This week’s Q&A column is sponsored and written by Brian Bonnet, Senior Loan Officer (NMLS ID# 224811) of Atlantic Coast Mortgage, LLC (NMLS ID# 643114). To learn more about current mortgage rates and the home loan process, contact Brian at 703-766-6702 or email [email protected]. You may also submit your questions to McEnearney Associates via email for response in future columns.

Question: How do I navigate the current mortgage environment?

Answer: A great deal has changed in the mortgage industry over the past several weeks as the industry responds to COVID-19 economic concerns. Real estate agents and consumers need to be aware of the changes as they navigate the current residential real estate market.

The mortgage industry is facing a severe liquidity problem. Investors stopped purchasing Mortgage Backed Securities (MBS) which is the source of capital mortgage bankers use to make loans to consumers. The Federal Reserve stepped in and began purchasing some MBS offerings but is limiting its purchases to true conforming Fannie Mae and Freddie Mac packages.

Securities based on larger loans and on VA and FHA loans are not being sold. When the mortgage industry cannot sell its MBS, there is limited cash available to make loans to consumers, evidenced by current disparity in rate and point structures.

Generally true conforming loans (< $510,401) are available in the low 3 percentiles at zero points for borrowers with good credit. By contrast, high balance conforming loans, jumbo loans and VA and FHA loans are in the upper 3’s to low 4’s.

In addition to rate/point increases, the past several weeks has seen underwriting guidelines tighten significantly. Across the industry minimum credit scores for all loan programs are being raised and minimum down payments for larger loans are being increased. Where jumbo loans are still available, minimum borrower reserve requirements are being increased and income standards are being tightened.

On some programs, maximum debt-to-income ratios are being lowered. Mortgage insurance companies are also tightening their underwriting requirements and have increased mortgage insurance premiums. All in all, many borrowers are finding it more difficult to qualify for mortgage financing.

On the positive side, both Fannie and Freddie began accepting exterior only and “desktop” appraisals for most scenarios. VA and FHA are following suit.

Our industry is beginning to work with the settlement industry to allow for hybrid electronic settlements, limiting those documents which must be “wet signed” to just a handful of the settlement documents.

Undoubtedly some consumers will decide now is not the time to sell or purchase a home. Others will recognize that this may be a great time to enter the market. For sellers, inventory is still low. For buyers, they may be competing against fewer fellow purchasers. As I always told my boys when they were standing at the plate, you cannot hit if you don’t swing.

Agents, buyers and sellers need to keep a couple of additional things in mind. The mortgage process for the next month or so will take a little longer than usual as lenders are processing very high re-finance volumes. The appraisal process where interior inspections are required will take longer and will require coordination between sellers and appraisers for safe practices.

More than ever, borrowers need to be truly approved for financing before writing contracts. In some instances, after being preliminarily approved, buyers will lose employment and or income prior to settlement and will end up not qualified for financing. Financing contingencies must remain in place from contract to settlement.

As the nation and the world work through the virus crisis and our economy stabilizes, the mortgage industry will stabilize as well.

If you would like more information to help plan your next move, please contact Brian Bonnet at [email protected] or call 703-766-6702.

If you would like a question answered in our weekly column or to set up an appointment with one of our Associates, please email: [email protected] or call 703-549-9292.

McEnearney Associates Realtors®, 109 S. Pitt Street, Alexandria, VA 22314. www.McEnearney.com Equal Housing Opportunity. #WeAreAlexandria

Recent Stories

Good news, D.C. area. You can save money on your next home cleaning with Well-Paid Maids. It’s easy!

We offer a discount when you set up recurring cleans — and the discounts just increased this week!

For weekly cleans, get $30 off each cleaning.

Potomac Harmony is Back! Following a gap year of competing, then virtual rehearsals during the pandemic, followed by the well-earned retirement of our long-term director, a year of a director search, Potomac Harmony hit the regional contest stage in Concord, North Carolina in March for the first time since 2018! It was exhilarating, reaffirming, and rewarding!

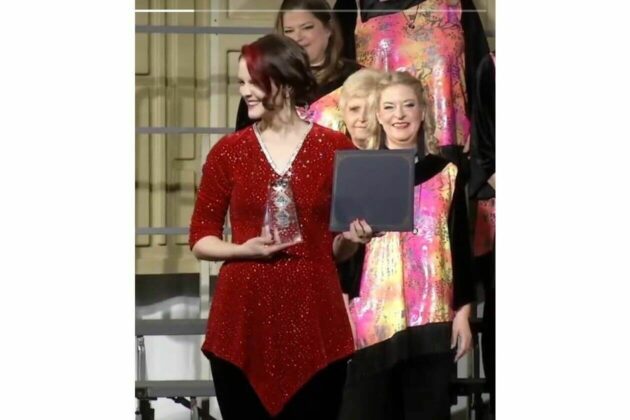

The chorus hit all of its goals, the biggest of which was to have fun and sing our best on contest stage — we did both! Because we earned a score over 400 points, our new Director, Allison Lynskey, was awarded the Novice Director award, photo above. Additionally, one of our charter members, Jackie Bottash, was nominated for and honored with the Leadership Excellence award. It was a celebratory weekend!

What’s next? So much! We now look forward to upcoming performances, growing our membership, and expanding our musical product with new arrangements and an education component each week. It’s an exciting time to be part of this ever-growing ensemble!

Alexandria NAACP, Shiloh Baptist Church, DPC to hold City Council…

The Alexandria Branch of the NAACP, Shiloh Baptist Church, and The Departmental Progressive Club to hold the City Council Candidate Forum for ALL Candidates in the City of Alexandria Virginia. The event is Free of Charge and Open to The