This week’s Q&A column is written by Darlene Duffett of McEnearney Associates Realtors®, the leading real estate firm in Alexandria. To learn more about this article and relevant Alexandria market news, contact Darlene at 703-969-9015 or email [email protected]. You may also submit your questions to McEnearney Associates via email for response in future columns.

This week’s Q&A column is written by Darlene Duffett of McEnearney Associates Realtors®, the leading real estate firm in Alexandria. To learn more about this article and relevant Alexandria market news, contact Darlene at 703-969-9015 or email [email protected]. You may also submit your questions to McEnearney Associates via email for response in future columns.

Question: Are high interest rates hindering homeowners with lower rates from selling?

Answer: The real estate market has been experiencing a significant slowdown in recent times, and one of the reasons behind it is the low interest rates enjoyed by many homeowners.

With rates below 3%, many homeowners are reluctant to sell their properties and give up their incredibly low mortgage rates. Even if they have a desire to move to a bigger and better house, the prospect of a higher interest rate and larger mortgage payment is discouraging them from doing so.

For example, let’s say a homeowner has a $500,000 mortgage at a rate of 3%. Their monthly principal and interest payment would be approximately $2,100. Now, if they want to upgrade their home and add an additional $100,000 to their mortgage, they would have to accept a new rate of around 6.5%. That would increase their monthly payment to $3,750, which is a staggering 78% increase in their housing cost.

This is a major concern for economists who are tracking the real estate market closely. They believe that the current high-rate environment is not just suppressing buyer activity but is also affecting seller activity. With fewer new listings coming on the market, homeowners are hesitant to sell and give up their low mortgage rates. Unless there is a significant change in their life circumstances, such as a job change, divorce, or more kids, homeowners are not going to make a move with such a significant increase in housing cost.

While economists differ on the exact rate drop required to coax sellers off the sidelines, the consensus is that it will take more than a 1% reduction in interest rates. In the scenario described above, a drop from 6.5% to 5.5% only reduces the monthly payment by $300. A drop to 5% would reduce the payment by about $500 per month, but even that may not be enough to convince homeowners to sell.

The lack of seller activity is also contributing to the shortage of housing inventory in the market, making it difficult for buyers to find suitable homes. This situation is further compounded by the fact that interest rates are currently well above 6%, creating a significant delta of at least 3% between current rates and the rates that many homeowners enjoy.

In conclusion, the low interest rates enjoyed by many homeowners are a significant factor behind the current slowdown in the real estate market. With the current high-rate environment, homeowners are hesitant to sell their properties and give up their low mortgage rates, contributing to the shortage of housing inventory.

While a reduction in interest rates may help coax some homeowners off the sidelines, it may take more than just a slight reduction to encourage them to sell and move to a bigger and better home.

Would you like to receive a valuation of your home? Click here and I’ll get one right over to you.

Darlene Duffett is a licensed real estate agent in Virginia with McEnearney Associates Realtors® in Old Town, Alexandria. She is licensed in Virginia and Washington, D.C. She has built a reputation of partnering with her friends and clients through the homebuying process and loves working with first time home buyers. If you would like more information on selling or buying in today’s complex market, contact Darlene at 703-969-9015, [email protected] or visit her website DarleneDuffettRealEstate.com.

If you would like a question answered in our weekly column or to set up an appointment with one of our Associates, please email: [email protected] or call 703-549-9292.

McEnearney Associates Realtors®, 109 S. Pitt Street, Alexandria, VA 22314. www.McEnearney.com Equal Housing Opportunity. #WeAreAlexandria

Recent Stories

Good news, D.C. area. You can save money on your next home cleaning with Well-Paid Maids. It’s easy!

We offer a discount when you set up recurring cleans — and the discounts just increased this week!

For weekly cleans, get $30 off each cleaning.

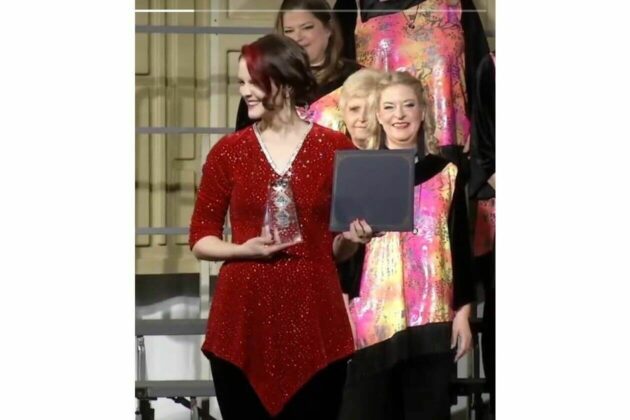

Potomac Harmony is Back! Following a gap year of competing, then virtual rehearsals during the pandemic, followed by the well-earned retirement of our long-term director, a year of a director search, Potomac Harmony hit the regional contest stage in Concord, North Carolina in March for the first time since 2018! It was exhilarating, reaffirming, and rewarding!

The chorus hit all of its goals, the biggest of which was to have fun and sing our best on contest stage — we did both! Because we earned a score over 400 points, our new Director, Allison Lynskey, was awarded the Novice Director award, photo above. Additionally, one of our charter members, Jackie Bottash, was nominated for and honored with the Leadership Excellence award. It was a celebratory weekend!

What’s next? So much! We now look forward to upcoming performances, growing our membership, and expanding our musical product with new arrangements and an education component each week. It’s an exciting time to be part of this ever-growing ensemble!

Alexandria NAACP, Shiloh Baptist Church, DPC to hold City Council…

The Alexandria Branch of the NAACP, Shiloh Baptist Church, and The Departmental Progressive Club to hold the City Council Candidate Forum for ALL Candidates in the City of Alexandria Virginia. The event is Free of Charge and Open to The