This week’s Q&A column is sponsored and written by Hope Peele of The Peele Group and McEnearney Associates Realtors®, the leading real estate firm in Alexandria. To learn more about this article and relevant Alexandria market news, contact The Peele Group at 703-244-6115 or email [email protected]. You may also submit your questions to McEnearney Associates via email for response in future columns.

This week’s Q&A column is sponsored and written by Hope Peele of The Peele Group and McEnearney Associates Realtors®, the leading real estate firm in Alexandria. To learn more about this article and relevant Alexandria market news, contact The Peele Group at 703-244-6115 or email [email protected]. You may also submit your questions to McEnearney Associates via email for response in future columns.

Question: Interest rates are rising! What does that mean to you as a buyer or a seller?

Answer: Mortgage interest rates have already jumped significantly in the last month or two, leaving both sellers and buyers to speculate what this could mean to them. Buyers are wondering if it’s even worth it to still try to buy a home when their buying power has diminished. Sellers are wondering whether they missed that sweet spot for listing, since many buyers may be getting discouraged, or not even qualify any longer, due to higher interest rates.

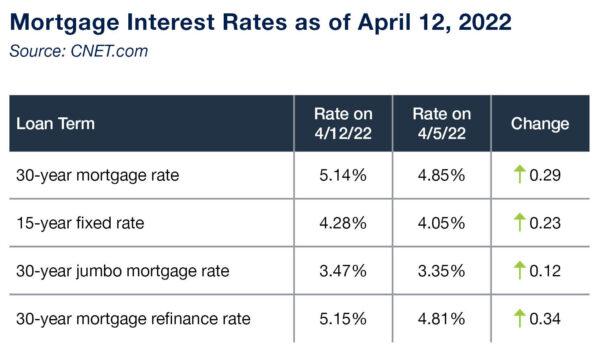

The rate on a 30-year mortgage changed by 0.29%, just in the last week, according to CNET.

By all accounts, it will continue to be a sellers’ market in Northern Virginia and beyond. While many buyers are giving up and renting for another year, there is still a huge demand for housing — and very short supply. If you are thinking about selling your home, rest assured, there will be buyers.

However, despite the strong demand, sellers benefit immensely by preparing their home properly as I discussed here last month. Even in a sellers’ market, fresh paint, the condition of floors, the degree of updating and all the regular visible maintenance will affect how many buyers want the property and the sales price. The key will be in deciding which improvements will do the most to increase your return on investment and assure a speedy sale. An experienced Realtor will help you make the right decisions so that you don’t waste money on updates that won’t make much difference in sales price or buyer appeal.

If you are trying to buy a home, don’t be discouraged! Buying a home is ALL about preparation, especially in a market like this. The best way to be fully prepared is to have an “ace team” to guide you through the process. Every team needs a leader, and that should be an excellent Realtor. They will help you plan your strategy, and can introduce you to the best lenders, home inspectors, and vendors. Your Realtor will be there with you from start to finish, helping to keep everyone focused on achieving your goals.

The most important thing will be figuring out what you can afford. There are strategies that work in this market to lower your interest rate! Not everyone gets the same rate. Speak to a trusted lender about ways that you can boost your credit score and potentially get a lower rate, which will ultimately impact your buying power.

Talk to your Realtor about your ability (and willingness) to waive contingencies — financing appraisal and home inspection. In this market, most buyers have had to waive some, or all, of these contingencies. Understanding how this works, and what you can do to protect yourself is a conversation that should happen early in the process, with both your Realtor and your lender.

First, and most importantly, don’t wait to get a full financing approval! Do it now, before you fall in love with a home. Submit all your paperwork and ask your lender to send it through underwriting quickly so that you can confidently waive a financing contingency, if you choose to do so.

Almost every real estate purchase that includes a loan will require an appraisal. It will be your choice on whether you decide to make the appraisal value a contingency of the contract. If the appraised value comes in lower than the sales price, and you do not have it as a contingency, you will need to have the extra cash to cover the difference between what the mortgage company will loan for the property.

For instance, if you were planning to borrow 90% of the appraised value, it may mean that you change this to a loan where you borrow 92% of the appraised value and bring a little more cash to settlement. These are potential scenarios that should be discussed in advance with your lender and Realtor, so that you can make an informed decision on whether to waive an appraisal contingency.

The minute you find a home that you want to make an offer on, figure out how to waive the home inspection, especially if you know there will be multiple offers. One option is to do an inspection prior to making the offer. This will cost you approximately $400-700, but it may be worth it to be able to waive the inspection contingency while also knowing what you are getting into.

Another option is to assess the risk. How old are the major systems, and how likely are they to fail soon? If it looks to be newer, or has a home warranty, maybe you can set aside a “worst case” fund to cover any potential issues after settlement. Discuss these options with your Realtor before submitting your offer, to determine which is the best option for you to feel comfortable while still being competitive in a sellers’ market.

In Virginia, homes are selling nearly twice as fast as they were in January 2000. It will continue to be a sellers’ market for the foreseeable future, as the supply of homes remains extremely low.

Sellers, don’t hesitate to sell your home! Just be sure that you have a new home to go to. We are pros at helping sellers make that transition and have great strategies for allowing you to stay in your home after settlement while you find a new home.

And Buyers, you can do it! Prepare, prepare, prepare. Talk through the possible loan scenarios in advance. Learn how to waive contingencies without taking on too much risk. We can help!

Hope Peele is a licensed real estate agent with McEnearney Associates, Inc. in Alexandria, Virginia. She grew up in Old Town and currently lives in Del Ray. As a partner with The Peele Group, Hope is dedicated to guiding her clients successfully through the many faceted process of buying or selling a home. Contact Hope at 703-244-6115.

If you would like a question answered in our weekly column or to set up an appointment with one of our Associates, please email: [email protected] or call 703-549-9292.

McEnearney Associates Realtors®, 109 S. Pitt Street, Alexandria, VA 22314. www.McEnearney.com Equal Housing Opportunity. #WeAreAlexandria

Recent Stories

For Immediate Release

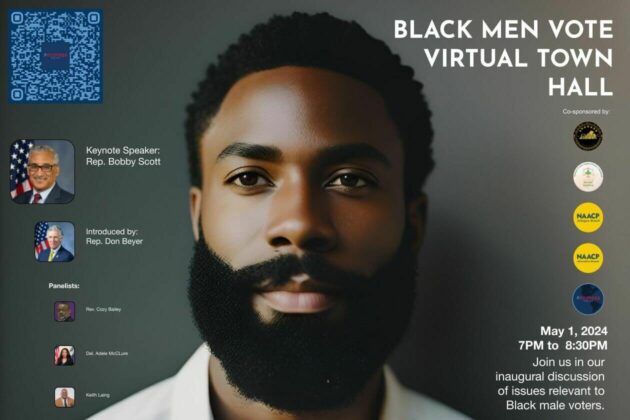

Progress for All Announces Inaugural Black Men Vote Virtual Town Hall

Date: April 19, 2024

Il Porto Ristorante is thrilled to announce that a new executive chef has joined our team! Hailing from Sicily, Italy, Chef Giuseppe’s culinary journey began at home, where he was immersed in the rich aromas and flavors of homemade Italian cuisine from a young age. His culinary skills flourished further in Piedmont, Italy, where he had the privilege of learning from esteemed chefs renowned worldwide. Under their mentorship, he refined his craft and developed a unique culinary style that marries classic Italian traditions with contemporary flair. Now, Chef Giuseppe proudly brings his exceptional talents to Il Porto, infusing each dish with his distinct blend of tradition and innovation. Chef Giuseppe is introducing brand new dinner specials and entrees, so make a reservation to enjoy his culinary excellence, today!

Pro Coro Alexandria – To the Sea

Join Pro Coro Alexandria, the chamber choir of the Alexandria Choral Society, this Saturday for our concert, “To the Sea.” Experience a variety of songs from beloved choral classics like “Shenandoah” and “What Shall We Do With A Drunken Sailor?”

Del Ray Kitchen Confidential Design Tour

Please join us for Del Ray Kitchen Confidential – a walking tour of recently renovated kitchens in Del Ray with the experts who make the magic happen! FA Design Build owner Rob Menefee and Design Consultant Melissa Fielding walk us