This week’s Q&A column is sponsored and written by Kim Peele and Hope Peele of The Peele Group and McEnearney Associates Realtors®, the leading real estate firm in Alexandria. To learn more about this article and relevant Alexandria market news, contact The Peele Group at 703-244-5852 or email [email protected]. You may also submit your questions to McEnearney Associates via email for response in future columns.

This week’s Q&A column is sponsored and written by Kim Peele and Hope Peele of The Peele Group and McEnearney Associates Realtors®, the leading real estate firm in Alexandria. To learn more about this article and relevant Alexandria market news, contact The Peele Group at 703-244-5852 or email [email protected]. You may also submit your questions to McEnearney Associates via email for response in future columns.

Question: What exactly does a backup offer mean, and do they even work?

Answer: So glad you asked! There was a time when backup offers were rarely used or even talked about. Once a home is under contract, it did not seem likely it would come back on the market, so it was seen as a waste of time to put in a backup offer. However, in the past year, we have seen a resurgence in the use of backup offers, and sometimes they are actually successful! We recently had a buyer win the home of their dreams with a backup offer after losing the home in a bidding war less than a week prior.

This past year has been a tough market for buyers due to low inventory, and a huge number of buyers searching through a very limited supply of housing. It’s just been super competitive to get a home! In some areas of Northern Virginia and D.C., you can count on multiple offers, sometimes 10 or more. It can be stressful to look at homes, find one that you love and lose out. Due to this bidding frenzy, we’ve been seeing that sometimes buyers will move fast, make a quick decision to bid on a home, win with a high offer, and immediately have buyer’s remorse and cancel the contract.

Buyers in HOA or condo communities have three days to review the community association documents and decide whether to stay in the deal. They can cancel with no penalty and no explanation within that three-day period. Some buyers consider this a safety net if they have some hesitation about whether they really want the home. They offer big, win out over everyone else, and then try to decide if they really want it or not. This is not a strategy that we recommend — nor is it fair to sellers or all the other buyers — but we are seeing it happen more often lately.

Side note: A good listing agent will have those documents available prior to going on the market and deliver them immediately so that the three-day period happens fast, and all parties can move forward quickly.

Some other reasons that the first buyer may cancel are home inspection or financing contingencies. Including a home inspection allows them to cancel with little reason, even if the home inspection did not uncover anything major. And another reason that contracts fall apart is that the buyer does not get their financing, maybe due to a job loss or something on their record that gets in the way of finalizing a loan. So between loopholes for buyers with a change of heart and other hiccups, homes do go back on market. That’s where a backup offer can be a wonderful thing.

How does a backup offer work?

A backup offer is a promise to the seller that you will buy the home if the primary contract falls through. An addendum simply gets added to your offer, and all parties agree that if the first contract gets canceled, your offer will then become the primary contract and you will settle within a specific timeframe. You can even state that the earnest money deposit is not due until the backup offer becomes the primary contract.

Backup offers also give sellers the comfort of knowing that they will not have to put their home back on the market if the offer in hand falls through. Sellers also like backup offers because it can give them leverage with the first contract if they are giving them pushback on anything, so it does not always help your position, but sometimes it does.

Our very happy buyers recently ratified a contract through a backup offer. We presented a beautiful offer to the seller the first day it was on the market. However, our contract eventually became one of five, and we were disappointed to learn that our offer was the seller’s second choice. Our contract had almost no contingencies. The other offer had zero contingencies, just the HOA document three-day period. The seller’s agent asked if we would like to resubmit our offer as the backup offer.

Our buyers took a day to soak in their disappointment and to decide whether they did want to go back with a backup offer. There were conflicting feelings. If their offer was not good enough in the first place, why would the sellers accept it in future? Why bother getting their hopes up a second time, when it was highly unlikely that the current contract would fall through? Maybe it was just not meant to be, they thought. These were all feelings that they had to process, but the next day, they came back to us and said that they’d like to submit the backup.

They had questions, though. Could they still look at homes? The answer to that is, definitely yes! What if they made an offer on another home and got it? We can withdraw our offer immediately, if we find another home. A backup offer is a legally binding contract, so the key is for your Realtor to stay in close contact with the seller’s agent, letting them know that we are submitting an offer on another home but still want their home if it does not work out. The minute you are ratified on another home, we just withdraw the backup offer.

So yes! Backup offers are a longshot, but they have been working slightly more often lately. The advantage is that puts you in a second position to get the house if the first contract falls through, and it locks in the price that you offered. You can continue shopping, and you may even end up with the beautiful home that you wanted and thought you lost. That’s what happened to our buyers!

We are happy to help you in your home hunting process! For a confidential meeting, reach out to Hope and Kim Peele at 703-244-5852.

Kim Peele is a licensed real estate agent with McEnearney Associates, Inc., lives in Old Town and works in Virginia, D.C. and Maryland. She and her daughter Hope Peele are The Peele Group. Kim is a second-generation Realtor and fourth-generation Washingtonian and is dedicated to helping owners through the challenges of selling their home.

If you would like a question answered in our weekly column or to set up an appointment with one of our Associates, please email: [email protected] or call 703-549-9292.

McEnearney Associates Realtors®, 109 S. Pitt Street, Alexandria, VA 22314. www.McEnearney.com Equal Housing Opportunity. #WeAreAlexandria

Recent Stories

For Immediate Release

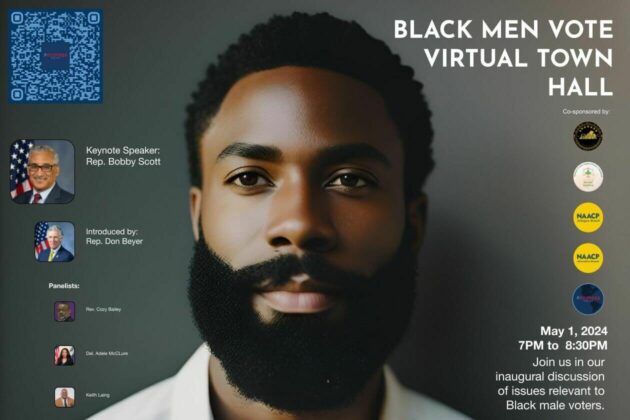

Progress for All Announces Inaugural Black Men Vote Virtual Town Hall

Date: April 19, 2024

Il Porto Ristorante is thrilled to announce that a new executive chef has joined our team! Hailing from Sicily, Italy, Chef Giuseppe’s culinary journey began at home, where he was immersed in the rich aromas and flavors of homemade Italian cuisine from a young age. His culinary skills flourished further in Piedmont, Italy, where he had the privilege of learning from esteemed chefs renowned worldwide. Under their mentorship, he refined his craft and developed a unique culinary style that marries classic Italian traditions with contemporary flair. Now, Chef Giuseppe proudly brings his exceptional talents to Il Porto, infusing each dish with his distinct blend of tradition and innovation. Chef Giuseppe is introducing brand new dinner specials and entrees, so make a reservation to enjoy his culinary excellence, today!

Pro Coro Alexandria – To the Sea

Join Pro Coro Alexandria, the chamber choir of the Alexandria Choral Society, this Saturday for our concert, “To the Sea.” Experience a variety of songs from beloved choral classics like “Shenandoah” and “What Shall We Do With A Drunken Sailor?”

Del Ray Kitchen Confidential Design Tour

Please join us for Del Ray Kitchen Confidential – a walking tour of recently renovated kitchens in Del Ray with the experts who make the magic happen! FA Design Build owner Rob Menefee and Design Consultant Melissa Fielding walk us