This week’s Q&A column is written by Rebecca McCullough of McEnearney Associates Realtors®, the leading real estate firm in Alexandria. To learn more about this article and relevant Alexandria market news, contact Rebecca at 571-384-0941 or email [email protected]. You may also submit your questions to McEnearney Associates via email for response in future columns.

This week’s Q&A column is written by Rebecca McCullough of McEnearney Associates Realtors®, the leading real estate firm in Alexandria. To learn more about this article and relevant Alexandria market news, contact Rebecca at 571-384-0941 or email [email protected]. You may also submit your questions to McEnearney Associates via email for response in future columns.

Question: What should I know about real estate appraisals?

Answer: An appraisal is an unbiased professional opinion of the value of a home. An appraisal is needed when a mortgage is involved in the buying, refinancing, or selling of a property. Other reasons you may get an appraisal is to determine value in the case of estate settlement, divorce, or insurance purposes.

It is important to understand the meaning of unbiased which is without prejudice and favoritism. In this case the appraiser has no financial interest personally in the property or transaction. It does not say that the unbiased professional opinion will not be subjective.

What is the process of an appraisal?

For the purposes of the article, we are going to assume the appraisal is being ordered as the result of a ratified contract where the buyer needs to obtain a mortgage to pay for the property

Upon ratification the contract is sent to the buyer’s lender. The lender then requests an appraisal through an independent Appraisal Management Company (AMC). Lenders and buyers cannot choose their own appraiser.

The contract will specify a timeframe to have the appraisal completed. The assigned appraiser will reach out to the listing agent for an appointment to see the property. The appointment usually takes less than one hour.

The appraiser will measure the square footage, take pictures, and attempt to determine the age of appliances, windows, roof, and other systems. They will want to know of any major improvements made in the home and when they were done. They will also take into consideration the surrounding area, schools, transportation infrastructure, and other amenities in the community.

After the physical review they will do the same market analysis that the real estate agent does to determine the market value of the home. They will look through the most recent sales to determine the homes which best compare to the subject house with respect to square footage, number of bedrooms and baths, lot size, age of home, finishes, and condition. Sometimes those are very difficult to find because the areas have been redeveloped over time. There may be brand new homes next to old or even historic homes.

The diversity of homes in our Alexandria communities can make finding good comps very difficult. When this happens, the appraiser often goes to neighborhoods further away. That could lead to the two homes being in different school districts which could impact the value of a home.

Once the appraiser has determined what they feel are the best comps they will make monetary adjustments to the various features of a home to bring the homes into alignment. For example, one has a screened porch the other does not. What value do you add or subtract for this feature? Now do that a few times with other features and it is subjective.

It’s not an exact science, but appraisals are necessary. Flash back to the 2008 housing crisis, when lenders were loaning people more money than the house was worth. We know we don’t want a repeat of that. It’s the appraiser’s job to protect the interests of the lender and the buyer.

Once the lender receives the completed appraisal one of three scenarios can happen:

- The appraisal value is higher than the sales price. Excellent, instant equity!

- The appraisal value equals the sales price. Again, excellent parties move forward.

- The appraisal value is lower than the sales price. Uh-oh.

Low appraisals are everyone’s worst scenario. Depending on the contract, and the type of financing the buyer is applying for, the next steps are different. Let’s lay them out.

Cash or conventional financing that is contingent on appraisal value:

- The buyer and the seller will negotiate. Easy option the seller agrees to lower the sales price to the appraisal. Transaction moves forward.

- The buyer and seller agree on a compromised price, the transaction moves forward. This may mean the buyer has to add money to his down payment to meet loan requirements to preserve rates and conditions. For example, if the amount now puts the buyer’s downpayment at less than 20% they will have to bring more money to closing to avoid paying mortgage insurance.

- The buyer and seller cannot agree to a price, and if the buyer is protected by an appraisal contingency, the buyer can void the contract and walk away with no penalty. If they put an earnest money deposit down, they will receive it back in full.

VA (Veterans) Loan

VA loans are guaranteed by U.S. Department of Veterans Affairs. Veterans can borrow up to 100% of the sales price with no limit. VA loan borrowers CANNOT waive the appraisal. Even if they do waive their right in the contract documents, it can’t be enforced. This is very complicated, yet simple too when submitting contracts. There’s a lot of misunderstanding regarding this issue in the industry.

With respect appraisals coming in over, at, and under the sale price, the scenarios are all the same as above. However, the veteran does not need a Finance Contingency Addendum to be protected. They are protected by statue.

Understanding this, you can appreciate that it can especially trying for veteran’s who want to take advantage of the great rates and terms VA Loans can provide and get a VA loan. However, because they cannot waive appraisal, or the right to void based on a low appraisal, sellers are sometimes hesitant to accept offers with VA loans. This is especially frustrating in multiple offer situations. But understanding each contract is critical, and not making blanket assumptions regarding the offer because it’s a VA loan is important.

Honestly, this is one of the key scenarios where a knowledgeable agent can make or break a deal for a seller and/or buyer. Understanding and navigating a successful contract with a VA Loan can be tricky.

We are expecting another seller’s market in the spring of 2024 with inventory still very limited. Buyers are tired of waiting on the sidelines and with the slight decrease in rates they are out looking for houses to buy. The contingencies and terms that a buyer includes in their offer are critical. Please make sure you are working with a knowledgeable agent if listing or buying a home this spring, and always!

Rebecca McCullough has built a successful real estate business in Alexandria and Northern Virginia by providing excellent service to her clients. If you would like more information on selling or buying in today’s complex market, contact Rebecca today at 571-384-0941 or visit her website RebeccaMcCullough.com.

If you would like a question answered in our weekly column or to set up an appointment with one of our Associates, please email: [email protected] or call 703-549-9292.

McEnearney Associates Realtors®, 109 S. Pitt Street, Alexandria, VA 22314. www.McEnearney.com Equal Housing Opportunity. #WeAreAlexandria

Recent Stories

Good news, D.C. area. You can save money on your next home cleaning with Well-Paid Maids. It’s easy!

We offer a discount when you set up recurring cleans — and the discounts just increased this week!

For weekly cleans, get $30 off each cleaning.

Potomac Harmony is Back! Following a gap year of competing, then virtual rehearsals during the pandemic, followed by the well-earned retirement of our long-term director, a year of a director search, Potomac Harmony hit the regional contest stage in Concord, North Carolina in March for the first time since 2018! It was exhilarating, reaffirming, and rewarding!

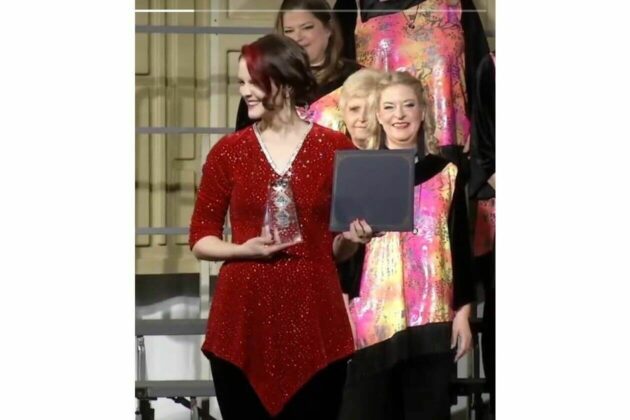

The chorus hit all of its goals, the biggest of which was to have fun and sing our best on contest stage — we did both! Because we earned a score over 400 points, our new Director, Allison Lynskey, was awarded the Novice Director award, photo above. Additionally, one of our charter members, Jackie Bottash, was nominated for and honored with the Leadership Excellence award. It was a celebratory weekend!

What’s next? So much! We now look forward to upcoming performances, growing our membership, and expanding our musical product with new arrangements and an education component each week. It’s an exciting time to be part of this ever-growing ensemble!

Alexandria NAACP, Shiloh Baptist Church, DPC to hold City Council…

The Alexandria Branch of the NAACP, Shiloh Baptist Church, and The Departmental Progressive Club to hold the City Council Candidate Forum for ALL Candidates in the City of Alexandria Virginia. The event is Free of Charge and Open to The