This week’s Q&A column is sponsored and written by Brian Bonnet, Senior Loan Officer (NMLS ID# 224811) of Atlantic Coast Mortgage, LLC (NMLS ID# 643114). To learn more about current mortgage rates and the home loan process, contact Brian at 703-766-6702 or email [email protected]. You may also submit your questions to McEnearney Associates via email for response in future columns.

Question: What’s the status of the mortgage industry this fall?

Answer: As we roll into fall 2021, the US mortgage industry will see some changes, some more attractive to consumers and some not as much.

Recent positive changes include a reduction in the spread between rates for owner occupied properties and those for second homes and investment properties. Several months ago, regulatory changes caused significant increases in the rates for non-owner occupied properties.

For a period, the rate spread between primary residence properties and non-owner occupied could be as high as 1.75% in rate. That spread is now back down to roughly .500% to .750% making investment purchases and second home purchases more tenable.

At the start of the pandemic, Fannie Mae, Freddie Mac and most of the secondary market imposed various additional restrictive underwriting guidelines. The purpose of the tighter underwriting guidelines was to protect lenders from potential increased risk associated with pandemic related economic downturns. At this point most of the more restrictive guidelines have been lifted and underwriting guidelines generally reflect pre-pandemic standards.

Mortgage program options have continued to rebound as well. Some programs were suspended early in the pandemic, again to allay risk. Many lenders suspended their non-conforming or jumbo programs. At Atlantic Coast Mortgage we suspended our construction loan and bridge loan programs at the beginning of the pandemic.

The good news is we have brought those two programs back. Additionally, we added programs such as special loans for doctors and lawyers. Most lenders in the secondary mortgage market have brought back their jumbo loan programs. The loan program offerings for consumers today generally mirror those offered prior to the pandemic.

The last bit of good news is conforming loan limits are going to increase significantly at the start of the new year. There are no official numbers currently, but we expect the standard conforming loan limit to increase from $548,250 to at least $625,000. At Atlantic Coast we have already begun making conforming loans up to that loan amount.

In the Washington Metro area, we enjoy the benefit of the 2nd tier conforming loan limit which is currently $822,375. That number will also likely increase to somewhere close to $900,000. Conforming loans have less restrictive underwriting standards including lower down payment requirements which make it easier to purchase property in the ever increasingly expensive Washington area.

Now for the less than pleasant news. Interest rates are increasing. We knew it would happen and it is generally a sign of an improving economy. Interest rates have been in the two percentiles for most of the past year. The Federal Reserve’s response to the pandemic economy were the reason for the historically low rates and now the Fed is faced with the need to address the reality of significant inflation. Generally, the Fed’s response to inflation is to increase the Fed funds rate which also has the impact of driving up all other interest rates as well.

Mortgage interest rates have inched into the low three percentiles for most transactions, and we expect they will continue to rise in the coming months. An increase in rates has an impact on a consumer’s ability to qualify for loans. At some point that will translate to pressure against the rising cost of housing. The lack of housing supply has been the primary driver of the cost and it will continue to be so, but a rise in rates will have some tempering affect.

If you would like more information to help plan your next move, please contact Brian Bonnet at [email protected] or call 703.766.6702.

If you would like a question answered in our weekly column or to set up an appointment with one of our Associates, please email: [email protected] or call 703.549.9292.

McEnearney Associates Realtors®, 109 S. Pitt Street, Alexandria, VA 22314. www.McEnearney.com Equal Housing Opportunity. #WeAreAlexandria

Recent Stories

Good news, D.C. area. You can save money on your next home cleaning with Well-Paid Maids. It’s easy!

We offer a discount when you set up recurring cleans — and the discounts just increased this week!

For weekly cleans, get $30 off each cleaning.

Potomac Harmony is Back! Following a gap year of competing, then virtual rehearsals during the pandemic, followed by the well-earned retirement of our long-term director, a year of a director search, Potomac Harmony hit the regional contest stage in Concord, North Carolina in March for the first time since 2018! It was exhilarating, reaffirming, and rewarding!

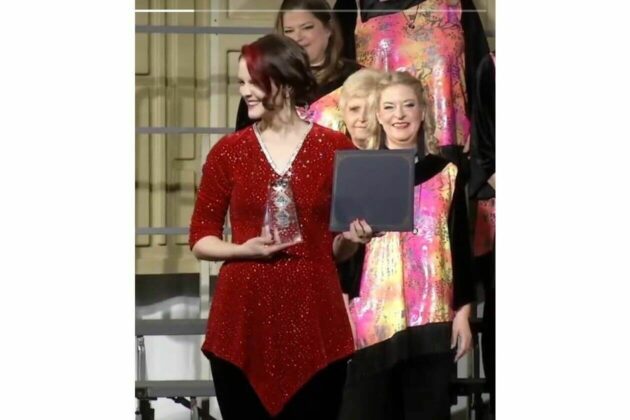

The chorus hit all of its goals, the biggest of which was to have fun and sing our best on contest stage — we did both! Because we earned a score over 400 points, our new Director, Allison Lynskey, was awarded the Novice Director award, photo above. Additionally, one of our charter members, Jackie Bottash, was nominated for and honored with the Leadership Excellence award. It was a celebratory weekend!

What’s next? So much! We now look forward to upcoming performances, growing our membership, and expanding our musical product with new arrangements and an education component each week. It’s an exciting time to be part of this ever-growing ensemble!

Alexandria NAACP, Shiloh Baptist Church, DPC to hold City Council…

The Alexandria Branch of the NAACP, Shiloh Baptist Church, and The Departmental Progressive Club to hold the City Council Candidate Forum for ALL Candidates in the City of Alexandria Virginia. The event is Free of Charge and Open to The