This week’s Q&A column, sponsored and written by McEnearney Associates Realtors®, the leading real estate firm in Alexandria, is a bit of a departure from our usual format. To learn more about this article and relevant Alexandria market news, contact us at 703-549-9292. You may also submit your questions to McEnearney Associates via email for response in future columns.

Question: What is “The 85% Perfect Home” and How Does It Help Buyers?

Answer: Seeking perfection is noble but it could cost you in this market.

We’ve all read the industry reports and heard buyers’ distress about the lack of inventory in our area. Interest rates have stabilized but are still much higher than what’s been available for most of the last decade. Listings are few, competition is fierce and homes are getting snapped up at top dollar. In a very hot seller’s market, what’s a buyer to do?

Enter “The 85% Perfect Home.” In the HGTV-era, this challenges the notion that the “perfect” home is out there and that all a buyer has to do is wade through multiple listings to find “The One” that will deliver exactly what they want. But this kind of thinking can lead to buyer frustration because holding out for perfection can often mean missing out on an otherwise great home.

As we recently wrote about on our company website, even in this hot seller’s market more than half the homes on the market are taking more than two months to sell and are selling at a discount. That’s a lot of inventory that’s being overlooked in the pursuit of perfection.

McEnearney Associates recently held a panel with a number of agents to brainstorm ways to help clients find properties that are within their budget, fit with their timeline, and helped solve their housing needs. Here are suggestions from our agents who have successfully helped their buyer clients get unstuck from the belief that the home had to be perfect to be theirs.

Don’t get stuck on things that are beyond your control like rising interest rates and limited inventory. Figure out what you can afford now. If you are motivated to move, you buy within those means. If last year that was a $1million house and this year it’s an $800,000 house, that’s just the way it is. Stop living for last year’s market.

Bring a foldable paper template of your largest or can’t-live-without pieces of furniture that includes the floor parameters as well as height dimensions. This will allow you to see if the house fits your needs logistically but it can also give you an idea of how you will live in it.

Is this home meant to be your “Forever Home” or is this a stepping stone? Younger buyers can expect life changes that mean they’ll be shopping for a larger home or taking a job in another area sooner than they expect.

Think of the “Pareto 80/20 Rule” and how it applies to how you’d live in your house. If 80 percent of your time is spent in 20 percent of your dwelling, then focus on the spaces that you will be using the most. For example, don’t elevate the importance of a dining room if you’re only using it for special occasions.

Especially for buyers who move here from less competitive markets, reaching even 70-80% in a home is a win! You can learn that in the first week, or you can take a year to learn that lesson. But there’s a chance that you will miss “The Right Home” by searching for “The Perfect Home” for too long.

Another good suggestion is that buyers can also enlist the advice of a contractor to help see past the current floorplan and price out changes big or small that could make the property fit what you’re looking for. Just having an expert set of eyes to envision how moving a wall here or a doorway there can open up possibilities that are within your budget. Agents have these contacts at their fingertips so don’t be afraid to ask!

Buyers have many concerns that can prevent them from buying a home: paying too much, buying a home that’s not in good condition, missing out on a better property, and more worries. These are valid reasons to keep looking but it’s as important in homebuying as it is in life to know that perfection is almost always unattainable.

Make the best decision with the information and circumstances at this moment and heed the advice of experienced agents who are here to get you into a home that you can make just right for your needs.

If you would like a question answered in our weekly column or to set up an appointment with one of our Associates, please email: [email protected] or call 703-549-9292.

McEnearney Associates Realtors®, 109 S. Pitt Street, Alexandria, VA 22314. www.McEnearney.com Equal Housing Opportunity. #WeAreAlexandria

This week’s Q&A column is sponsored and written by Hope Peele of The Peele Group and McEnearney Associates Realtors®, the leading real estate firm in Alexandria. To learn more about this article and relevant Alexandria market news, contact The Peele Group at 703-244-6115 or email [email protected]. You may also submit your questions to McEnearney Associates via email for response in future columns.

This week’s Q&A column is sponsored and written by Hope Peele of The Peele Group and McEnearney Associates Realtors®, the leading real estate firm in Alexandria. To learn more about this article and relevant Alexandria market news, contact The Peele Group at 703-244-6115 or email [email protected]. You may also submit your questions to McEnearney Associates via email for response in future columns.

Question: Will artificial intelligence (AI) take over real estate?

Answer: With the current writers’ strike happening in the entertainment world, a popular topic of conversation is the upswing of AI in various industries, and real estate is no different.

There are a few things that might seem like obvious deficiencies when it comes to AI — for example, staging a listing for marketing. Of course, a bot could give some tips, and might even get to a point at which it can scan a room and give personalized suggestions. But a bot is not going to move an ottoman. Aside from the literal human body aspect of it though, let’s talk about a few of the less evident things that some people may think could be done by AI.

Pricing — In fact, artificial intelligence has been in use for years on many popular real estate websites like Zillow. One only has to Google “Zestimate accuracy” to read all about typical margins of error. I’ve even discussed it in various posts on this blog. While a “Zestimate” can provide a jumping off point, they are rarely accurate, and Zillow even admits to their own margin of error.

Negotiation — If you haven’t been through a real estate transaction before, you might think that negotiation only happens when you’re trying to get an offer accepted. However, it actually happens throughout the process. Even little things can be negotiated, like furniture sales or rent backs. The ability for a listing agent to get on the phone with the buyer’s agent and just talk those things through can be a huge asset — not to mention make your purchase or sale much easier to navigate.

Individual needs — Nobody prefers a robot when they call up a customer service line. I think many of us know the feeling of loudly telling an automated answering service that you just want an operator, but the robot keeps telling you to push a number. Since humans are usually on each side of a real estate transaction, the nuances can be as varied as the individuals involved. An experienced Realtor can understand you in ways that a computer cannot.

Psych/counseling aspect — While some don’t necessarily expect it, there can be very strong emotions that come up during a real estate transaction. Sellers who are excited to make a move into their new home can feel nostalgic and maybe even regretful. Even when you’re making the best move for you — and you know it — it’s common to get cold feet. Of course, it’s never a Realtor’s job to convince you to buy or sell. But it is nice to have someone to bounce ideas off, remind you why you’re here, and the best way to move forward, if you need it. Your Realtor can get very close to you during the course of a transaction, and it is nice to know that you have them on your side.

Your Realtor also doesn’t have any goal pre-planned. If the decision ends up not right for you, a trusted Realtor should agree with you and continue to help you achieve your goals. However, if there is a computer working on your behalf — at the end of the day they are still working with their programmer. Individual Realtors are usually playing the long game, meaning that they want their clients to continue to use and refer them for years to come. That doesn’t always mean making a sale. Computers are more binary.

So, while artificial intelligence can be helpful in writing a real estate property description, it will never take the place of a trusted Realtor. Don’t hesitate to reach out if you ever need some human, and very real advice on buying or selling a home.

Hope Peele is a licensed real estate agent with McEnearney Associates, Inc. in Alexandria, Virginia. She grew up in Old Town and currently lives in Del Ray. As a partner with The Peele Group, Hope is dedicated to guiding her clients successfully through the many-faceted process of buying or selling a home. Contact Hope at 703-244-6115.

If you would like a question answered in our weekly column or to set up an appointment with one of our Associates, please email: [email protected] or call 703-549-9292.

McEnearney Associates Realtors®, 109 S. Pitt Street, Alexandria, VA 22314. www.McEnearney.com Equal Housing Opportunity. #WeAreAlexandria

This week’s Q&A column, sponsored and written by McEnearney Associates Realtors®, the leading real estate firm in Alexandria, is a bit of a departure from our usual format. To learn more about this article and relevant Alexandria market news, contact us at 703-549-9292. You may also submit your questions to McEnearney Associates via email for response in future columns.

Question: How can I help a family member finance a home purchase?

Answer: Tapping into monetary gifts and family financing can be a creative — and caring — way to help loved ones get the home they want.

Real estate is one of the most effective ways that families build, generate, and protect their wealth. Home appreciation offers cash equity, vacation and investment properties bring consistent revenue streams, and multigenerational living allows extended family to share expenses.

But with rising home prices, interest rates the highest they have been in a generation, and a lot of graduates carrying significant college loans (often for decades), it can be difficult if not outright impossible for new buyers to fund the purchase of a first home. According to the most recent report from the National Association of Realtors, the share of first-time home buyers in 2022 dropped to a record low of 26%, while the age of a typical first-time buyer increased to an all-time high of 36 years old, in part due to the time it takes to save for a down payment.

So, how can parents, guardians and caregivers help the next generation get to that first rung of the home investment ladder? Here are a few important family financial strategies that can guide cash-strapped relatives to the home of their dreams.

Family as Landlord — It’s often the lament of would-be empty nesters: a kiddo moves back home after school, during a break-up, or, more recently, into a COVID-19 bubble and just never left. Yet, all this togetherness can be a great opportunity for lessons on budgeting, saving, and investing. Assuming your live-in lodger has an income, charge a small but fair amount for rent and household expenses that will be put into savings or an investment account to be used as a down payment. It may take time for this nest egg to grow but with each deposit the goal of moving on will be closer and the practice of regular saving will pay off in the long run.

Give Money — Monetary gifts for a down payment are the easiest way to assist a family member with a home purchase and can be tax free within IRS guidelines. Gifts must come from immediate family — parents, siblings, grandparents, spouse or even a partner (if engaged to be married) — and there can’t be a plan for repayment, so nothing with “strings attached.” This will be spelled out in a gift letter that will be shared with the lender. Current monetary limits are $15,000 per person buying a home, meaning if a purchase has two buyers, then there can be $30,000 in gifts. Discuss any gifts with your lender to ensure they are documented properly and used accordingly.

Finance the Mortgage — Someone looking to park their cash in real estate can make it work for the greater family good and act as the lender, funding the purchase but without additional fees and a reduced interest rate. Family lenders must charge at least the Applicable Federal Rate (AFR), the minimum interest rate required to keep the assistance from being considered a gift. These rates are almost always much less than the current market rate and are three AFR tiers based on the repayment term of a family loan:

- Short-term rates, for loans with a repayment term of up to three years.

- Mid-term rates, for loans with a repayment term between three and nine years.

- Long-term rates, for loans with a repayment term greater than nine years.

Rates change monthly. For example, the short-term rate for May 2023 is 4.30% (for April it was 4.86% and for March it was 4.50%); mid-term rate for May 2023 is 3.57% (for April it was 4.15% and March was 3.70%); and long-term rate for May 2023 is 3.72% (for April it was 4.02% and March was 3.74%) (Figures from NationalFamilyMortgage.com as of April 24, 2023). Before finalizing a family loan be sure to consult with an accountant or tax authority for any potential tax liability.

This week’s Q&A column is written by Darlene Duffett of McEnearney Associates Realtors®, the leading real estate firm in Alexandria. To learn more about this article and relevant Alexandria market news, contact Darlene at 703-969-9015 or email [email protected]. You may also submit your questions to McEnearney Associates via email for response in future columns.

This week’s Q&A column is written by Darlene Duffett of McEnearney Associates Realtors®, the leading real estate firm in Alexandria. To learn more about this article and relevant Alexandria market news, contact Darlene at 703-969-9015 or email [email protected]. You may also submit your questions to McEnearney Associates via email for response in future columns.

Question: Are high interest rates hindering homeowners with lower rates from selling?

Answer: The real estate market has been experiencing a significant slowdown in recent times, and one of the reasons behind it is the low interest rates enjoyed by many homeowners.

With rates below 3%, many homeowners are reluctant to sell their properties and give up their incredibly low mortgage rates. Even if they have a desire to move to a bigger and better house, the prospect of a higher interest rate and larger mortgage payment is discouraging them from doing so.

For example, let’s say a homeowner has a $500,000 mortgage at a rate of 3%. Their monthly principal and interest payment would be approximately $2,100. Now, if they want to upgrade their home and add an additional $100,000 to their mortgage, they would have to accept a new rate of around 6.5%. That would increase their monthly payment to $3,750, which is a staggering 78% increase in their housing cost.

This is a major concern for economists who are tracking the real estate market closely. They believe that the current high-rate environment is not just suppressing buyer activity but is also affecting seller activity. With fewer new listings coming on the market, homeowners are hesitant to sell and give up their low mortgage rates. Unless there is a significant change in their life circumstances, such as a job change, divorce, or more kids, homeowners are not going to make a move with such a significant increase in housing cost.

While economists differ on the exact rate drop required to coax sellers off the sidelines, the consensus is that it will take more than a 1% reduction in interest rates. In the scenario described above, a drop from 6.5% to 5.5% only reduces the monthly payment by $300. A drop to 5% would reduce the payment by about $500 per month, but even that may not be enough to convince homeowners to sell.

The lack of seller activity is also contributing to the shortage of housing inventory in the market, making it difficult for buyers to find suitable homes. This situation is further compounded by the fact that interest rates are currently well above 6%, creating a significant delta of at least 3% between current rates and the rates that many homeowners enjoy.

In conclusion, the low interest rates enjoyed by many homeowners are a significant factor behind the current slowdown in the real estate market. With the current high-rate environment, homeowners are hesitant to sell their properties and give up their low mortgage rates, contributing to the shortage of housing inventory.

While a reduction in interest rates may help coax some homeowners off the sidelines, it may take more than just a slight reduction to encourage them to sell and move to a bigger and better home.

Would you like to receive a valuation of your home? Click here and I’ll get one right over to you.

Darlene Duffett is a licensed real estate agent in Virginia with McEnearney Associates Realtors® in Old Town, Alexandria. She is licensed in Virginia and Washington, D.C. She has built a reputation of partnering with her friends and clients through the homebuying process and loves working with first time home buyers. If you would like more information on selling or buying in today’s complex market, contact Darlene at 703-969-9015, [email protected] or visit her website DarleneDuffettRealEstate.com.

If you would like a question answered in our weekly column or to set up an appointment with one of our Associates, please email: [email protected] or call 703-549-9292.

McEnearney Associates Realtors®, 109 S. Pitt Street, Alexandria, VA 22314. www.McEnearney.com Equal Housing Opportunity. #WeAreAlexandria

This week’s Q&A column is written by Peter Crouch of McEnearney Associates Realtors®, the leading real estate firm in Alexandria. To learn more about this article and relevant Alexandria market news, contact Peter at 703-244-4024 or email [email protected]. You may also submit your questions to McEnearney Associates via email for response in future columns.

This week’s Q&A column is written by Peter Crouch of McEnearney Associates Realtors®, the leading real estate firm in Alexandria. To learn more about this article and relevant Alexandria market news, contact Peter at 703-244-4024 or email [email protected]. You may also submit your questions to McEnearney Associates via email for response in future columns.

Question: It seems rather overwhelming to think about downsizing a long-time residence. Any tips?

Answer: It can be a bit daunting to make a move after many years in your home. Once you have made the decision, however, there is a sequence of events that definitely works best — and keeps you on track!

First, where are you going, and what is the floor plan? This will tell you what you should keep, and what will not be coming with you. If you are going to a condo, for example, or community serving older adults, they will have floor plans, and even suggestions on what furniture fits and what does not. There are also companies called “Move Managers” who will help in that process — and even completely set you up in the new location including unpacking and hanging pictures!

A word about what to keep and what not to keep. Many of us have collected a good bit of furniture and other “stuff” over the years. Most of us have even inherited possessions that were our parents’ or grandparents’.

Two truths: Our children likely do not want much of it, and it is NOT disloyal to get rid of our ancestors’ things. Keeping a few small, very personal items honors them just fine.

A good way to manage those two truths is to decide what fits in the new place, then make an inventory of what you do NOT plan to keep. Then send it to all the kids and grandkids, asking if there is anything important to them that they would like. (You can even make a photo inventory if you are so inclined.)

Do not be hurt if not much is taken — styles change, and large pieces are not likely to mesh with their household possessions.

Once you have decided what to keep and have gifted to those you care about, the hard part is over. This is when it is usually best to go ahead and move, if possible. Get settled in the new place, which takes the stress off the rest of the process. You can even go back and forth trying out pieces that might fit better in the new place. If you have to sell the house before the move, that is fine — just a slightly different process.

The next steps are usually as follows: Sell remaining possessions that might be of value. Either an estate sale, or consignment-type for certain higher-value pieces. Donate items that do not sell but have value to any one of the many charities we have locally. Discard the rest — there are certain good “cleaning” firms that will take the remaining contents and recycle if they can, discarding what they cannot.

Now for the house itself! Preparing a house for market does not mean you have to remodel, or have the latest-greatest features. You can easily sell a home that has not been upgraded — the price will be lower than one totally up-to-date, but big projects are certainly not necessary.

Why spend tens of thousands remodeling the kitchen to get some of that money back in a higher price? Let alone endure the stress of the project? It is one thing to have re-done the kitchen a few years ago and had the opportunity to enjoy it for a while; it is another thing to do it just for sale. Generally speaking, don’t!

This week’s Q&A column is sponsored and written by Hope Peele of The Peele Group and McEnearney Associates Realtors®, the leading real estate firm in Alexandria. To learn more about this article and relevant Alexandria market news, contact The Peele Group at 703.244.6115 or email [email protected]. You may also submit your questions to McEnearney Associates via email for response in future columns.

This week’s Q&A column is sponsored and written by Hope Peele of The Peele Group and McEnearney Associates Realtors®, the leading real estate firm in Alexandria. To learn more about this article and relevant Alexandria market news, contact The Peele Group at 703.244.6115 or email [email protected]. You may also submit your questions to McEnearney Associates via email for response in future columns.

Question: When preparing my home to sell, how important is landscaping?

Answer: This is a great question, and one that many of our sellers ask. After all the time, energy and money spent on getting the inside of the home ready, many sellers do wonder if they really need to spend more on the yard. Well, the answer is yes! Curb appeal is a huge part of selling your home!

How a buyer feels about your home starts the minute they drive up and park. It can even impact whether they decide to come in at all. We have had buyers tell us they don’t need to go inside, that the yard says it all, so “let’s head to the next house”.

The yard and the front of your home can often evoke emotions for the buyers, and those thoughts and feelings will set the tone for the rest of the visit. Those first impressions can be the start of an attachment to a home, or the opposite. So, it’s important to do all possible to keep it positive. Positive buyer emotions can often override rational decision-making, even causing buyers to increase how much they thought they were willing to pay for a home, which is even more reason to make sure the first impression is fantastic.

According to a recent study by the National Association of Realtors, 92% of Realtors surveyed suggest that their sellers improve curb appeal prior to listing a home for sale. Landscaping is a major part of a home’s curb appeal, and investing in your property’s outdoor spaces is a smart move if you’re looking to sell. Your Realtor can help you decide what needs to be done, and suggest contractors to assist with landscaping, power washing, tree maintenance, and more.

Here are our top tips for getting the exterior of your home ready for sale.

- Mow the Lawn: Mow the lawn just before your Realtor takes the professional photos, and then mow it regularly right up until the sale is complete. If you have a next-door neighbor with an unkempt yard, you may even want to offer them a mowing or two.

- Add Some Color: Flowers and plants are a great way to add pops of color to your yard. Choose plants that are native to your area and are suitable for the amount of sunlight and moisture in your yard. Plant them in well-defined beds or pots to create a focal point and add visual interest.

- Define Walkways and Flower Beds: Clearly defined walkways and borders can create a sense of order and structure in your yard. Use pavers, stones, or bricks to edge the walkways, and stones or timbers, to edge your flower beds.

- Invest in Your Front Entrance: This is the focal point of your home’s exterior, so make it inviting and appealing. Make sure the paint is fresh and you may want to consider a bold color for extra pop! The door knocker and mailbox should look newish, and we always suggest some potted plants to create a welcoming entrance.

- Get Rid of Clutter: Put the garden tools, toys, and other items in the shed or garage, and avoid leaving trash or debris lying around. All outdoor furniture should be clean and well-maintained to create an inviting seating area. If you have an umbrella, put it up for photos and showings.

- Prune and Trim: Make sure to remove dead branches, shape all shrubs, and trim trees away from your home and other structures.

By investing in your outdoor spaces, you can make it more attractive to buyers and set it apart from the competition. So, if you’re getting ready to sell your home, be sure to take a close look at your landscaping and consider making some improvements — it could be the key to a successful sale.

If you’re looking for some awesome ideas to spruce up your home’s landscaping and gardening, join us this weekend, April 14 and 15, at the American Horticultural Society Spring Garden Market at River Farm, sponsored by The Peele Group. It’s going to be a fun-filled event with loads of plants, flowers, and gardening goodies to check out. Get inspired by chatting with fellow plant lovers and picking the brains of expert horticulturists. Don’t miss out on this fantastic opportunity to jazz up your outdoor space — see you there! For information and tickets visit: ahsgardening.org.

Hope Peele is a licensed real estate agent with McEnearney Associates, Inc. in Alexandria, Virginia. She grew up in Old Town and currently lives in Del Ray. As a partner with The Peele Group, Hope is dedicated to guiding her clients successfully through the many-faceted process of buying or selling a home. Contact Hope at 703-244-6115.

If you would like a question answered in our weekly column or to set up an appointment with one of our Associates, please email: [email protected] or call 703.5499292.

McEnearney Associates Realtors®, 109 S. Pitt Street, Alexandria, VA 22314. www.McEnearney.com Equal Housing Opportunity. #WeAreAlexandria

This week’s Q&A column is written by David Howell, Executive Vice President and Chief Information Officer, of McEnearney Associates Realtors®, the leading real estate firm in Alexandria. To learn more about this article and relevant market news, contact David at 703-855-5089 or email [email protected]. You may also submit your questions to McEnearney Associates via email for response in future columns.

This week’s Q&A column is written by David Howell, Executive Vice President and Chief Information Officer, of McEnearney Associates Realtors®, the leading real estate firm in Alexandria. To learn more about this article and relevant market news, contact David at 703-855-5089 or email [email protected]. You may also submit your questions to McEnearney Associates via email for response in future columns.

Question: How was the real estate market for the first quarter of 2023?

Answer: As the 1st quarter of the year comes to a close, the low inventory of available homes for sale continues to be a dominant factor in the local market.

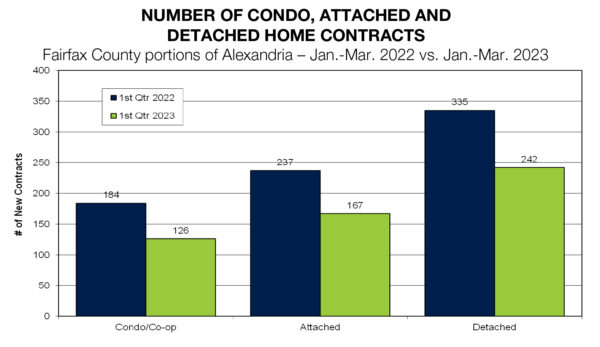

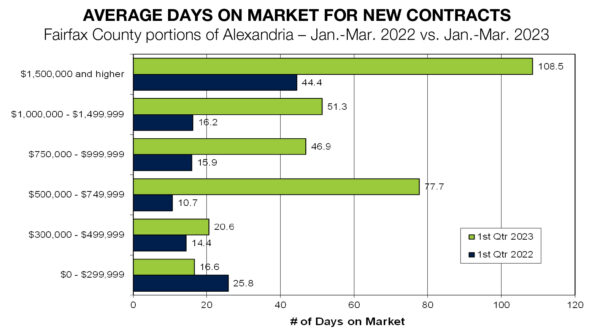

This week we look at market activity for January-March of 2023 compared with the same time in 2022 for the City of Alexandria and South Alexandria (Fairfax County portions of Alexandria). The charts below show contract activity by price range and by property type (condos, attached homes, and detached homes) and the average days on market.

City of Alexandria

New Contract Activity

- Contract activity in the City of Alexandria decreased 28.8% in the 1st quarter of 2023 compared to the 1st quarter of 2022.

- Contract activity was down for all price categories.

Number of Condo, Attached Home, and Detached Home Contracts

- The number of detached homes, the smallest part of the Alexandria City market, going under contract in the 1st quarter of 2023 decreased 45.2% compared to 2021.

- Contract activity in the condo market decreased 35.3% and attached homes activity decreased 29.7%.

Average Number of Days on the Market — New Contracts

- Overall time on the market increased 27.8% to 27.8 days for the 1st quarter of 2023.

- The average number of days a home was on the market before receiving a contract decreased for homes priced less than $300,000.

This week’s Q&A column, sponsored and written by McEnearney Associates Realtors®, the leading real estate firm in Alexandria, is a bit of a departure from our usual format. To learn more about this article and relevant Alexandria market news, contact us at 703-549-9292. You may also submit your questions to McEnearney Associates via email for response in future columns.

Question: As a landlord, what are the most important issues I need to know about the renting process?

Answer: In our recent column, What do I need to know before renting a home?, we shared suggestions from the Realtor® perspective for tenants about the rental process. These tips were part of a lively discussion at a McEnearney Associates “Masterclass” featuring several of our top agents who have made a name for themselves as rental experts — both for tenants and landlords — as well as staff from our Property Management team.

This week we follow up with some important recommendations for Landlords.

For Landlords

DO: Follow all Fair Housing requirements. Your Realtor® is bound by a professional code of ethics and will ensure that the public is treated fairly during the leasing process of your property. Fair Housing violations can be reported to the local Realtor® association and may result in fines. Learn about your Fair Housing requirements and explore resources for Virginia, D.C. and Maryland, and ask your agent for clarification on anything you have questions about.

DO: Understand the difference between pets, emotional support animals and service animals. Tenants with registered support animals and service animals do not fall under “no pets” provisions. Virginia has a helpful brochure that outlines what qualifies for what and how tenants with service animals must be accommodated, and you can see D.C. and Maryland guidelines here.

DO: Consider accepting Housing Vouchers. The lack of affordable housing is a growing problem throughout the country and is felt by many in our region. Housing vouchers — awarded to eligible tenants after a complex and thorough screening by government and housing officials — ensure that low-income, elderly, disabled and other housing-insecure people have access to a decent, safe, and sanitary place to live. Landlords who participate in voucher programs will receive government subsidies for a portion of the rent and tenants will pay the difference based on their voucher award. This ensures consistent payment with tenants who have already passed federal and local screening processes.

Because of the lack of landlords who participate in subsidized housing programs, there are some voucher recipients who have been waiting several years to find an affordable home match. We encourage landlords to speak with their agent to find out how they can be part of helping many deserving tenants find a place to call home.

DO: Work with a Realtor®! It may seem like a landlord could put a “For Rent” sign in the yard and wait for qualified applicants to roll in without any help from an agent. But good Realtors® know that the right presentation, careful application screening processes, and a professional approach to onboarding a tenant can make all the difference between a smooth move between tenants and a logistical leasing nightmare. Count on the expertise and market knowledge that a seasoned agent brings to assist in the successful renting of your valuable investment!

If you would like a question answered in our weekly column or to set up an appointment with one of our Associates, please email: [email protected] or call 703.5499292.

McEnearney Associates Realtors®, 109 S. Pitt Street, Alexandria, VA 22314. www.McEnearney.com Equal Housing Opportunity. #WeAreAlexandria

This week’s Q&A column is written by Rebecca McCullough of McEnearney Associates Realtors®, the leading real estate firm in Alexandria. To learn more about this article and relevant Alexandria market news, contact Rebecca at 571-384-0941 or email [email protected]. You may also submit your questions to McEnearney Associates via email for response in future columns.

This week’s Q&A column is written by Rebecca McCullough of McEnearney Associates Realtors®, the leading real estate firm in Alexandria. To learn more about this article and relevant Alexandria market news, contact Rebecca at 571-384-0941 or email [email protected]. You may also submit your questions to McEnearney Associates via email for response in future columns.

Question: What’s the difference between market, appraisal, and assessment values?

Answer: This is a particularly hot topic in Northern Virginia at the moment. The main questions for many are “what are assessment values, how are they calculated, and why do they change?”

Let’s break them down. First, what is market value? Market value is very subjective. There are a lot of sources that will provide a presumed market value for your home. The first one that comes to mind for many is Zillow. I’m sure almost everyone who owns a home has looked up their “Zestimate!” It’s the value that Zillow tells you your house is worth. Is it reliable? Rarely, in my experience.

The “Zestimate” is simply a computer calculation of your home based on data from recent sales in an area. What Zillow can’t do is see the condition of the home, get a feeling for the community, the neighbors, the view, nor the curb appeal. It’s a sample of one, but I just took a peek at my Zestimate, and I can confirm that it’s at least 40% off the mark!

Recently I was showing a client a home with a Zestimate of $1,000,000. My research had revealed that homes in this neighborhood were easily selling at prices over $1M. The home in question had been updated in the past 5 years, and yet it was listed at $950,000. Why? Lots of aesthetic and practical reasons, none of which are known to Zillow’s computer calculations.

Truly, the seller will be fortunate to get $900,000, but is convinced the home is a bargain at its current price because of how it compares to the “Zestimate.”

In fairness, though, market value can be challenging to determine. (The only way to truly know what the market value is, is to put it on the market and see what the market is willing to pay for it!) A good agent will do the research and help you determine an optimal asking price. But it’s important to note that many things can affect this as well, particularly timing and demand. In my view pricing a home is more of an art than a science, and experience helps!

But what about the appraised price?

Once you have contracted to sell a home, the transaction may be conditional on an appraisal. If the buyer is obtaining a loan, the bank will want to verify the sales price. They will send an appraiser to render an objective opinion of the sales price. An appraisal is a formal process to create “an opinion of value at a certain time.”

There are three methods an appraiser will use to determine the sales value: cost analysis, income analysis and comparative sales value. Cost analysis is determined by how much it would cost to replace the property as it stands and is most often used in new construction. Income analysis is used when looking at rental and commercial properties.

Most likely your appraiser will use the comparative market analysis. It is very similar to what a real estate agent does. The appraiser gets very detailed and will assign dollar values to various features of a home in the process. For example, they may add $10,000 for a deck, or $5,000 for an extra bedroom. They typically compare three homes in the area that closely compare to the subject property to support the sales price.

Not surprisingly in this NOVA market, sometimes we agree with appraisers, and sometimes we don’t. We may take exception with the $10,000 credit for the deck when the sellers have put in a $50,000 deck that extends three levels, constructed of Trex™ and is fully lit!

In their defense, appraisers are under a great deal of pressure. Buyers want the property to appraise at sales value. If a home does not appraise at sales price, the buyer may need to bring more money to the closing table. If the property does not appraise, and the contract is conditional on appraisal and it does not appraise at sales price, the buyer may choose to walk away from the deal.

Appraisals are also used for refinancing or when someone wants to take out an equity line of credit, or possibly to transfer property after someone has passed away and there is a real estate settlement.

This week’s Q&A column, sponsored and written by McEnearney Associates Realtors®, the leading real estate firm in Alexandria, is a bit of a departure from our usual format. To learn more about this article and relevant Alexandria market news, contact us at 703-549-9292. You may also submit your questions to McEnearney Associates via email for response in future columns.

Question: What do I need to know before renting a home?

Answer: Previously we reviewed the Blueprint for a Renter Bill of Rights, the Federal Government’s recommendations for how to make rental housing more equitable and expand renters’ rights when it comes to rent increases, lease terms, and evictions. This week we’ll take a look at the rental market from the Realtor® perspective.

McEnearney Associates recently convened a “Masterclass” with several of our top agents who have made a name for themselves as rental experts — both for tenants and landlords — as well as staff from our Property Management team. It was a lively discussion and we’re sharing some of the tips and processes that Lauren Budik (McLean), Ann Duff (Alexandria), and Sarah Picot (Arlington) believe will make the rental process more efficient and less stressful for everyone involved.

Stay tuned in the coming weeks for our recommendations for Landlords.

For Tenants

DON’T: Start your search too early. We understand, it’s exciting to imagine your next home and see all the options out there. But if you are looking to move in May and want to start looking in January, you will be spinning your wheels. Most leases require a 60-day notice to vacate, and the landlord will look to turn them over quickly. Most landlords will not hold a property if you’re not ready to make a move on their terms.

DO: Understand that most leasing documents are standardized and will have to be completed before or during the rental search. Expect to sign a representation agreement that spells out the responsibilities of both you and your agent, review, and sign disclosures about the property, and understand that leases are standard forms used by most landlords and brokerages in the area. Changing boilerplate clauses or asking for too many changes in terms likely won’t be possible.

DON’T: Hide or be shy about sharing credit issues. Financial setbacks happen and the best way to work around them is to let your agent know if there are credit dings that could affect your rental application. Your agent will help to strategize on the best approach, such as offering to pre-pay several months of rent in advance. A letter explaining how your credit was affected and what you’ve done to repair it can go a long way in assuring a cooperative landlord that past issues have been resolved.

DO: Have a good amount of cash ready for securing a property. Between the first month’s rent, security deposits, pet fees, building move-in/move-out fees, and other moving costs, you may need an outlay of several thousand dollars just to secure a lease. Make sure you’ve set a reasonable budget and saved your money for those immediate payments.

DO: Work with a Realtor®! You’ve heard it before: inventory is extremely tight and great properties go quickly. Having a leasing agent working with you in your housing search ensures that you get access to listed properties quickly (and safely), that your application will be submitted correctly with the proper documentation. Helping clients find the right home is what Realtors® do every day so use their expertise to your advantage in this competitive market!

If you would like a question answered in our weekly column or to set up an appointment with one of our Associates, please email: [email protected] or call 703.549.9292.

McEnearney Associates Realtors®, 109 S. Pitt Street, Alexandria, VA 22314. www.McEnearney.com Equal Housing Opportunity. #WeAreAlexandria