This week’s Q&A column, sponsored and written by McEnearney Associates Realtors®, the leading real estate firm in Alexandria, is a bit of a departure from our usual format. To learn more about this article and relevant Alexandria market news, contact us at 703-549-9292. You may also submit your questions to McEnearney Associates via email for response in future columns.

Question: How can I help a family member finance a home purchase?

Answer: Tapping into monetary gifts and family financing can be a creative — and caring — way to help loved ones get the home they want.

Real estate is one of the most effective ways that families build, generate, and protect their wealth. Home appreciation offers cash equity, vacation and investment properties bring consistent revenue streams, and multigenerational living allows extended family to share expenses.

But with rising home prices, interest rates the highest they have been in a generation, and a lot of graduates carrying significant college loans (often for decades), it can be difficult if not outright impossible for new buyers to fund the purchase of a first home. According to the most recent report from the National Association of Realtors, the share of first-time home buyers in 2022 dropped to a record low of 26%, while the age of a typical first-time buyer increased to an all-time high of 36 years old, in part due to the time it takes to save for a down payment.

So, how can parents, guardians and caregivers help the next generation get to that first rung of the home investment ladder? Here are a few important family financial strategies that can guide cash-strapped relatives to the home of their dreams.

Family as Landlord — It’s often the lament of would-be empty nesters: a kiddo moves back home after school, during a break-up, or, more recently, into a COVID-19 bubble and just never left. Yet, all this togetherness can be a great opportunity for lessons on budgeting, saving, and investing. Assuming your live-in lodger has an income, charge a small but fair amount for rent and household expenses that will be put into savings or an investment account to be used as a down payment. It may take time for this nest egg to grow but with each deposit the goal of moving on will be closer and the practice of regular saving will pay off in the long run.

Give Money — Monetary gifts for a down payment are the easiest way to assist a family member with a home purchase and can be tax free within IRS guidelines. Gifts must come from immediate family — parents, siblings, grandparents, spouse or even a partner (if engaged to be married) — and there can’t be a plan for repayment, so nothing with “strings attached.” This will be spelled out in a gift letter that will be shared with the lender. Current monetary limits are $15,000 per person buying a home, meaning if a purchase has two buyers, then there can be $30,000 in gifts. Discuss any gifts with your lender to ensure they are documented properly and used accordingly.

Finance the Mortgage — Someone looking to park their cash in real estate can make it work for the greater family good and act as the lender, funding the purchase but without additional fees and a reduced interest rate. Family lenders must charge at least the Applicable Federal Rate (AFR), the minimum interest rate required to keep the assistance from being considered a gift. These rates are almost always much less than the current market rate and are three AFR tiers based on the repayment term of a family loan:

- Short-term rates, for loans with a repayment term of up to three years.

- Mid-term rates, for loans with a repayment term between three and nine years.

- Long-term rates, for loans with a repayment term greater than nine years.

Rates change monthly. For example, the short-term rate for May 2023 is 4.30% (for April it was 4.86% and for March it was 4.50%); mid-term rate for May 2023 is 3.57% (for April it was 4.15% and March was 3.70%); and long-term rate for May 2023 is 3.72% (for April it was 4.02% and March was 3.74%) (Figures from NationalFamilyMortgage.com as of April 24, 2023). Before finalizing a family loan be sure to consult with an accountant or tax authority for any potential tax liability.

Co-Sign the Mortgage — Being a signatory on any debt can have risks, but sometimes it’s the fastest way to get to the settlement table. When co-signing a mortgage, the bank will take all borrowers income, assets, debts and credit worthiness into account and hold all parties equally liable. This is where having a clear and mutually agreed upon plan is critical as missed payments or a default on the loan will negatively affect all parties. Co-signers do not have to be on title, but it might be in their interest to be named on the deed so that they are co-owners and not just co-borrowers, giving them more say in management of the home as an asset.

Family as Landlord, Part 2 — Buying a home for a relative to rent is another win-win option, especially if the payment is going to a rent-to-own situation where a portion of the rent is banked toward equity in the home, or for down payment on the purchase of another property. For example, parents who buy a home and allow their child to live in it might be able to take tax deductions on property taxes, mortgage interest, repairs, maintenance, and structural improvements. Check IRS guidelines to determine rent requirements vs. personal use so there are no tax surprises.

It Takes a Village — It’s not for everyone but bringing several relatives under one roof can be a windfall in more ways than one. Multi-generational living is nothing new, with benefits like convenient and trusted childcare, shared expenses, and the ability to “age in place” giving families support and a safety net to help through life’s joys and challenges. Pooling resources among relatives increases buying power and can offer different options for what the living structure will look like: a larger traditional home, a multi-unit building where the family lives in one part and rents out the other, or a large tract of land where family dwellings can be built close together and share a common space.

As with any financial arrangement, it is important that all parties are clear about expectations and responsibilities. This is even more important with family members where emotions and personal history can have an outsized influence.

But when looking at ways to help the next generation get on the road to home ownership, sometimes it is the case that “family knows best.”

If you would like a question answered in our weekly column or to set up an appointment with one of our Associates, please email: [email protected] or call 703-549-9292.

McEnearney Associates Realtors®, 109 S. Pitt Street, Alexandria, VA 22314. www.McEnearney.com Equal Housing Opportunity. #WeAreAlexandria

Recent Stories

Good news, D.C. area. You can save money on your next home cleaning with Well-Paid Maids. It’s easy!

We offer a discount when you set up recurring cleans — and the discounts just increased this week!

For weekly cleans, get $30 off each cleaning.

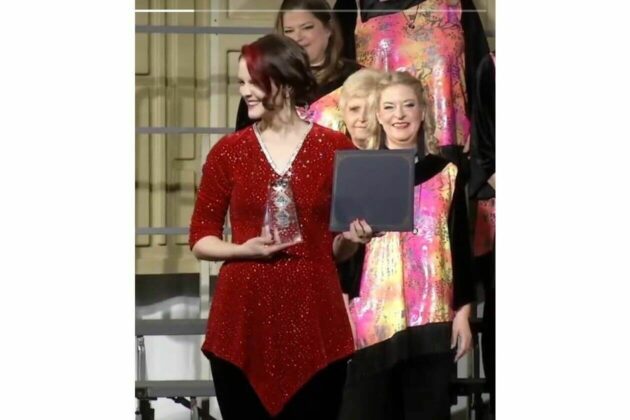

Potomac Harmony is Back! Following a gap year of competing, then virtual rehearsals during the pandemic, followed by the well-earned retirement of our long-term director, a year of a director search, Potomac Harmony hit the regional contest stage in Concord, North Carolina in March for the first time since 2018! It was exhilarating, reaffirming, and rewarding!

The chorus hit all of its goals, the biggest of which was to have fun and sing our best on contest stage — we did both! Because we earned a score over 400 points, our new Director, Allison Lynskey, was awarded the Novice Director award, photo above. Additionally, one of our charter members, Jackie Bottash, was nominated for and honored with the Leadership Excellence award. It was a celebratory weekend!

What’s next? So much! We now look forward to upcoming performances, growing our membership, and expanding our musical product with new arrangements and an education component each week. It’s an exciting time to be part of this ever-growing ensemble!

Alexandria NAACP, Shiloh Baptist Church, DPC to hold City Council…

The Alexandria Branch of the NAACP, Shiloh Baptist Church, and The Departmental Progressive Club to hold the City Council Candidate Forum for ALL Candidates in the City of Alexandria Virginia. The event is Free of Charge and Open to The