This week’s Q&A column is sponsored and written by Brian Bonnet, Senior Loan Officer (NMLS ID# 224811) of Atlantic Coast Mortgage, LLC (NMLS ID# 643114). To learn more about current mortgage rates and the home loan process, contact Brian at 703-766-6702 or email [email protected]. You may also submit your questions to McEnearney Associates via email for response in future columns.

This week’s Q&A column is sponsored and written by Brian Bonnet, Senior Loan Officer (NMLS ID# 224811) of Atlantic Coast Mortgage, LLC (NMLS ID# 643114). To learn more about current mortgage rates and the home loan process, contact Brian at 703-766-6702 or email [email protected]. You may also submit your questions to McEnearney Associates via email for response in future columns.

Question: How can my mortgage lender help my offer win a bidding contest?

Answer: Anyone who has been thinking about purchasing a home within the past year has heard over and over how competitive the marketplace is. The severe lack of residential inventory has affected all price points and all types of properties. Rising interest rates may cause some purchasers to exit the process, but the need for housing will have a greater impact on the continued supply/demand equation.

Price and net proceeds are obviously important factors in the seller’s decision-making process, but several other factors related to financing can make the difference between a prospective purchaser being successful or having to find another home and write another contract. As a purchaser there are several things you can do related to financing which can make you more attractive to sellers.

First, you must be preliminarily approved for your financing. Your offer will not be considered without that preliminary approval. Additionally, you should choose a local lender. Seasoned listing agents have all had transactions which settled late or did not happen at all because a big-box lender or Skippy’s mortgage.com failed. They may get the job done 90% of the time, but that means they do not 10% of the time.

Local lenders and their reputations are often known to the listing agent and local lenders will use locally-based appraisers. Local appraisers tend to know the nuances of neighborhoods and are more likely to generate quality appraisals. With multiple offers on the table, listing agents are likely to recommend to the seller that they ratify the contract which proposes financing through a local lender.

Next, talk with your lender about whether you can waive your financing and appraisal contingencies. It is not wise for some purchasers to waive the financing contingency, but other purchasers are virtually assured of loan approval, as long as they don’t walk in and tell their bosses to pound sand. Have a frank conversation with your lender about the risk (or lack thereof) of waiving the financing contingency. Many contracts are ratified with no financing contingency.

Regarding waiving the appraisal contingency, it comes down to the purchaser’s ability to finance at a higher loan-to-value or their willingness and ability to come up with additional down payment funds if the property does not appraise at the contract sales price. Again, a conversation with the lender is critical, and again most contracts in our market are currently being ratified without appraisal contingencies.

Get your lender all the supporting documentation they will need to make the final underwriting decision before you start looking for property. You will likely need to update some of the documents, but you want to be ready to settle very quickly after contract ratification. You want a preliminary approval with loan specifics which line up with your offer. A vague “pre-qualification” does not put you in the best position. Not all sellers will want to settle quickly, but you don’t know which one’s will want to settle quickly, and you don’t want to lose to another prospective purchaser who proposes to do so.

Generally, sellers want their funds as soon as possible and the best lenders can settle in three weeks or less from the time of ratification. Proposing a quick settlement may make yours the winning offer.

In a future article we will address ways to purchase your next home before selling your current home.

If you would like more information to help plan your next move, please contact Brian Bonnet at [email protected] or call 703-766-6702.

If you would like a question answered in our weekly column or to set up an appointment with one of our Associates, please email: [email protected] or call 703-549-9292.

McEnearney Associates Realtors®, 109 S. Pitt Street, Alexandria, VA 22314. www.McEnearney.com Equal Housing Opportunity. #WeAreAlexandria

Recent Stories

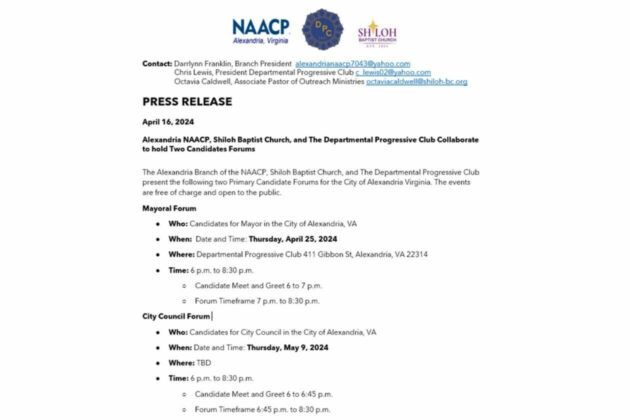

The Alexandria Branch of the NAACP, Shiloh Baptist Church, and The Departmental Progressive Club present the following two Primary Candidate Forums for the City of Alexandria Virginia. The events are free of charge and open to the public.

Mayoral Forum

● Who: Candidates for Mayor in the City of Alexandria, VA

Unlike our competitors, Well-Paid Maids doesn’t clean your home with harsh chemicals. Instead, we handpick cleaning products rated “safest” by the Environmental Working Group, the leading rating organization regarding product safety.

The reason is threefold.

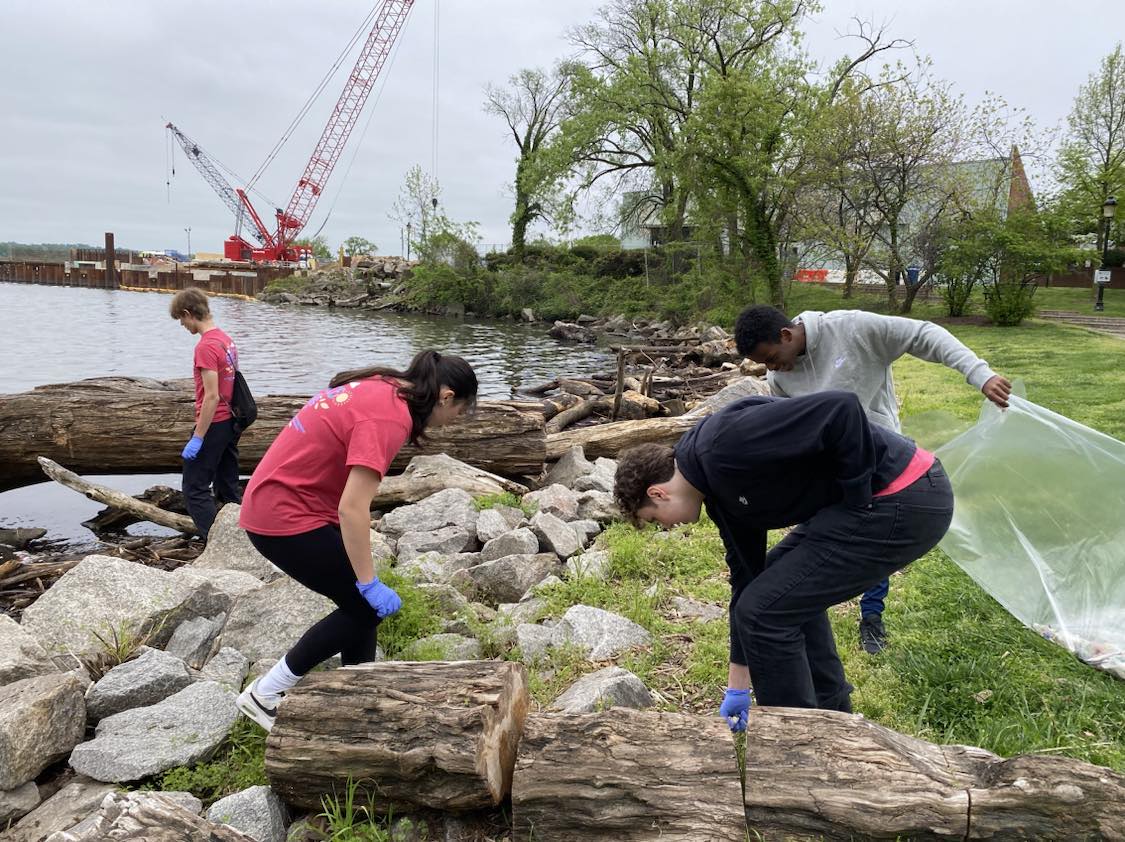

First, using safe cleaning products ensures toxic chemicals won’t leak into waterways or harm wildlife if disposed of improperly.

Pro Coro Alexandria – To the Sea

Join Pro Coro Alexandria, the chamber choir of the Alexandria Choral Society, this Saturday for our concert, “To the Sea.” Experience a variety of songs from beloved choral classics like “Shenandoah” and “What Shall We Do With A Drunken Sailor?”

Del Ray Kitchen Confidential Design Tour

Please join us for Del Ray Kitchen Confidential – a walking tour of recently renovated kitchens in Del Ray with the experts who make the magic happen! FA Design Build owner Rob Menefee and Design Consultant Melissa Fielding walk us