The Alexandria City Council on Tuesday unanimously approved a $1.155 real estate tax rate cap per $100 of assessed value — potentially a 2.5 cent increase — for the proposed city budget.

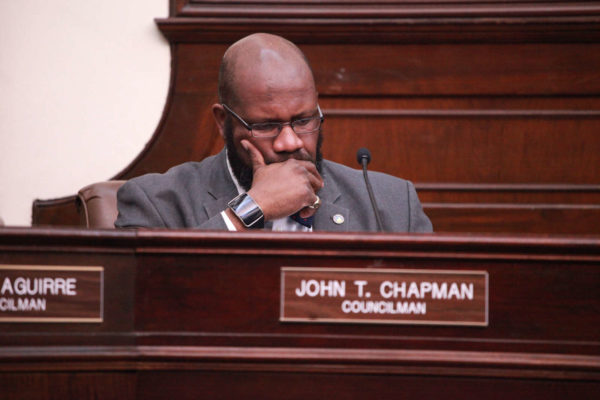

City Councilman John Taylor Chapman proposed that council approve a half cent more than the $1.15 rate proposed by City Manager Mark Jinks last month. That half cent equates to $2.1 million, which Chapman says is a cushion that will allow council to add budget items without making cuts.

“I think we need to go over and above the manager’s recommendation, even if it is half of a cent, to provide that conversation that if we feel strongly enough, if our residents feel strongly enough about a certain issue, a certain thing that needs to be funded and we’re not able to find the cuts… we have that availability,” Chapman said.

Chapman made a similar motion in last year’s budget process.

Jinks proposed raising the real estate tax rate by 2 cents, from the current $1.13 per $100, in order to pay for construction of two new elementary schools.

Mayor Justin Wilson said that the city philosophy has been to balance the operating budget with available revenue, and that any additional increases on the real estate tax rate are invested in infrastructure.

“I think that’s the philosophy the city manager took in proposing his budget, and we can certainly have a conversation during our process about where we end up, but that’s how I would look at this process,” Wilson said. “We’ll see where we all end up as we build consensus and try to get to the end of April.”

On Monday, council also conducted a budget public hearing and heard from a number of city employees concerned about compensation.

City Councilman Mo Seifeldein said that the city needs to be clearer regarding compensation issues with city employees.

“Our employees are telling us we’re not where we want to be comparatively,” Seifeldein said, and then addressed the city manager. “If council were to dedicate $2 million to employee compensation, do you have any idea how that would be distributed, given all of our employees feel like they’re getting underpaid, specifically the firefighters?”

Jinks responded, “I think I would like to consult with the HR director and my staff before coming back with how to allocate something.”

City Council will discuss employee compensation at a budget work session tonight at 7 p.m. at City Hall.

The full city press release on the approved tax rate cap is below the jump.

On March 10, the Alexandria City Council voted unanimously to consider a 2020 calendar year real estate tax rate of up to $1.155 per $100 of assessed value. The real estate tax rate City Council eventually adopts could be higher, lower, or the same as the current rate of $1.13, but cannot be higher than $1.155. No increase will be considered for the tax rates on personal property (vehicles) or business tangible property.

On February 18, City Manager Mark Jinks proposed a Fiscal Year (FY) 2021 Operating Budget that funds 100% of City government and Alexandria City Public Schools operating costs at the current tax rate of $1.13. The proposed budget also recommends a two-cent tax rate increase (for a total tax rate of $1.15) to be used solely for Schools and City capital needs, including the $248 million construction cost of new buildings for Douglas MacArthur Elementary School and the Minnie Howard Campus of T.C. Williams High School.

If City Council adopts the real estate tax rate in the proposed budget of $1.15 for 2020, the average residential tax bill would increase $428 or 6.82% when compared to 2019 residential tax bills. If City Council were to adopt the maximum real estate tax rate of $1.155 for 2020, the average residential tax bill would increase $457 or 7.29%.

No decision has been made yet on what the adopted tax rates will be. City Council will adopt final rates in conjunction with the adoption of the FY 2021 budget on April 29. A public hearing on the ordinance establishing the real estate tax rate will be held on Saturday, April 18, at 9:30 a.m., in the City Hall Council Chamber (301 King St.).

For more information about the FY 2021 budget process, visit alexandriava.gov/Budget.

Recent Stories

Finding a gift for moms can be difficult. Google “Mother’s Day gifts,” and you’ll scroll through endless lists of beauty products, candles and fuzzy robes. Sure, those are sweet, but sometimes it’s fun to surprise loved ones with something a little more, well, practical!

Here’s one idea: Give her a gift certificate for a home cleaning from Well-Paid Maids. It’s the perfect “thank you,” “I love you” or “you’ve got this” for any mom. She can schedule the home cleaning at her convenience and breathe easy knowing she has one less thing to do.

Our cleaners will take care of everything, including vacuuming and mopping as well as cleaning and dusting countertops, tables, mirrors, appliances and more. Sinks, toilets, showers and appliance exteriors also get a good scrub.

Plus, when you buy a gift certificate from Well-Paid Maids, you’re supporting a living-wage cleaning company. That means cleaners get paid a starting wage of $24 an hour and get access to benefits, like 24 days of PTO and health insurance.

Good news, D.C. area. You can save money on your next home cleaning with Well-Paid Maids. It’s easy!

We offer a discount when you set up recurring cleans — and the discounts just increased this week!

For weekly cleans, get $30 off each cleaning.

Alexandria NAACP, Shiloh Baptist Church, DPC to hold City Council…

The Alexandria Branch of the NAACP, Shiloh Baptist Church, and The Departmental Progressive Club to hold the City Council Candidate Forum for ALL Candidates in the City of Alexandria Virginia. The event is Free of Charge and Open to The