This week’s Q&A column is sponsored and written by Brian Bonnet, Senior Loan Officer (NMLS ID# 224811) of Atlantic Coast Mortgage, LLC (NMLS ID# 643114). To learn more about current mortgage rates and the home loan process, contact Brian at 703-766-6702 or email [email protected]. You may also submit your questions to McEnearney Associates via email for response in future columns.

Question: Where do you think interest rates are going? Should I lock my interest rate now or float it?

Answer: Two very common questions asked by prospective borrowers who are either purchasing a home or considering refinancing their existing home mortgage. The hard truth is that even the most experienced mortgage banker cannot know for sure. The real questions being asked by the consumer of the mortgage professional are, “do you have a crystal ball” and “are you able to time the market?” Consumers should be wary of any mortgage professional who suggests he or she has that kind of clarity or ability.

The decision to lock your rate or float the rate is a question about gambling. You lock your interest rate to be protected against rates going the wrong direction between the lock date and your settlement date. You float your interest rate because you are betting interest rates will improve before your settlement date.

In a market environment where bond prices are steadily increasing and interest rates are steadily falling, it might not be a bad bet to float the rate. We do not, however, generally have that type of bond market. Instead, we usually have a bond market which experiences daily up and down prices resulting in the up and down movement of interest rates.

In our local real estate market, most residential real estate transactions go from contract ratification to settlement in under forty-five days which means there is generally not enough time for a true downward trend of interest rates. So, getting back to the question of whether to lock or float, I usually provide the numbers to the consumer and remind them that no one can guarantee rates will improve between that point and settlement. Most consumers understand and most choose to lock their rate.

Refinance transactions tend to be a little different. There is often no time frame for the consumer during which the transaction must be completed, so many consumers choose to hold out for lower rates. Sometimes it works in their favor, but often it does not. Consumers are usually in communication with mortgage professionals because rates have dropped below their current mortgage rate.

In many cases, the lower rates will allow the consumer to save hundreds of dollars per month. But often the consumer wants to hold out for even lower rates and more savings. Rates move the wrong direction faster than they improve and if that happens while a consumer is holding out for lower rates for a refinance, they may lose their opportunity to save at all.

I often advise consumers that once they choose to lock the rate, they should put that issue behind them. They can drive themselves crazy second guessing whether they made the correct decision to lock. The focus at that point should be on all the other aspects associated with purchasing the home and moving into that home, or how the savings associated with their refinance will impact their monthly budget.

If you would like more information to help plan your next move, please contact Brian Bonnet at [email protected] or call 703-766-6702.

If you would like a question answered in our weekly column or to set up an appointment with one of our Associates, please email: [email protected] or call 703-549-9292.

McEnearney Associates Realtors®, 109 S. Pitt Street, Alexandria, VA 22314. www.McEnearney.com Equal Housing Opportunity. #WeAreAlexandria

Recent Stories

Good news, D.C. area. You can save money on your next home cleaning with Well-Paid Maids. It’s easy!

We offer a discount when you set up recurring cleans — and the discounts just increased this week!

For weekly cleans, get $30 off each cleaning.

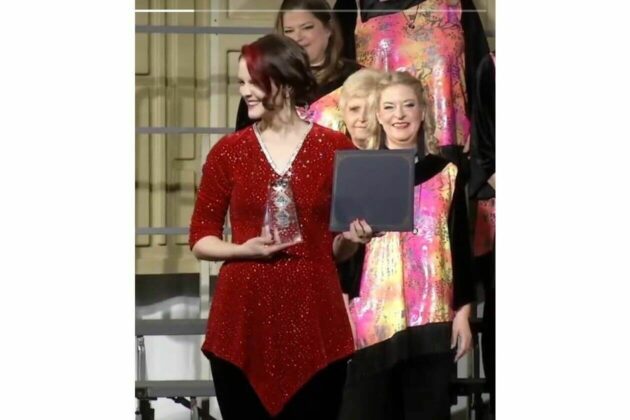

Potomac Harmony is Back! Following a gap year of competing, then virtual rehearsals during the pandemic, followed by the well-earned retirement of our long-term director, a year of a director search, Potomac Harmony hit the regional contest stage in Concord, North Carolina in March for the first time since 2018! It was exhilarating, reaffirming, and rewarding!

The chorus hit all of its goals, the biggest of which was to have fun and sing our best on contest stage — we did both! Because we earned a score over 400 points, our new Director, Allison Lynskey, was awarded the Novice Director award, photo above. Additionally, one of our charter members, Jackie Bottash, was nominated for and honored with the Leadership Excellence award. It was a celebratory weekend!

What’s next? So much! We now look forward to upcoming performances, growing our membership, and expanding our musical product with new arrangements and an education component each week. It’s an exciting time to be part of this ever-growing ensemble!

Alexandria NAACP, Shiloh Baptist Church, DPC to hold City Council…

The Alexandria Branch of the NAACP, Shiloh Baptist Church, and The Departmental Progressive Club to hold the City Council Candidate Forum for ALL Candidates in the City of Alexandria Virginia. The event is Free of Charge and Open to The