This week’s Q&A column, sponsored and written by McEnearney Associates Realtors®, the leading real estate firm in Alexandria, is a bit of a departure from our usual format. To learn more about this article and relevant Alexandria market news, contact us at 703-549-9292. You may also submit your questions to McEnearney Associates via email for response in future columns.

Question: Are there ways to lower my interest rate when buying a house?

Answer: The new year will shake up how everyone involved in the home ownership process as consumers, lenders and Realtors explore solutions to keep the housing market moving at a healthy pace. The days of throwing a home on the market and watching multiple offers roll in is probably a thing of the past, but there are still advantages available to both sides to ensure people can buy the homes that are available, even with rates at their highest in several years.

For buyers, taking an (honest!) inventory of finances and speaking with a lender is the first step. While it is advisable to have a healthy cash reserve when buying a home, the old standard of 20% down is rarely the case today. The National Association of Realtors 2022 study of homebuyers and sellers showed that the typical down payment for first-time buyers was 6% while for repeat buyers it was 17%.

But even with lower requirements for a down payment, buyers will still have to qualify for financing and bring money to closing. What are some options to make every dollar count on the pathway to homeownership?

Rate Buydowns

Buyers over the past several years were treated to historically low interest rates in the high 2-percentiles to low three-percentiles. With rates now in the low to mid six-percentile, diminished buyer power is leading to creative solutions in adjusting where buyers start out with their rate — and where they might end up.

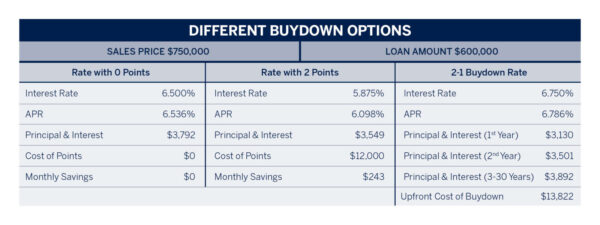

Brian Bonnet of Atlantic Coast Mortgage shared insight into two buydown strategies — one that’s traditional and one that has been sparking conversation among Realtors looking for every option to help their clients. The tried-and-true rate buydown is where buyers lower their interest rate by buying “points” at the time of closing. The lowered interest rate is fixed for the lifetime of the loan and offer buyers a consistent amortization schedule.

The “2-1 Buydown” is a temporary rate adjustment where a buyer uses cash to lower their interest rate by 2% in the first year of their mortgage and 1% in the second year of the mortgage, coming back to their full rate at the 25th month of mortgage payments. For example, the buyer who would qualify at the loans note (which is generally slightly higher than the current market fixed rate — let’s say 7% — would pay to bring their rate down to 5% in 2023, 6% in 2024 and back to 7% — the rate at which the buyer was qualified — in 2025.

The benefit of this scenario is that buyers will have a cushion of two years before they start paying the fully amortized rate, and the cash can come in the form of a seller credit (see more on this topic below). Bonnet points out that consumers can’t assume rates will drop or that refinancing will be cheaper in 2025, and must think carefully about whether they will be in a better or worse position when the full rate goes into effect.

“Will rates be better after two years? Will you be in a better financial position to account for the increased interest payment? Will you be able to refinance if you aren’t?” Bonnet said the 2-1 buydown option is good for buyers who don’t expect to be in their home long-term, such as a military buyer who isn’t using their VA opportunity and plans to sell at the end of their assignment. “The typical buyer is not a 2-1 buydown consumer.”

Seller Credits

As buyers navigate higher interest rates, inflation and other economic factors, sellers may see homes taking longer to sell and with more negotiating on terms. In some cases a seller chipping in cash can be what gets a deal to the closing table.

An example of a seller credit would look like this: A home is listed for $600,000 and gets an offer from a buyer who is putting a little less than 20% down and financing $500,000. Rather than negotiate the price to $590,000, the buyer offers the seller their asking price of $600,000 but asks for $10,000 to help them cover their closing costs. The net to the seller is $590,000 and the buyer is able to qualify for their loan and close with help from the seller.

Down Payment Assistance

Buyers can explore local grants and down payment assistance (DPA) programs that offer financial resources, some based on income and some are available to certain types of workers (ex: HUD’s Good Neighbor Next Door program that offers available homes at a discount to educators, civil servants, First Responders). To see what local monies may be available in your area, check these HUD resources for Virginia, Maryland and D.C.

Government-Backed Mortgage Programs

FHA and VA loans are popular government-backed loans aimed at specific types of buyers and with specific criteria to qualify, usually less restrictive than conventional mortgage loans but with their own mandated processes and procedures. And for buyers who aren’t afraid of a fixer-upper, there are FHA 203(k) loans that serves as a construction loan that finances both the purchase and repairs to a home.

Adjustable-Rate Mortgages

While these were popular in the mid-2000s as buyers were trying to qualify for homes as prices dramatically rose, the economic factors aren’t as favorable for ARMs in 2023. Bonnet explained that because the bond markets currently have an inverted yield curve with a very widespread, ARMs are generally not offering more favorable terms than fixed rates and signs do not indicate that this will improve anytime soon.

In many ways, consumers are back to basics when it comes to buying and selling a home in 2023. Save money, research options, be prepared to get creative, look for ways to collaborate. There is no magic wand when prices are high, inventory is tight, and buyers are squeezed. But working with the right professionals like trusted local lenders and expert McEnearney Associates will get you where you want to go!

If you would like a question answered in our weekly column or to set up an appointment with one of our Associates, please email: [email protected] or call 703-549-9292.

McEnearney Associates Realtors®, 109 S. Pitt Street, Alexandria, VA 22314. www.McEnearney.com Equal Housing Opportunity. #WeAreAlexandria

Recent Stories

Finding a gift for moms can be difficult. Google “Mother’s Day gifts,” and you’ll scroll through endless lists of beauty products, candles and fuzzy robes. Sure, those are sweet, but sometimes it’s fun to surprise loved ones with something a little more, well, practical!

Here’s one idea: Give her a gift certificate for a home cleaning from Well-Paid Maids. It’s the perfect “thank you,” “I love you” or “you’ve got this” for any mom. She can schedule the home cleaning at her convenience and breathe easy knowing she has one less thing to do.

Our cleaners will take care of everything, including vacuuming and mopping as well as cleaning and dusting countertops, tables, mirrors, appliances and more. Sinks, toilets, showers and appliance exteriors also get a good scrub.

Plus, when you buy a gift certificate from Well-Paid Maids, you’re supporting a living-wage cleaning company. That means cleaners get paid a starting wage of $24 an hour and get access to benefits, like 24 days of PTO and health insurance.

Good news, D.C. area. You can save money on your next home cleaning with Well-Paid Maids. It’s easy!

We offer a discount when you set up recurring cleans — and the discounts just increased this week!

For weekly cleans, get $30 off each cleaning.

Alexandria NAACP, Shiloh Baptist Church, DPC to hold City Council…

The Alexandria Branch of the NAACP, Shiloh Baptist Church, and The Departmental Progressive Club to hold the City Council Candidate Forum for ALL Candidates in the City of Alexandria Virginia. The event is Free of Charge and Open to The