This week’s Q&A column, sponsored and written by McEnearney Associates Realtors®, the leading real estate firm in Alexandria, is a bit of a departure from our usual format. To learn more about this article and relevant Alexandria market news, contact us at 703-549-9292. You may also submit your questions to McEnearney Associates via email for response in future columns.

Question: With interest rates fluctuating how can I confidently search for my next home?

Answer: There are myriad programs and creative financing options that can pave the way to owning a home if you know who to ask and prepare ahead.

As we prepare for the 2024 spring market, Realtors and their clients are having in-depth discussions about what they can afford and how to secure their financing. But many wannabe buyers are dissuaded from believing homeownership is in the cards because they don’t have a big down payment, need to sell an existing home first, or are retired, among other hurdles. But with guidance from a savvy lender, the doors to homeownership start to open up.

Brian Bonnet and Eric Boutcher of Atlantic Coast Mortgage recently held classes for McEnearney agents to review financing programs and products for buyers eager to purchase but who need a little extra help putting their financing together. They reviewed common buyer challenges and the solutions available through ACM’s lending programs and those offered by housing agencies like Virginia Housing, Maryland’s Community Development Agency, and DC’s Open Doors.

Scenario 1: First-time purchaser with little available cash

Agents shared that many buyers are waiting on the sidelines because of concerns of not having a 20% down payment. In reality, there are many lower down payment options, even for conventional loans.

For Fannie Mae and Freddie Mac, who provide guidelines for the vast majority of loans originated nationwide, the minimum down payment is only 3% for first-time homebuyers (which applies even if you’ve owned a home before but not in the last three years) and for higher-priced loans of $766,550-$1,149,825 the minimum down payment is only 5%. There are even lower down payment programs, such as those provided by VH, which are income-dependent programs with 0-3% down payments. VHDA provides both conventional first mortgages up to 97% and grants that can be used toward down payments.

The Virginia Housing Development Authority (VHDA) is a key resource for individuals seeking to achieve homeownership in Virginia. Recently, VHDA introduced groundbreaking changes aimed at expanding accessibility to their programs, notably eliminating the first-time homebuyer requirement which opens opportunities for a broader range of buyers. Additionally, VHDA offers a 2% grant program, providing financial assistance towards down payments and closing costs, easing the financial burden of purchasing a home. Another noteworthy initiative is the VHDA Plus program, which offers 100% financing, and some buyers may even qualify for an additional 1.5% in funds to be applied toward closing costs. Through the recent guideline changes, VHDA is enhancing affordability and making homeownership dreams more achievable for Virginians.

In one example Bonnet shared, a qualified buyer using the Virginia Housing (VH) Plus program could purchase a $300,000 condo with a first mortgage of $291,000 and a second mortgage of $13,500 for total financing of $304,500. That means the buyer can finance $4,500 of the total closing costs, leaving them with a cash requirement of roughly $8,200.

In another example, for a $500,000 townhouse with a first mortgage of $485,000 and a second mortgage of $22,500, the borrower’s cash needed is approximately $7,900. In both scenarios, buyers do need cash funds, but as seen in these examples, the amount required was less than $10,000, much lower than many buyers expect they’ll need.

Atlantic Coast Mortgage offers a grant program for eligible buyers to help with down payment and closing cost assistance. Boutcher explained that eligible first-time home buyers can receive up to a $12,500 grant and community partners — which includes firefighters, first responders, doctors, nurses, law enforcement, educators, and more — may be eligible for a grant of up to $15,000. This program has income limits based on household size but is eligible throughout the DMV and beyond.

Scenario 2: Home to sell and can’t compete with a Home Sale Contingency

In a competitive market, a home sale contingency is generally a non-starter for sellers who want “clean” contracts with few or zero contingencies, but agents know that potential seller-buyers want to avoid selling their existing home before they have their next home to move to. Stalemate, right?

Not always, says Bonnet. “I have active customers who thought they couldn’t purchase before first selling because they needed the cash equity from their existing home, and they cannot qualify for the new traditional loan without getting rid of the existing home loan,” he shared as he explained how they worked out a plan using a bridge loan.

There are two types of bridge loans that Atlantic Coast Mortgage offers: a cash-out bridge loan and a purchase bridge loan. In the first, owners can refinance their current home to allow for a line of credit that can be used for a down payment or closing costs on a new home and must be repaid within three months.

“We have qualified them for a bridge loan on their existing home without consideration of their debt service on the next home,” Bonnet explained. With that bridge loan, they convert equity to cash to be used as a down payment on the next $1.1M home.”

Bonnet continued, “Because they don’t qualify for a traditional loan on the next home while carrying the debt on the existing home, we have also qualified them for a bridge loan on the new home without consideration of the debt on the existing home. With this unique Atlantic Coast Mortgage underwriting guideline, the seller-buyers are now able to write a contract that is not contingent on the sale of their existing home, and, if they choose, they can waive financing and appraisal contingencies and be in the hunt as competitive prospective homebuyers.”

Scenario 3: Retirees and self-employed buyers without steady incomes

There are other ways a smart lender can set clients up for success, even without a monthly income. Self-employed buyers will have many deductions that can reduce their net income (on paper), but with the right documentation, lenders can help them add back depreciation, thereby increasing their eligible qualifying income. One example is a retiree who could begin drawing from their qualified retirement account penalty-free at 59 ½ years old. With a $1M retirement fund, the retiree could set up a distribution of $10,000/month that can be counted as immediate income that can be used for qualification purposes.

Bonnet explained that the more information a lender has, the better they can advise buyers, and he suggests buyers get in contact with their financing expert as soon as possible. This gives buyers the opportunity to review with their lender which programs they might qualify for and what timelines they will be working under.

Don’t let a challenging market get in the way of your dream of homeownership. Work with an experienced McEnearney agent and trusted lender to find the options and avenues you didn’t know were possible to get you on your way.

If you would like a question answered in our weekly column or to set up an appointment with one of our Associates, please email: [email protected] or call 703-549-9292.

McEnearney Associates Realtors®, 109 S. Pitt Street, Alexandria, VA 22314. www.McEnearney.com Equal Housing Opportunity. #WeAreAlexandria

Recent Stories

Good news, D.C. area. You can save money on your next home cleaning with Well-Paid Maids. It’s easy!

We offer a discount when you set up recurring cleans — and the discounts just increased this week!

For weekly cleans, get $30 off each cleaning.

Potomac Harmony is Back! Following a gap year of competing, then virtual rehearsals during the pandemic, followed by the well-earned retirement of our long-term director, a year of a director search, Potomac Harmony hit the regional contest stage in Concord, North Carolina in March for the first time since 2018! It was exhilarating, reaffirming, and rewarding!

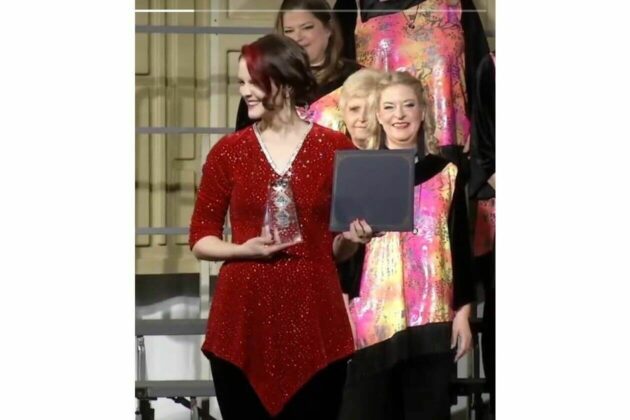

The chorus hit all of its goals, the biggest of which was to have fun and sing our best on contest stage — we did both! Because we earned a score over 400 points, our new Director, Allison Lynskey, was awarded the Novice Director award, photo above. Additionally, one of our charter members, Jackie Bottash, was nominated for and honored with the Leadership Excellence award. It was a celebratory weekend!

What’s next? So much! We now look forward to upcoming performances, growing our membership, and expanding our musical product with new arrangements and an education component each week. It’s an exciting time to be part of this ever-growing ensemble!

Alexandria NAACP, Shiloh Baptist Church, DPC to hold City Council…

The Alexandria Branch of the NAACP, Shiloh Baptist Church, and The Departmental Progressive Club to hold the City Council Candidate Forum for ALL Candidates in the City of Alexandria Virginia. The event is Free of Charge and Open to The