shiloh Baptist Church, DPC to hold City Council…

The Alexandria Branch of the NAACP, Shiloh Baptist Church, and The Departmental Progressive Club to hold the City Council Candidate Forum for ALL Candidates in the City of Alexandria Virginia. The event is Free of Charge and Open to The