This week’s Q&A column is sponsored and written by Hope Peele of The Peele Group and McEnearney Associates Realtors®, the leading real estate firm in Alexandria. To learn more about this article and relevant Alexandria market news, contact The Peele Group at 703-244-6115 or email [email protected]. You may also submit your questions to McEnearney Associates via email for response in future columns.

Question: How have the interest rate hikes affected the real estate market for buyers?

Answer: Seeing mortgage interest rates climb over the last few months has been scary for both buyers and sellers. Many buyers are wondering if they can still afford to buy, and many sellers are wondering if they missed their opportunity to sell at a great price. What I am seeing is a much more balanced market, which can be good for both buyers and sellers.

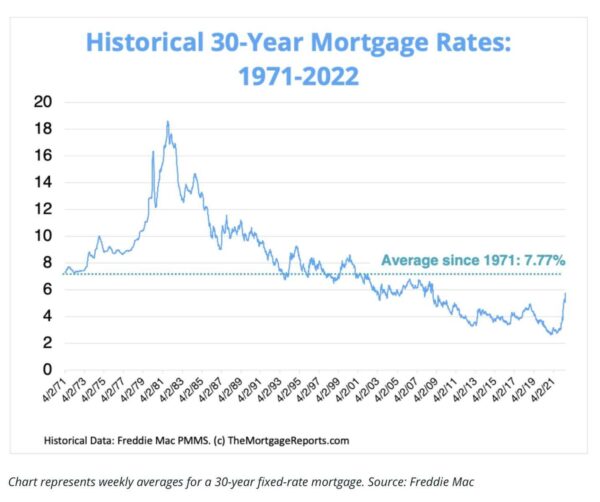

It has been very disappointing for buyers to see the interest rates climb. Many buyers are concerned about their ability to buy a new home with these increases. As 2022 has progressed, the super-competitive housing market began to slow down a bit in April with each new rate hike. By early summer, the rates hit 6% and many buyers took a break to figure things out.

Now we are seeing some of those buyers rethink things, and as they head back into the market they are finding a much more balanced environment. Of course, if you are wanting a home in a really hot neighborhood, it may still be super competitive. However, in general, it just got a lot easier for buyers. Yes, your monthly mortgage will be higher, but there are some great things about this market.

Since the pool of buyers has shrunk somewhat, there will be less competition for many homes. While the interest rates are higher, both the cash required at settlement and the risks involved in purchasing have gone down.

During the past two years there were often multiple offers, sometimes even 15-20 buyers competing for the same home. Buyers were not only having to make offers well above the list price, but they were waiving home inspection, appraisal and financing contingencies. This was a super stressful process for most buyers, who were accepting most or all the risk in the purchase, and oftentimes not getting the home they wanted.

When they did get the home, they had to be ready and able to put down substantial amounts of extra cash in case they had to cover a low appraisal. They also had to have extra cash in case of potential problems with the home, since they often had to waive home inspections and budget to fix things themselves.

To give you some perspective, a home in Alexandria was listed for $695,000 in early 2022 and sold for $758,000. That buyer probably had to come up with an extra $63,000 on top of their 10% or 20% down payment to get to closing. Or they may have had to reduce their downpayment to roll the shortage into the mortgage, increasing their monthly payment. In the current market, it very well may go for exactly list price, saving the buyer from coming up with that extra cash at closing.

Homes right now are staying on the market a little bit longer, giving buyers more time to make an informed decision. Because of this, and the decreased likelihood of competitive situations, buyers have a much better chance of paying list price, or less. Buyers can also usually ask for a home inspection now, and perhaps even negotiate some fixes. In addition to the inspection contingency, buyers can often ask for an appraisal contingency, so that if the home appraises lower than the contract price, they can negotiate a price adjustment.

All these options and contingencies are great for buyers and have been much less available in the market over the last year or two. But things are always changing!

If you are trying to figure out whether this is a good time for you to buy a home, the best place to start is to find a great lender and go through your options with them. I have several lenders that I work with who will take the extra time to be sure you understand the many scenarios available to you.

Once you know your loan options, it’s time to get started shopping. Meet with your Realtor to discuss your goals, to understand what your buying power is, and start narrowing down your search. I’d love to help, so don’t hesitate to reach out!

Hope Peele is a licensed real estate agent with McEnearney Associates, Inc. in Alexandria, Virginia. She grew up in Old Town and currently lives in Del Ray. As a partner with The Peele Group, Hope is dedicated to guiding her clients successfully through the many faceted process of buying or selling a home. Contact Hope at 703-244-6115.

If you would like a question answered in our weekly column or to set up an appointment with one of our Associates, please email: [email protected] or call 703-549-9292.

McEnearney Associates Realtors®, 109 S. Pitt Street, Alexandria, VA 22314. www.McEnearney.com Equal Housing Opportunity. #WeAreAlexandria

Recent Stories

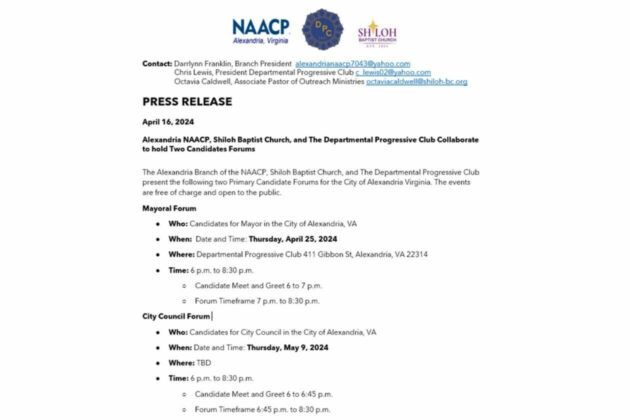

The Alexandria Branch of the NAACP, Shiloh Baptist Church, and The Departmental Progressive Club present the following two Primary Candidate Forums for the City of Alexandria Virginia. The events are free of charge and open to the public.

Mayoral Forum

● Who: Candidates for Mayor in the City of Alexandria, VA

Unlike our competitors, Well-Paid Maids doesn’t clean your home with harsh chemicals. Instead, we handpick cleaning products rated “safest” by the Environmental Working Group, the leading rating organization regarding product safety.

The reason is threefold.

First, using safe cleaning products ensures toxic chemicals won’t leak into waterways or harm wildlife if disposed of improperly.

Pro Coro Alexandria – To the Sea

Join Pro Coro Alexandria, the chamber choir of the Alexandria Choral Society, this Saturday for our concert, “To the Sea.” Experience a variety of songs from beloved choral classics like “Shenandoah” and “What Shall We Do With A Drunken Sailor?”

Del Ray Kitchen Confidential Design Tour

Please join us for Del Ray Kitchen Confidential – a walking tour of recently renovated kitchens in Del Ray with the experts who make the magic happen! FA Design Build owner Rob Menefee and Design Consultant Melissa Fielding walk us