This week’s Q&A column is written by Rebecca McCullough of McEnearney Associates Realtors®, the leading real estate firm in Alexandria. To learn more about this article and relevant Alexandria market news, contact Rebecca at 571-384-0941 or email [email protected]. You may also submit your questions to McEnearney Associates via email for response in future columns.

This week’s Q&A column is written by Rebecca McCullough of McEnearney Associates Realtors®, the leading real estate firm in Alexandria. To learn more about this article and relevant Alexandria market news, contact Rebecca at 571-384-0941 or email [email protected]. You may also submit your questions to McEnearney Associates via email for response in future columns.

Question: Should I buy now or wait until interest rates drop a bit?

Answer: You’ll want to read this article. I am going to get my crystal ball out and tell you exactly where interest rates and home prices are going in 2024. Ready? I wish.

Don’t we all wish we knew if waiting to buy is the right move now? Right now, real estate agents are being asked that question a lot. Here are some of the things we are hearing:

- If I wait, I’ll be able to afford more when interest rates come down.

- There is nothing to choose from as inventory is low. If I wait until the rates come down, sellers will be more inclined to move, and inventory will go up. I will have more to choose from.

Can anyone spot the issue(s)?

- What if rates go up?

- What if prices go up?

- If rates go down, yes, we believe there will be more inventory. Homeowners may sell. But that also means they will need to buy, adding more buyers to the market, not to mention the ones who’ve been waiting, or the ones who haven’t been able to find something.

Currently there is no scenario where inventory will meet the demand. We have a national housing shortage. This isn’t the first time you’ve heard this. It has been the underlying current of the market for the past several years. Even today, we still see multiple offers on houses. Quite frequently! Even at 7% interest rates.

Insert here standard disclaimer, properties that show well and are priced right will always sell. So, if you are seeing properties sit, thinking there is no demand, I advise you to check those two things on those properties, condition, and price. Buyers are even more choosy in this market. If they are going to buy a house at 7% interest rates, it better be worth it!

It is true that the higher interest rates may have pushed buyers of detached homes into the price range of townhomes, or townhome buyers to condos. We get it. You may want to wait to save a little more cash for a down payment to get the property you want. Hopefully you can stay where you are or rent somewhere that allows for savings to happen.

However, we are also seeing rental rates rise. With people choosing to rent, rental prices are going up. It’s very competitive. In order to get the rental property you want, you may have to commit to a longer lease. This will lock you in and if rates do come down next year you may not be in a position to buy because of your lease.

Let’s do some math. What could renting now look like as a cost vs buying now or buying later.

Let’s just say you were thinking of buying a detached home for $800,000. (I’m sorry the example is so high, but sadly we live in a very expensive area, and realistically that’s what it takes in a lot of areas to get into a detached home.)

Scenario 1

With 20% down today the monthly payment would be around $5,200 including principal, interest, and property taxes. You could rent an amazing house in NOVA for $5,200!

Scenario 2

Let’s say you do rent, and you decide you’d like to save a few dollars and only pay $4,000 per month in rent. If you sign a 2-year lease, at the end of it you will have paid the landlord $96,000. One could argue you saved $1,200 x 24 months or $28,800. However, here’s the problem. Two years from now, we expect prices to be higher, but we are anticipating interest rates will have come down by then.

Scenario 1 — two years from now

Let’s say that that $800,000 house would now be priced at $850,000 and interest rates have dropped back down to 5%. If you refinance, your new monthly payment will be $4,200. Just $200 a month more than you had planned on spending in rent. Sweet! You will have put that $96,000 towards your mortgage, paid it down some and will now pay $1,000 less per month by refinancing.

Scenario 2 — two years from now

You rented at $4,000 per month, saved some money, and now want to buy. The $800,000 house is now selling for $850,000. Therefore, to put 20% down now you will need an extra $17,000. Well, you did save $28,800 by not buying at 7%. So, you’re ahead! Except for the $96,000 in rent you paid during the past 2 years. Hmm.

Where does that leave you? Maybe instead of waiting for the dream property, buy what you can afford now and begin to build equity. You may end up staying longer than you want, but waiting could be very costly. We run into people all the time who have been renting for a long time, waiting for the right time to finally take the plunge. We’ve talked about the potential cost of waiting 2 years. What about 5 or even 10 years?

People have been trying to time the markets for years. Albeit the stock market, the currency markets, or the real estate markets. Sometimes you win, sometimes you lose. But there is one thing all experts agree upon is that building home equity builds wealth. Renting does not. A true cliché but a poignant one: If you’re renting, you’re paying someone else’s mortgage. If you can, wouldn’t it be better to be paying your own?

*My thanks to Carey Meushaw, Branch Manager & Sr. Loan Officer (NMLS ID 310813) at Atlantic Coast Mortgage for his contributions this week.

Rebecca McCullough has built a successful real estate business in Alexandria and Northern Virginia by providing excellent service to her clients. If you would like more information on selling or buying in today’s complex market, contact Rebecca today at 571-384-0941 or visit her website RebeccaMcCullough.com.

If you would like a question answered in our weekly column or to set up an appointment with one of our Associates, please email: [email protected] or call 703-549-9292.

McEnearney Associates Realtors®, 109 S. Pitt Street, Alexandria, VA 22314. www.McEnearney.com Equal Housing Opportunity. #WeAreAlexandria

Recent Stories

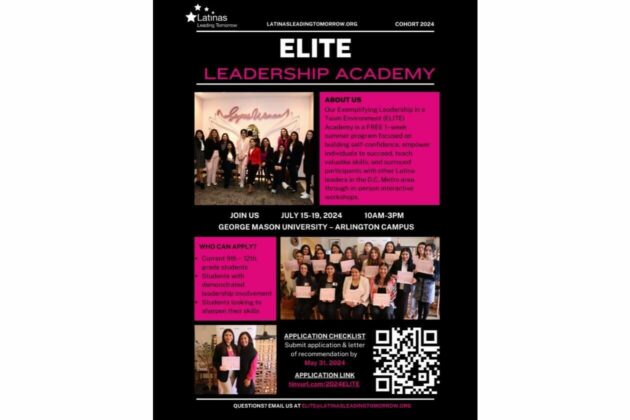

FREE Leadership Sessions will be conducted at the George Mason University –Arlington Campus for High School Latinas. The program runs from Monday 7/15 through Friday 7/19 from 10:00AM to 3:00PM EST each day (1-week).

Las sesiones de liderazgo GRATUITAS se llevarán a cabo en el campus de George Mason University – Arlington para latinas de secundaria. El programa se desarrollará desde el lunes 15 de julio hasta el viernes 19 de julio, de 10:00 a.m. a 3:00 p.m. EST cada día (1 semana).

Our goal is to equip students with the fundamentals of self-promotion and guide them in shaping their personal brand for future success. What sets this program apart is its integration of self-awareness activities and mentorship by seasoned professionals.

Finding a gift for moms can be difficult. Google “Mother’s Day gifts,” and you’ll scroll through endless lists of beauty products, candles and fuzzy robes. Sure, those are sweet, but sometimes it’s fun to surprise loved ones with something a little more, well, practical!

Here’s one idea: Give her a gift certificate for a home cleaning from Well-Paid Maids. It’s the perfect “thank you,” “I love you” or “you’ve got this” for any mom. She can schedule the home cleaning at her convenience and breathe easy knowing she has one less thing to do.

Our cleaners will take care of everything, including vacuuming and mopping as well as cleaning and dusting countertops, tables, mirrors, appliances and more. Sinks, toilets, showers and appliance exteriors also get a good scrub.

Plus, when you buy a gift certificate from Well-Paid Maids, you’re supporting a living-wage cleaning company. That means cleaners get paid a starting wage of $24 an hour and get access to benefits, like 24 days of PTO and health insurance.

Alexandria NAACP, Shiloh Baptist Church, DPC to hold City Council…

The Alexandria Branch of the NAACP, Shiloh Baptist Church, and The Departmental Progressive Club to hold the City Council Candidate Forum for ALL Candidates in the City of Alexandria Virginia. The event is Free of Charge and Open to The