This week’s Q&A column is sponsored and written by Hope Peele of The Peele Group and McEnearney Associates Realtors®, the leading real estate firm in Alexandria. To learn more about this article and relevant Alexandria market news, contact The Peele Group at 703-244-6115 or email [email protected]. You may also submit your questions to McEnearney Associates via email for response in future columns.

This week’s Q&A column is sponsored and written by Hope Peele of The Peele Group and McEnearney Associates Realtors®, the leading real estate firm in Alexandria. To learn more about this article and relevant Alexandria market news, contact The Peele Group at 703-244-6115 or email [email protected]. You may also submit your questions to McEnearney Associates via email for response in future columns.

Question: Are real estate appraisals always accurate?

Answer: The short answer is, no. Not always. However, it’s complicated! Here are some important considerations for understanding appraisals, and how to assure the best appraisal outcome.

Real estate appraisals are an important part of the process for buying and selling homes when there is a mortgage lender involved in the transaction. The lender needs to assure the value, since they are often contributing 80% or more to the purchase price. An appraisal will be ordered by the lender, and they will send a licensed professional to evaluate the property. The appraiser will take note of all the important property characteristics. However, there are many nuances about a property that can affect value, and sometimes the individual doing the appraisal is not aware of them all.

First, the real estate market can change, year to year and even month to month. We’ve seen drastic changes during presidential election seasons, during Covid, during the seasons of the year, and even due to nearby construction or other short-term factors. This can lead to variations in accuracy.

Secondly, an appraiser needs to find recent comparable sales (comps) to determine value. If the market has changed, like after the recent increase in interest rates, sales may be down for a period of time. If it’s a small community, there may not have been any sales for many months. Things like this may affect the accuracy of an appraisal.

Next, the condition of the property will affect the appraisal. Has it just been updated top to bottom? Or does the subject property still have all original features from the 1980s? This can affect the appraised value. It can even matter if the home is staged beautifully versus having the appraiser visit when it’s empty and sad looking. Some appraisers will value the aesthetically pleasing property at a higher amount, while others can look past these factors.

This brings me to subjectivity! Appraisers are human, and sometimes different people will look at the level of upgrades, the condition, and curb appeal of the same property and come to drastically different assessed values.

We recently had a buyer’s appraisal that came in $40,000 low. This may seem like a good problem. You may think that the seller will just have to lower the price. However, if there’s an appraisal contingency, which there was in this case, then there’s a negotiation that needs to happen. In our recent case, the seller knew that sales for this sized condo over the past few years fully supported the sales price, and I agreed. They also had multiple offers, so there were other buyers waiting to step in. What did we do? First, we provided facts for an appeal.

However, the appraiser would not budge on value. The lender agreed with us, so they ordered a new appraisal. This time the appraiser read through all the data that we provided and agreed with the sale price, which was a full $40,000 higher than an appraisal that was issued just two weeks prior.

So, what does one do to assure the best outcome for an appraisal?

- Make sure the property is “show ready” for the appraiser, as if a potential buyer were visiting. If the home was “staged”, leave the staging until the appraiser has visited. The better the home looks, the higher the assessed value tends to be.

- Prepare a list for the appraiser with all recent upgrades, ages of the HVAC, hot water heater, roof, appliances, and estimate the amount that’s been spent on everything in the last couple of years. This will help an appraiser find extra value in the home.

- Ask your Realtor to provide a report on recent sales (comps) for the appraiser. This is typically something that a listing agent does, but so many buyers are waiving appraisal that when we represent the buyer, we send comps to the appraiser, as well. Appraisers have access to recent sales and will look for comps themselves, of course. However, sometimes they may miss a good comp, so it’s best to make sure that they have all of the sales that could be used to support the price.

- Last, but not least, ALWAYS have someone meet the appraiser. There is no substitute for a face-to-face discussion of the features and improvements of the property, and the nuances of the home and neighborhood. This assures that the appraiser has all the important information in making an accurate appraisal assessment.

Real estate assessments are important to the lender, so that they are comfortable that the property is worth the sale price. They are also important as a buyer, to be sure that you are not overpaying for a home that you should be able to sell at or above the sale price in years to come. And appraisals are important to a seller, as they want the sale to happen at the agreed upon sale price, and don’t want to negotiate a new price if the value comes in low.

In theory, real estate appraisals are supposed to give an accurate assessment of a property’s value. However, they are definitely subjective and there is lots of room for interpretation. That’s why it is so important that your Realtor takes an active role in the process. By meeting the appraiser, providing recent comparable sales and lots of information on the property and neighborhood, you have a much better chance of a positive outcome on the appraisal.

Whether buying or selling, to have the best appraisal experience, you should have an expert working with you.

Hope Peele is a licensed real estate agent with McEnearney Associates, Inc. in Alexandria, Virginia. She grew up in Old Town and currently lives in Del Ray. As a partner with The Peele Group, Hope is dedicated to guiding her clients successfully through the many-faceted process of buying or selling a home. Contact Hope at 703-244-6115.

If you would like a question answered in our weekly column or to set up an appointment with one of our Associates, please email: [email protected] or call 703-549-9292.

McEnearney Associates Realtors®, 109 S. Pitt Street, Alexandria, VA 22314. www.McEnearney.com Equal Housing Opportunity. #WeAreAlexandria

This week’s Q&A column is written by Rebecca McCullough of McEnearney Associates Realtors®, the leading real estate firm in Alexandria. To learn more about this article and relevant Alexandria market news, contact Rebecca at 571-384-0941 or email [email protected]. You may also submit your questions to McEnearney Associates via email for response in future columns.

This week’s Q&A column is written by Rebecca McCullough of McEnearney Associates Realtors®, the leading real estate firm in Alexandria. To learn more about this article and relevant Alexandria market news, contact Rebecca at 571-384-0941 or email [email protected]. You may also submit your questions to McEnearney Associates via email for response in future columns.

Question: How do finance contingencies work in a competitive market?

Answer: For the past several years we have been experiencing a seller’s market in residential real estate. Buyer demand exceeds the number of homes available for sale. There have been plenty of news articles over the past few months that appear to question that, but for a lot of buyers out there, that is what they are experiencing. Realistically, we can expect to experience a seller’s market for a long time coming.

In a seller’s market, buyers have to be aggressive to win against multiple offers, and this understandably can make many buyers very uncomfortable. So, what do I mean by aggressive? Largely that translates to removing contingencies and adding price escalations to contracts. There are two key contingencies that are often removed, and I will explain both.

The first contingency that might be removed is a home inspection. To be clear, an agent should never recommend waiving home inspection. However, the reality is that in a competitive situation, sellers do not want to see this contingency. A good practice would be to do a pre-inspection before an offer is written. That way, a buyer will be able to understand any potential issues before submitting an offer.

To learn more about home inspections please read my article from May 31, 2023 titled “What are home inspection deal breakers? And should they be?”.

The other major contingency is the “finance contingency.” This one can be tricky. There are a great many things to consider and to understand. I’d like to say that all agents are equally knowledgeable on the nuances of them, but truthfully, they are not. I’ve seen deals lost where the agents and the seller did not understand the financing, and sensational buyer offers are rejected.

Regular readers of Ask McEnearney are likely familiar with the three main types of mortgages: conventional, VA, and FHA. Put simply, VA mortgages are loans available to active and retired military. FHA loans are insured by the Federal Housing Administration and offer borrowers with limited resources or credit issues opportunities to purchase homes. Conventional loans are generally what everyone else will apply for. In each case, they can be offered by banks, credit unions and mortgage companies.

However, these are not the only types of lending opportunities. There are a few more that may not be as well known. First, it is possible the seller may offer financing. This means that the seller agrees to allow you to purchase the home and they will provide your financing and be your lender.

Another is a bridge loan, which is underwritten like a mortgage, but is short term and can be paid off when proceeds become available. This is a terrific option for those who can’t qualify for a new mortgage until they sell their current home. Not all financial companies offer this type of loan, but it can be worth researching companies that do to help you win an offer. One such company is Atlantic Coast Mortgage* (NMLS ID 643114). They’ve saved a few deals for McEnearney clients!

Another option is investor financing.

Let’s explore this last one. Why would someone go this route? There are many individuals who temporarily can’t get traditional financing, but don’t want to wait to buy. Here are some scenarios where investor financing might be employed:

- Buyers want to purchase before they sell but need the equity from their current home for a down payment on the new home.

- Buyers want to purchase before they sell but don’t qualify for the purchase without selling first.

- Buyers with insufficient credit or whose scores don’t meet conventional/FHA guidelines.

- Buyers are self-employed or commissioned, but don’t have the required history to meet conventional guidelines.

- Buyers are temporarily unemployed, or working part-time and will be securing a full-time salaried job in the near future.

- Buyers want to purchase a primary home but won’t be moving into the property within the requisite period of time, and don’t have the funds necessary to secure conventional second home or investment financing.

- Investors or builders looking for funds to flip a home.

- Buyers with debt-to-income ratios that exceed conventional guidelines, but are paying off debt, obtaining a new job, etc, in the near future which will allow them to qualify for a conventional refinance.

- Buyers want to make the equivalent of an all-cash offer and settle in a matter of days in order to be more attractive/competitive.

- Buyers looking for up to 100% financing.

This week’s Q&A column is written by David Howell, Executive Vice President and Chief Information Officer, of McEnearney Associates Realtors®, the leading real estate firm in Alexandria. To learn more about this article and relevant market news, contact David at 703-855-5089 or email [email protected]. You may also submit your questions to McEnearney Associates via email for response in future columns.

This week’s Q&A column is written by David Howell, Executive Vice President and Chief Information Officer, of McEnearney Associates Realtors®, the leading real estate firm in Alexandria. To learn more about this article and relevant market news, contact David at 703-855-5089 or email [email protected]. You may also submit your questions to McEnearney Associates via email for response in future columns.

Question: How was the real estate market for the first half of 2023?

Answer: As we wrap up the first half of the year, the low inventory of available homes for sale continues to be a dominant factor in the local market. Despite the significant pullback in contract activity because of interest rates that edged near 7% by the end of June, home prices in Northern Virginia still rose in June and have risen year-to-date.

It is a great market for motivated sellers, but a challenging one for buyers who are dealing with higher home prices and high interest rates. The imbalance won’t stay this way forever, but it’s going to take a drop in mortgage rates to unleash the pent-up demand from buyers and sellers alike.

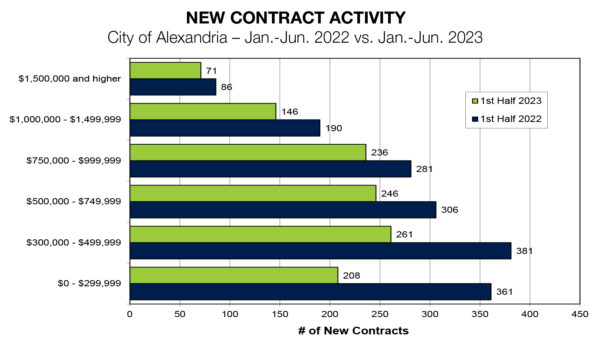

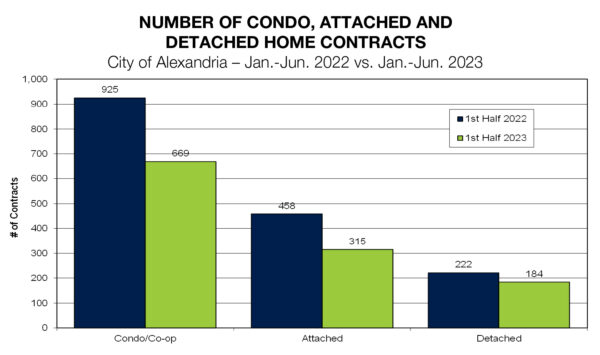

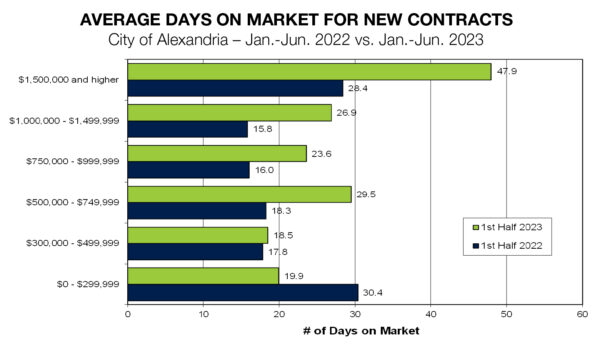

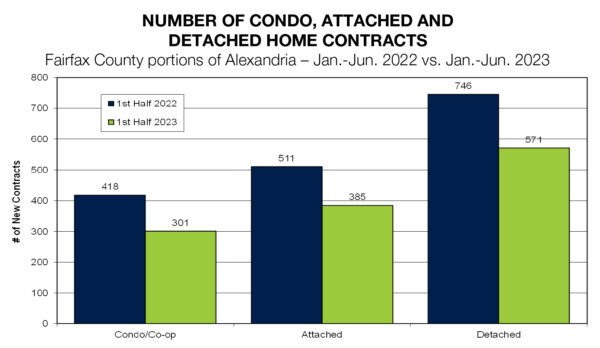

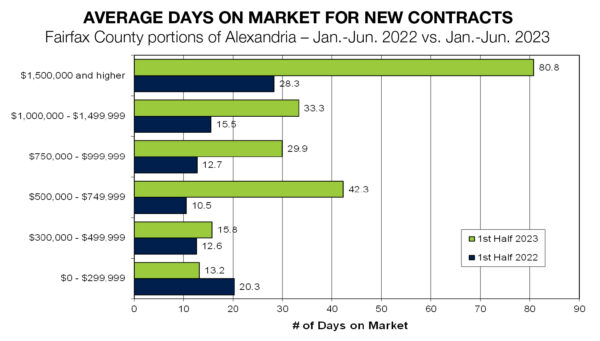

This week we look at market activity for January-June of 2023 compared with the same time in 2022 for the City of Alexandria and South Alexandria (Fairfax County portions of Alexandria). The charts below show contract activity by price range and by property type (condos, attached homes, and detached homes) and the average days on market.

City of Alexandria

New Contract Activity

- Contract activity in the City of Alexandria decreased 27.2% in the 1st half of 2023 compared to the 1st half of 2022.

- Contract activity was down for all price categories.

Number of Condo, Attached Home, and Detached Home Contracts

- The number of detached homes, the smallest part of the Alexandria City market, going under contract in the 1st half of 2023 decreased 17.1% compared to 2021.

- Contract activity in the condo market decreased 27.7% and attached homes activity decreased 31.2%.

Average Number of Days on the Market — New Contracts

- Overall time on the market increased 20.3% to 24.9 days for the 1st half of 2023.

- The average number of days a home was on the market before receiving a contract decreased for one price category.

South Alexandria — Fairfax County Portions of Alexandria

New Contract Activity

- “South Alexandria” refers to those portions of Fairfax County with an Alexandria mailing address.

- Contract activity decreased 25.0% in the 1st half of 2023 compared to the 1st half of 2022.

- Contract activity was down for all price categories.

Number of Condo, Attached Home, and Detached Home Contracts

- Condo contract activity decreased 28.0% in the 1st half of 2023 compared to the 1st half of 2022.

- Attached home activity decreased 24.7%, and detached home activity decreased 23.5%.

Average Number of Days on the Market — New Contracts

- The average number of days a home was on the market before receiving a ratified contract increased for five price categories.

- Overall time on the market increased 135.9%(!) to 30.9 days for the 1st half of 2023.

Note: Data derived from BrightMLS and is deemed reliable, but not guaranteed.

If you would like a question answered in our weekly column or to set up an appointment with one of our Associates, please email: [email protected] or call 703-549-9292.

McEnearney Associates Realtors®, 109 S. Pitt Street, Alexandria, VA 22314. www.McEnearney.com Equal Housing Opportunity. #WeAreAlexandria

This week’s Q&A column is sponsored and written by Hope Peele of The Peele Group and McEnearney Associates Realtors®, the leading real estate firm in Alexandria. To learn more about this article and relevant Alexandria market news, contact The Peele Group at 703-244-6115 or email [email protected]. You may also submit your questions to McEnearney Associates via email for response in future columns.

This week’s Q&A column is sponsored and written by Hope Peele of The Peele Group and McEnearney Associates Realtors®, the leading real estate firm in Alexandria. To learn more about this article and relevant Alexandria market news, contact The Peele Group at 703-244-6115 or email [email protected]. You may also submit your questions to McEnearney Associates via email for response in future columns.

Question: Why wouldn’t the highest price offer win, in a competitive situation?

Answer: Although the local market has cooled somewhat since the height of 2020, it is still a fairly competitive market for buyers right now. One question that I’ve been asked a lot lately is, shouldn’t the highest price offer get the home? It seems so, but it’s not actually quite that simple.

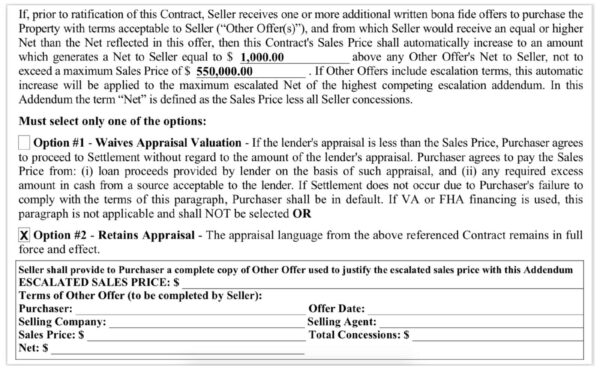

First of all, it’s important to remember that sometimes offers can be made with a somewhat flexible offer price. This comes in an escalation clause which is an addendum to the basic offer contract stating that the purchase price will go higher in the case of a competing offer. This document includes both an increment by which the buyer will increase their bid over the competition and a top end, which is the absolute max the buyer is willing to pay.

For example, the image below shows a part of the Virginia escalation clause that is basically stating this buyer will beat any other offer by $1,000, up to $550,000.

The number one reason that an offer would not be accepted, regardless of price, is too many contingencies. A contingency is basically an “exit” for the buyer, and naturally the seller wants as few of those as possible. The seller’s main goal is to sell their home. Point blank. Of course, the highest price is a very close second, but if the contract doesn’t get to settlement, then the price is irrelevant. So, the seller will weigh the price against any contingencies, such as a home inspection, an appraisal, and more.

A home inspection contingency is one of the shortest contingencies. It usually expires a few days after the contract is accepted. During these first few days, the buyer has the opportunity to have a licensed inspector look at the home and write up a report of defects, etc. They can then void the contract for any reason. This also allows the buyer to void the contract, even if they just don’t like something very minor, which can be a big risk for the seller. A great option for buyers, if the seller will allow, is to conduct a pre-offer inspection and then waive the home inspection contingency when they make the offer.

Another important contingency to be familiar with is the appraisal contingency. When a buyer is taking out a loan for a mortgage, the lender wants to ensure that the loan can be repaid in the case of a foreclosure. So, they send an appraiser to evaluate the home and determine their own value. If the value the appraiser finds is the same or higher than the contract price, there are no issues, and the deal continues smoothly.

However, if they find the value to be below the contract price, this means that the buyer’s loan is not going to be as much as they wanted originally, and they have to put more cash in to meet the offer price. In this case, if there is an appraisal contingency in place, there may be another negotiation between both parties to either lower the offer price or negotiate somewhere in the middle. If the appraisal contingency was waived, the buyer is basically agreeing to make up the difference, regardless of what the appraised value is.

Sometimes the buyer will make the offer with an appraisal contingency but promise in the contract to make up any gap up to a certain amount. For instance, if the offer price was $800K, the buyer could say they would cover up to $20K on a low appraisal.

All of this is kind of a long way to say, an offer with an appraisal contingency is much riskier to a seller than one without. Here’s another example: Let’s say a home is listed for $500,000. Offer A is for $550,000 without an appraisal contingency, and Offer B is for $575,000 with an appraisal contingency. Of course, $75k over list price seems like an obvious choice for the seller. However, if the appraised value ends up coming in at $530k, Offer A would still close at $550k. Offer B might drop all the way to $530k if the buyer doesn’t have enough cash to make up the difference. Or even worse, the deal might fall through.

With so many contingencies and options in the Virginia sales contract, it is so important to have a Realtor you trust, who will explain these terms and contingencies to you so that you understand clearly. Whether buying or selling a home, it is important to have the right Realtor by your side to help you navigate the process and to understand these concepts well before you need to make these decisions.

For a complimentary consultation and overview of the buying and selling process, don’t hesitate to reach out!

Hope Peele is a licensed real estate agent with McEnearney Associates, Inc. in Alexandria, Virginia. She grew up in Old Town and currently lives in Del Ray. As a partner with The Peele Group, Hope is dedicated to guiding her clients successfully through the many-faceted process of buying or selling a home. Contact Hope at 703-244-6115.

If you would like a question answered in our weekly column or to set up an appointment with one of our Associates, please email: [email protected] or call 703-549-9292.

McEnearney Associates Realtors®, 109 S. Pitt Street, Alexandria, VA 22314. www.McEnearney.com Equal Housing Opportunity. #WeAreAlexandria

This week’s column, sponsored and written by McEnearney Associates Realtors®, the leading real estate firm in Alexandria, is a bit of a departure from our usual format. To learn more about this article and relevant Alexandria market news, contact us at 703-549-9292. You may also submit your questions to McEnearney Associates via email for response in future columns.

Two of the most respected names in local real estate — McEnearney Associates and Middleburg Real Estate/Atoka Properties — have combined our exceptional talent and resources into one powerhouse firm. This strategic union marks a significant milestone poised to affirm our long-standing traditions of excellence and transform the future of independent real estate.

“Our firm is built on a foundation of trust, which starts with finding the absolute best agents in the business who have the highest standard of integrity and fiduciary responsibility for our clients,” said President Maureen McEnearney Dunn, who will continue to lead the new firm along with McEnearney Principals Dave Hawkins and David Howell, who are now joined by new Principals Peter Pejacsevich and Scott Buzzelli.

“It was a natural fit,” said McEnearney Dunn, “Middleburg Real Estate/Atoka Properties is a firm focused not on quantity, but quality; aiming not to be the biggest, but The Best, and that’s what we look for when partnering with others: common goals for growth and always doing the right thing for our agents and clients.”

For more than 40 years, McEnearney Associates’ corporate mission has been, foremost, to provide unrivaled support to its agents and clients while strategically expanding its footprint in Virginia, Maryland, and Washington, D.C. Atoka Properties was formed in 2008 by partners Pejacsevich and Buzzelli, who were drawn to Middleburg for its strong heritage and history. Since its inception, their brokerage has continued to grow into the premiere real estate brokerage in Hunt Country and beyond.

The combined forces of McEnearney Associates and Middleburg Real Estate/Atoka Properties unlocks myriad benefits with an expanded network of talented and exceptional agents, an increased portfolio of listings, a luxury presence, curated marketing, advanced data analytics, and — most importantly — a seamless experience for homebuyers, sellers, property management and real estate professionals.

“We are and will continue to be the industry’s best,” said Pejacsevich on the future of the newly merged company. “We provide hands down the most support for our agents and clients and can do so because we are not tied to a franchise fee or national ownership.”

Adds Buzzelli, “We believe in investing in our team to help agents create a stellar experience for clients, and by combining our strengths we will deliver a new level of service and value to everyone.”

The merger was announced June 20 and will take about six months to complete, expanding the firm’s footprint to 16 offices throughout Virginia, West Virginia, Maryland, and Washington, D.C.

If you would like a question answered in our weekly column or to set up an appointment with one of our Associates, please email: [email protected] or call 703-549-9292.

McEnearney Associates Realtors®, 109 S. Pitt Street, Alexandria, VA 22314. www.McEnearney.com Equal Housing Opportunity. #WeAreAlexandria

This week’s Q&A column is written by Trudy McCullough, VP of Relocation & Client Services, and Britni Spurlock, Relocation Specialist, at McEnearney Associates Realtors®, the leading real estate firm in Alexandria. To learn more about this article, contact Trudy at 703-639-7387 or email [email protected]. You may also submit your questions to McEnearney Associates via email for response in future columns.

This week’s Q&A column is written by Trudy McCullough, VP of Relocation & Client Services, and Britni Spurlock, Relocation Specialist, at McEnearney Associates Realtors®, the leading real estate firm in Alexandria. To learn more about this article, contact Trudy at 703-639-7387 or email [email protected]. You may also submit your questions to McEnearney Associates via email for response in future columns.

Question: How can my local real estate agent help me move long distance?

Answer: Buying and selling a home can be exciting and stressful all at the same time. Locally, most people know at least one real estate agent; whether an agent they have used before or someone they are acquainted with. If not, recommendations from a friend, family member, or trusted advisor are a great place to start.

However, there may come a time when you have a real estate need outside of your local real estate market. When looking for an agent, you have to remember that anyone can build a beautiful website and hire a professional marketing team to support them, that doesn’t guarantee they are experienced or the best agent for your needs.

We want to ensure you receive the same professional service anywhere in the world that you receive from us. The three most common reasons clients reach out for recommendations outside our local area include: job relocation, family needs, and life-style changes.

Job Relocation

Many employers offer a variety of packages from full relocation to flat-fee services, while other employers are not equipped to provide relocation services. If Realtor recommendations are part of your relocation program or suggested by a co-worker, you should still do your research. Job relocations add an extra level of stress due to time constraints of the position start, selling your current home, relocating family, and more.

The right Realtor is experienced in your market but also “relocation best practices,” fully understanding the relocation processes, additional paperwork, and requirements of the employer so that you can take full advantage of all relocation benefits. When you are not offered relocation benefits by your employer, you must find the right agent on your own; not just an experienced one, but an agent with a true relocation background, because it will make all the difference in your move.

Family Needs

From growing families to downsizing, inherited homes to vacant land, relocation trained agents are equipped to assist with all types of family situations as they arise. For example, when parents are no longer able to age in place, relocation agent services can include: complimentary market analysis noting as-is and repaired/improved values; supplier introductions from repairs to improvements and cleaners to movers.

A relocation trained agent is a full-service Realtor who specializes in the area and type of transaction you are navigating, as well as proficiency in working with out-of-town clients.

Life-Style Changes

Often buyers are comparing multiple areas as a potential destination for retirement, investment property or even a second home. Relocation specialists offer more than housing information; they provide cost of living comparisons, area tours, local life-style information, and market trends to assist you in decision making.

How is McEnearney Associates able to help?

Knowing a Realtor who is part of a truly global network of vetted professionals is key. At McEnearney Associates, we are fortunate to be a member of Leading Real Estate Companies of the World® (LeadingRE). LeadingRE is home to the world’s market-leading independent residential brokerages in over 70 countries, with 550 firms and 138,000 sales associates making 190 client introductions daily. Our by-invitation-only network is based on the unparalleled performance and trusted relationships that result in exceptional client experiences.

When you need an agent recommendation, anywhere in the world, McEnearney Associates are happy to help. We are your Trusted Relocation Resource.

If you would like a question answered in our weekly column or to set up an appointment with one of our Associates, please email: [email protected] or call 703-549-9292.

McEnearney Associates Realtors®, 109 S. Pitt Street, Alexandria, VA 22314. www.McEnearney.com Equal Housing Opportunity. #WeAreAlexandria

This week’s Q&A column is sponsored and written by Hope Peele of The Peele Group and McEnearney Associates Realtors®, the leading real estate firm in Alexandria. To learn more about this article and relevant Alexandria market news, contact The Peele Group at 703-244-6115 or email [email protected]. You may also submit your questions to McEnearney Associates via email for response in future columns.

This week’s Q&A column is sponsored and written by Hope Peele of The Peele Group and McEnearney Associates Realtors®, the leading real estate firm in Alexandria. To learn more about this article and relevant Alexandria market news, contact The Peele Group at 703-244-6115 or email [email protected]. You may also submit your questions to McEnearney Associates via email for response in future columns.

Question: How long should I plan on owning a home to make it a good investment?

Answer: Purchasing a home is one of the most significant financial decisions that one can make, and many wonder how long they should plan on owning a home to make it a good investment. If you plan to live in the home for many years, this may be less of a concern.

However, if there is a possibility that you might need to move within a few years, you are likely wondering how long you need to own it to recoup your investment. While there isn’t a definitive answer that applies universally, you will want to consider market conditions, potential for building equity, and your own financial goals when evaluating the ideal length of homeownership in the bustling D.C. metro area.

Understanding the ups and downs of the local housing market is essential for making an informed decision. While none of us have a crystal ball that will show us the future, looking at the market trends can give us a fairly good idea of what could happen. Researching trends, and consulting with a local real estate professional, can provide valuable insights into homes in the D.C. metro area. If you’ve lived in this area for any length of time, you probably already know how neighborhood-specific market trends can be, so it’s important to choose an agent who knows how to do their research.

Of course, a good rule of thumb is the longer you own a home, the more equity you gain. However, this isn’t always true, and it is important to get advice from a professional. A real estate professional can look at past sales in the neighborhood you are considering, as well as evaluate the condition of the home, as it compares to those sales.

Upcoming developments are another thing to consider. If there are projected growth projects close-by, it is more likely that your investment will grow more quickly.

Another thing to consider is the potential for renting the home. Some homeowners choose to leave the area, or upsize into a larger home, but want to keep the home for investment purposes. While being a landlord can come with its own challenges, it can also be rewarding in the long term, as your property builds equity. Your Realtor can advise you on projected rental income, even before you purchase the home.

Beyond market conditions and equity, your personal financial goals should shape your decision-making process. If you envision staying in your home for an extended period, the focus might shift from immediate profits to long-term stability and a comfortable living environment for many years. In such cases, the investment value lies in the overall lifestyle benefits, along with the potential for future appreciation.

Ultimately, there is no fixed timeframe that guarantees a successful investment in real estate. Various factors influence the profitability of homeownership, and the optimal length of ownership differs from one individual to another.

We are fortunate that the D.C. Metro area is a highly sought-after region and that we have a robust real estate market. Determining the ideal length of homeownership in the D.C. metro area is a nuanced process. By evaluating your own priorities and seeking the professional advice of an experienced Realtor, you can make an informed decision about the length of homeownership that maximizes the investment potential of any home that you are considering.

Hope Peele is a licensed real estate agent with McEnearney Associates, Inc. in Alexandria, Virginia. She grew up in Old Town and currently lives in Del Ray. As a partner with The Peele Group, Hope is dedicated to guiding her clients successfully through the many-faceted process of buying or selling a home. Contact Hope at 703-244-6115.

If you would like a question answered in our weekly column or to set up an appointment with one of our Associates, please email: [email protected] or call 703-549-9292.

McEnearney Associates Realtors®, 109 S. Pitt Street, Alexandria, VA 22314. www.McEnearney.com Equal Housing Opportunity. #WeAreAlexandria

This week’s Q&A column is sponsored and written by Peter Crouch & Katie Crouch of McEnearney Associates Realtors®, the leading real estate firm in Alexandria. To learn more about this article and relevant Alexandria market news, contact Peter at 703-244-4024 or email [email protected]. You may also submit your questions to McEnearney Associates via email for response in future columns.

This week’s Q&A column is sponsored and written by Peter Crouch & Katie Crouch of McEnearney Associates Realtors®, the leading real estate firm in Alexandria. To learn more about this article and relevant Alexandria market news, contact Peter at 703-244-4024 or email [email protected]. You may also submit your questions to McEnearney Associates via email for response in future columns.

Question: What are the main culprits of wet basements and how can I prepare?

Answer: Every summer we see rolled up carpet on curbs after thunderstorms. And sometimes just during heat spells. Summer brings heat, humidity, and thunderstorms. And wet basements.

Culprit #1: Thunderstorms seem to be getting stronger and stronger, with huge amounts of rain generated. The biggest lesson is that rain must have somewhere to go, and it follows the laws of gravity. SO, your house must encourage rain to flow away from it. That is first and foremost through the proper size CLEAN gutters, and extensions on downspouts to get roof water away from the foundation.

Plus, grading around a house must point away from the foundation and never toward it. The dirt around most homes settles over a time, so most will eventually need to have more dirt brought in to restore slope. Make the water flow downhill and away!

Many people call basement waterproofing companies when their basement gets wet. That can be very expensive, and rarely solves where the water is coming from in the first place. Solve them OUTSIDE, say our favorite home inspectors, and only inside after all other exterior measures have been taken. They say 95% or more of wet basements can be solved with proper grading and downspout extensions. So:

- Clean your gutters in late spring (again in late fall). Upgrade to “oversize” gutters if possible.

- Make sure the dirt slopes away from the house foundation for at least 4 feet.

- Put heavy black plastic on the sloped dirt, followed by mulch.

- Make sure all downspouts have extensions on them — at least 4 feet away.

- Call us if you want a layman’s opinion of your drainage.

Culprit #2: A/C systems make our homes comfortable, but they also make water. Lots of it. Usually located in basements, they must be set up to both drain easily and to be cleaned so they do not back up and discharge onto the basement floor.

Every A/C system should have a 1-inch white or tan pipe coming out of it and leading to a drain (or a pump to a drain). Most will have a place to open the pipe to make sure it is not becoming clogged. If it clogs, water backs up into the pan underneath the A/C, runs down the interior of the furnace (usually below the A/C), and out into the adjacent rooms.

You can usually brush the pipe out with a long slim brush, plus we frequently hear about pouring a cup of bleach in during summer months to kill any algae that can contribute to clogs. An HVAC technician can also come “blow out” the system to make sure it is as clean as possible for A/C season.

This week’s Q&A column is written by Rebecca McCullough of McEnearney Associates Realtors®, the leading real estate firm in Alexandria. To learn more about this article and relevant Alexandria market news, contact Rebecca at 571-384-0941 or email [email protected]. You may also submit your questions to McEnearney Associates via email for response in future columns.

This week’s Q&A column is written by Rebecca McCullough of McEnearney Associates Realtors®, the leading real estate firm in Alexandria. To learn more about this article and relevant Alexandria market news, contact Rebecca at 571-384-0941 or email [email protected]. You may also submit your questions to McEnearney Associates via email for response in future columns.

Question: What are home inspection deal breakers? And should they be?

Answer: Congratulations! You are under contract! Not only that, even in this seemingly sellers’ market you have negotiated a home inspection. Way to go!

Heading into the home inspection maybe you are concerned about some things. Or perhaps you feel sure the house is fantastic, in solid condition. Either way, you’re about to find out!

Three and half hours later, your shoulders are slumped, you’ve written a sizable check and the wind is out of your sails. You’ve potentially got one of the three unforeseen deal breakers: water, mold, or structural issues. The opportunity seems dead on arrival, with a “Notice to Void” soon to follow. But should it? Maybe not. Here’s why…

Firstly, the responsibility of the home inspector is to point out obvious and potential issues. Their biggest fear is they won’t find or point out a potential issue, and then the buyer comes after them for damages. So please know it is their job to point out the possibility that these items may be serious, and to recommend that the buyer hire an expert in a specific area to confirm. Think of the home inspector as your first line of defense (after a good Realtor, who hopefully can advise of some potential issues and their remediations), but it is likely if they find anything suspicious, they will recommend you hire a professional in the area you would like explore further.

But why would a buyer spend the money to investigate further when there’s an issue? Some people will simply void and walk away, but that is not always the best option for a serious buyer.

I have a different view than the immediate pivot. Now, I may have a strong stomach for this as I’ve owned a lot of houses, done my share of renovations, and have seen it all! But truly, most of the time there is a resolution, and it should resolve the problem to prevent any reoccurrence. A good service company will guarantee their work for many years to come.

Let’s explore the premise that you’ve found a house that you love, the inspection turned up a few issues and you want to explore resolution. Let’s dive more deeply into the three big challenging issues and some ways to mitigate them for now if you are a homeowner, and what to look for as a buyer.

Water

This is the issue we come across the most often. I have yet to do a home inspection on a detached house where the inspector doesn’t warn about poor grading around the house. Water should always run away from the house. Flower beds, soil and mulch get beaten down and they must be replenished at least annually to ensure proper grading. Adding a bunch of porous mulch is not enough, you need to make sure the underlying soil is laid appropriately.

Next of course, are the gutters and down spouts. They need to set up to maximize water being pulled away from the house. Those are the basics that you’ll find in the majority of home inspections. If these are not set up properly, you may find damp walls. A home inspector uses a moisture reader to determine if there is a potential issue behind the wall. You may also be able to visible see effervescence in foundation blocks. This could be as easy a fix as a coat of Drylok paint on the foundation walls.

This week’s Q&A column, sponsored and written by McEnearney Associates Realtors®, the leading real estate firm in Alexandria, is a bit of a departure from our usual format. To learn more about this article and relevant Alexandria market news, contact us at 703-549-9292. You may also submit your questions to McEnearney Associates via email for response in future columns.

Question: What is “The 85% Perfect Home” and How Does It Help Buyers?

Answer: Seeking perfection is noble but it could cost you in this market.

We’ve all read the industry reports and heard buyers’ distress about the lack of inventory in our area. Interest rates have stabilized but are still much higher than what’s been available for most of the last decade. Listings are few, competition is fierce and homes are getting snapped up at top dollar. In a very hot seller’s market, what’s a buyer to do?

Enter “The 85% Perfect Home.” In the HGTV-era, this challenges the notion that the “perfect” home is out there and that all a buyer has to do is wade through multiple listings to find “The One” that will deliver exactly what they want. But this kind of thinking can lead to buyer frustration because holding out for perfection can often mean missing out on an otherwise great home.

As we recently wrote about on our company website, even in this hot seller’s market more than half the homes on the market are taking more than two months to sell and are selling at a discount. That’s a lot of inventory that’s being overlooked in the pursuit of perfection.

McEnearney Associates recently held a panel with a number of agents to brainstorm ways to help clients find properties that are within their budget, fit with their timeline, and helped solve their housing needs. Here are suggestions from our agents who have successfully helped their buyer clients get unstuck from the belief that the home had to be perfect to be theirs.

Don’t get stuck on things that are beyond your control like rising interest rates and limited inventory. Figure out what you can afford now. If you are motivated to move, you buy within those means. If last year that was a $1million house and this year it’s an $800,000 house, that’s just the way it is. Stop living for last year’s market.

Bring a foldable paper template of your largest or can’t-live-without pieces of furniture that includes the floor parameters as well as height dimensions. This will allow you to see if the house fits your needs logistically but it can also give you an idea of how you will live in it.

Is this home meant to be your “Forever Home” or is this a stepping stone? Younger buyers can expect life changes that mean they’ll be shopping for a larger home or taking a job in another area sooner than they expect.

Think of the “Pareto 80/20 Rule” and how it applies to how you’d live in your house. If 80 percent of your time is spent in 20 percent of your dwelling, then focus on the spaces that you will be using the most. For example, don’t elevate the importance of a dining room if you’re only using it for special occasions.

Especially for buyers who move here from less competitive markets, reaching even 70-80% in a home is a win! You can learn that in the first week, or you can take a year to learn that lesson. But there’s a chance that you will miss “The Right Home” by searching for “The Perfect Home” for too long.

Another good suggestion is that buyers can also enlist the advice of a contractor to help see past the current floorplan and price out changes big or small that could make the property fit what you’re looking for. Just having an expert set of eyes to envision how moving a wall here or a doorway there can open up possibilities that are within your budget. Agents have these contacts at their fingertips so don’t be afraid to ask!

Buyers have many concerns that can prevent them from buying a home: paying too much, buying a home that’s not in good condition, missing out on a better property, and more worries. These are valid reasons to keep looking but it’s as important in homebuying as it is in life to know that perfection is almost always unattainable.

Make the best decision with the information and circumstances at this moment and heed the advice of experienced agents who are here to get you into a home that you can make just right for your needs.

If you would like a question answered in our weekly column or to set up an appointment with one of our Associates, please email: [email protected] or call 703-549-9292.

McEnearney Associates Realtors®, 109 S. Pitt Street, Alexandria, VA 22314. www.McEnearney.com Equal Housing Opportunity. #WeAreAlexandria