(Updated 4:15 p.m.) Alexandria experienced a 12.4%, or $440 million, drop in office property values this year, according to the city’s Office of Real Estate Assessments, and it could mean a reduction in city services.

Alexandria’s real estate tax base grew by just .33% this year, about $200 million, for a total of $48.49 billion, which is the smallest growth in 15 years, Mayor Justin Wilson tweeted. The city’s commercial property tax rate fell 4%, or $736.9 million.

The value of the city’s office properties fell 12.38%, from $3.58 billion in 2023 to $3.14 billion in 2024, according to a city report that City Council will receive in a legislative meeting on Tuesday night (Feb. 13). It’s the second year in a row that office properties dipped in value, dropping 10% last year.

The assessments also mean that the value of Alexandria’s total residential tax base has once again outpaced its commercial tax base, with the city’s residential tax base this year increasing by 3%, or $871.3 million. The average value of a single-family home value increased by 2.33% to $962,276, and the average value of a condo in the city is $423,765, an increase of roughly 4% over last year.

“Over 90% of that growth is from new development and the rest from appreciation,” Wilson wrote.

Wilson tweeted that the decrease was in spite of $237 million in commercial growth, along with $161 million in residential multi-family development.

City Council member John Taylor Chapman says that the reduction in revenue will mean a lean fiscal year 2025 budget for City Manager Jim Parajon. His draft budget will be presented to the City Council on Tuesday, Feb. 27.

“It means for this year’s budget that we’re gonna have to look at cuts around city services,” Chapman said. “We need to continue to press on how we deal with losses in the commercial, particularly the office building, sector. We’ve converted a number of old office buildings to residential, and I think that’s something that’s going to continue.”

A city report cited that the lingering effects of the coronavirus pandemic have made commercial real property a “considerable downside risk” for the city.

According to the report:

Commercial real estate is viewed as a more predictable investment asset, unlike stocks, bonds, and other paper assets which tend to be more volatile and react swiftly to economic sentiment. While commercial real estate performance is also sensitive to economic shifts, changes typically happen slowly. Since the pandemic, however, the commercial real property has demonstrated considerable downside risk. This is particularly evident in the office market where high vacancy, inflated tenant fit-up costs, and significant increases in capitalization rates have been detrimental to values.

Due to increased interest rates and continuing uncertainty in the market, there were few arm’s-length commercial sales transactions in 2023. However, those that did occur were adequate to judge market sentiment. Three large rental apartment projects, four office buildings, and approximately sixteen general commercial properties transferred in 2023. The transactions in all property classes were a mixture of performing assets, value-add, and buildings that involve a conversion in land use.

Parajon faced a $17 million budget shortfall when he started crafting last year’s budget, but it was wiped away by unexpectedly high real estate assessments and $4.6 million in citywide efficiency reductions.

This year, the city said that there were four sales of office buildings in 2023, and that many buildings are being repurposed into multi-family rental buildings or residential condominiums.

The following offices were converted to other uses in 2023:

- 801 N. Fairfax Street, converted into 54 condominium units

- 625 and 635 Slaters Lane, converted into 80 condominium units

- 4900 Seminary Road, converted into 212 multifamily rental units

The following office conversions have been proposed:

- 901 N Pitt Street

- Transpotomac Plaza, 1033 N. Fairfax Street

- 1101 King Street

More 2024 Alexandria Assessment Data:

Increases varied around the City

The average single-family home increased 2.33% to $962,276

The average condo home increased 3.96% to $423,765 pic.twitter.com/eVqnDzpQvo

— Justin Wilson (@justindotnet) February 7, 2024

More 2024 Alexandria Assessment Data:

The commercial tax base decreased by $736M.

This net decrease was in spite of $237M of new commercial growth, of which $161M was residential multi-family development (rental housing). pic.twitter.com/vTSRngRt0Q

— Justin Wilson (@justindotnet) February 7, 2024

The Alexandria Chamber of Commerce has selected Don Simpson, Jr. as its business leader of the year.

Simpson, the president of Simpson Development Company and vice president of Simpson Properties, Ltd., was recognized for giving back to the community. He’s a fourth generation Alexandria and has worked with his family firm for more than 40 years.

Simpson now serves as chair of the INOVA Alexandria Hospital Foundation Board.

Simpson is an active member of the Alexandria Rotary Club, the city’s Youth Sports Commission and the Youth IMPACT Foundation. He was named a Living Legend of Alexandria in 2020. He previously served on the boards for the Alexandria YMCA, the Miracle League of Alexandria and the Center for Alexandria’s children, among others, and his company has raised funds for dozens of local nonprofits.

Married with two children, Simpson graduated from T.C. Williams High School in 1978, and later Virginia Tech with a degree in building construction and engineering. His family also helped create the Scholarship Fund of Alexandria.

Simpson will be honored at the chamber’s annual Best in Business Awards on Oct. 12.

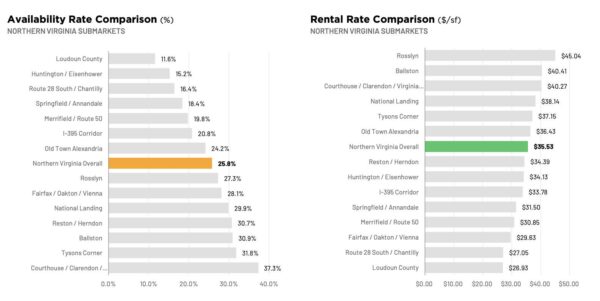

When it comes to office vacancy, Alexandria may be faring better than its neighbor to the north and west.

Its vacancy rates are lower than the average for the region and its rents are cheaper than every submarket in Arlington County, according to a new report from real estate company Savills.

Savills Executive Managing Director Wendy Feldman Block said Alexandria has an edge for two reasons: cheaper rent with proximity to top destinations and walkable commercial centers.

“Alexandria really is a great place to be,” she tells ALXnow. “The retail and restaurants are outperforming other areas because it walkable and has the ability to have one street to capture a lot of customer traffic [such as on] King Street.”

Alexandria Economic Development Partnership Vice President of Real Estate Christina Mindrup agrees, saying the city is benefiting from a trend dubbed the “flight-to-quality,” where companies are looking for new offices that offer more amenities for employees.

“We think the flight-to-quality also capitalizes on Alexandria’s strengths,” she tells ALXnow. “We already have vibrant, mixed-used neighborhoods that have seen growth throughout the pandemic.”

Meanwhile, Block said, it offers tenants proximity to top locations such as National Airport and D.C. while offering lower rent than National Landing, which is also close by. In National Landing, the rents are $38.14 per square foot, versus $36.43 per square foot in Old Town, $33.78 per square foot along the I-395 corridor and $34.14 in Huntington and Eisenhower.

Right now, Alexandria has some of the lowest amount of available sublease space in the region: less than 300,000 square feet compared to 5.8 million square feet across Northern Virginia, Block says. The city recently landed the largest lease in the D.C. area, the restructuring of United States Patent & Trademark Office to 1.6 million square feet.

“Even though the Patent Office is downsizing, new leases like Five Guys are choosing that neighborhood because it has trophy buildings with high visibility close to transit and adjacent to Old Town on one side and the booming Eisenhower corridor on the other,” Mindrup says.

In addition, Old Town has seen a marked decrease in available office space, from 28% in 2022 to 24.2% currently, Block said.

Mindrup also chalks up the city’s strong office leasing to the fact that its office buildings — especially its older, shorter or less desirable offices — tend to be smaller

“So while we do have less office inventory than our neighbors, we also have buildings that are better positioned with smaller floorplates to be converted into housing, schools, or other uses,” Mindrup said.

She noted the city also stays competitive by offering bonus density in exchange for affordable housing, allowing office-apartment conversions, keeping commercial uses broadly defined so offices, stores, hotels and other businesses can move in and focusing development on the West End and the Potomac River Generating Station site.

This could offset any lease changes the government makes because many of its workers are still mostly remote.

“We’re keeping an eye on the market and the region as government leases start to come up for renewal,” Mindrup said.

Bonaventure is pulling the plug on another of its properties in Del Ray. The Arlington-based real estate developer recently put its properties at 2903 Mount Vernon Avenue and 104 Hume Avenue for sale for a total of $3.3 million, according to a listing.

Bonaventure bought the two properties for $2.6 million in 2017. The two lots were proposed to be converted into an office building, but plans never materialized. The former Anthony’s Auto Center at 2901 Mount Vernon Avenue is 10,400 square feet, and was used as a spin studio, but closed down during the pandemic. It was assessed at $1.4 million in January 2022, and Bonaventure bought it for $1.6 million in 2017.

The 104 Hume Avenue property is 5,250 square feet and was assessed for $1.2 million in January 2022, according to city land use records. Bonaventure bought it for $1 million in 2017.

In its listing, Bonaventure says the property could be converted into a preschool or private school campus, a beer garden, a restaurant or retail.

The news comes after Bonaventure announced it was backing out of its plan to convert the old Alexandria Department of Community and Human Services building at 2525 Mount Vernon Avenue into a four-story, mixed-use development. In addition to 2525 Mount Vernon Avenue, the company also bought the properties at 2401, 2403 and 2411-2419 Mount Vernon Avenue, and owns a 144-space parking lot across from Pat Miller Square on Mount Vernon and E. Oxford Avenues.

A Bonaventure representative could not be reached for comment.

Photo via Google Maps

After years of stalls and starts with various redevelopment plans, another developer has scrapped its vision for the Del Ray North Shopping Center.

Last month, Alexandria Planning and Zoming staff got an email from MRP Realty‘s attorney indicating that that the company would not move forward with its plan to redevelop the shopping center.

“The email cited ‘worsening economic conditions’ making the project infeasible for MRP at this time,” Alexandrias Planning Director Karl Moritz told ALXnow.

MRP Realty, which did not return calls for comment, is one of several developers to abandon the shopping center in recent years. Their Mount Vernon Village project was envisioned as a mixed-use development with 593 apartments above 23,000 square feet of retail.

Actively leasing

Finmarc Management, Inc. is now actively leasing the property, which has more than 23,000 square feet of empty retail space, including a former CVS store that did not renew its lease due to redevelopment plans nearly a decade ago.

The property manager told ALXnow that the company has no plans for redevelopment and that the property is actively being marketed for leasing.

When the CVS and its pharmacy left the shopping center, it left a community need, said Alexandria City Councilman Canek Aguirre.

“I got my fingers crossed for this shopping center, because this community needs more positivity and more freshness,” Aguirre said. “When CVS went it left a big hole within the community for folks who could not just get pharmacy prescriptions, but also day-to-day items.”

Aguirre continued, “I guess at this point I’m somewhat encouraged that some of these empty retail storefronts will be filled, and hopefully soon.”

Anchored by a MOM’s Organic Market (3831 Mount Vernon Avenue), the shopping center is also home to a Subway, a Topper’s Pizza, the La Bona Nail Bar & Spa salon and a Virginia ABC store.

There are also several vacant storefronts, including:

- 3809 Mount Vernon Avenue — The former McCormick Paints, 3,900 square feet

- 3811 Mount Vernon Avenue — The former CVS, 11,342 square feet

- 3813 Mount Vernon Avenue — 3,035 square feet

- 3819 Mount Vernon Avenue — The former Neighborhood Health vaccination clinic, 3,359 square feet

- 3823 Mount Vernon Avenue — The former Soigne Salon, 1,807 square feet

The shopping center is also near the Alexandria Housing Development Corporation‘s (AHDC) Mount Vernon and Glebe project, which promises to bring hundreds of affordable housing units in two new apartment buildings by late 2025 or early 2026.

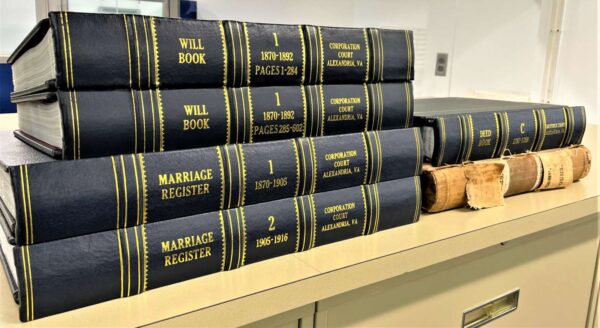

Alexandria’s land records date back to the 18th century, and the city’s Clerk of the Circuit Court just secured more than $43,000 in grant funding to conserve those records and digitize them for public enjoyment.

This is the second year that the clerk’s office has been awarded the grant, which is made possible through the Circuit Court Records Preservation program from the Virginia Court Clerks Association and the Library of Virginia. Approximately $4.7 million was awarded to clerks offices throughout Virginia this year.

This year’s funding will pay for the restoration of eight volumes of the city’s oldest and most valuable records covering 1785 through 1798. Those records include deeds to real property, marriages and wills.

“Alexandria’s history is one of its most precious assets and I am committed to securing resources to preserve, protect and make widely available these windows into our past,” Alexandria Clerk Greg Parks said.

Last year, the city was awarded about $15,400 toward the effort, which went toward the restoration and digitization of four historic volumes.

(Updated at 1:45 p.m. on Jan. 5) The new owner of 628 King Street is shopping the property around, and wants it to remain two retail spaces.

Douglas Development now owns three of the four buildings at the intersection of King and Washington Streets. The D.C.-based commercial real estate firm owns the adjacent properties at 700 (Lululemon) and 701 King Street (the now-closed Le Pain Quotidien), as well as 610 King Street (Anthropologie), 614 King Street (H&M) and 615 King Street (the former Walgreens) and 700 King Street.

Douglas Development bought the property on Dec. 10, and representatives of the firm say there has been some interest from prospective tenants, although nothing definite. The building was previously owned by the family of Wellington Goddin, and was appraised for $6.2 million last January.

GAP Inc. has leased the three-level, 20,000 square-foot building at 628 King Street since 1986, where it has long been home to a Banana Republic and Gap Outlet store, which will permanently close on Jan. 24. Staff at both stores said Gap Outlet was underperforming at the space, with most business coming in on weekends.

Commercial real estate firm KLNB’s represented Douglas Development in the purchase of the building, and is managing its next steps.

The owners plan on splitting the property into two units, keeping the uses as retail and renting them out as soon as possible.

The firm says their 652 retail transactions this year is a 39% increase over 2020 and 15% over 2019, but that property values have stayed relatively flat over the last two years.

“Brick and mortar retail also remains extremely relevant regardless of what folks may say about it being dead, as evidenced by KLNB’s transaction volume,” KLNB President and Chief Operating Officer Marc Menick told ALXnow. “All this being said, transactions are well up over 2019 levels, but value is basically flat. More deals, less value.”

The property, which has 158 square feet of frontage on King and S. Washington Streets, was originally developed as a 600-seat theatre in 1854, was converted to a Union hospital during the Civil War, changed hands through the decades and even burned down.

City staff said at a meeting earlier this week that, for the local real estate market, it is both the best of times and the worst of times.

While Alexandria’s taxable property value continued to increase dramatically, on the ground property owners face very different realities in the city based on whether that property is residential or commercial.

“This year is very different; it’s a tale of two markets, a very mixed experience,” said Kendel Taylor, the director of finance for the City of Alexandria. “In the past couple years, no matter what you owned, you were going up around the same rate. This year if you owned a home vs a hotel, your experience is vastly different in this year’s assessment report.”

City reports noted that the residential tax base increased by 6% overall, which a press release said reflected a strong residential market in Alexandria combined with low mortgage interest rates.

“This is the largest increase in the residential category since 2006,” the city said. “The average assessment for all residential property types, including single-family homes, townhomes and condominiums increased by 5.7%, to $615,858. The average single-family home value increased by 5%, to $839,961. The average condominium value increased by 7.7%, to $375,070. The increase in the total tax base for condominiums is only 3.98% due to the addition of luxury condos near the waterfront to the 2020 tax base during the year.”

But on the commercial side, the city’s markets have been devastated by closures from COVID-19, particularly in the hospitality and retail sectors.

“The value of commercial properties decreased $342.5 million as of January 1, 2021, compared to January 1, 2020,” the city said. “The commercial tax base decreased 1.96%, compared to an increase of 2.8% in 2020. A significant decline was offset by an increase of 3.53% in the multifamily rental sector, which included $110.1 million in new growth. COVID-19 pandemic conditions resulted in substantial decreases in the hospitality and retail market sectors, with declines of 29.64% and 10.72%, respectively. Commercial properties, including multifamily apartments, comprise 40.6% of the tax base.”

Taylor said that, despite this past year’s decline, it’s likely that commercial property values will rebound — though full long-term economic recovery could still be years away.

“We are an attractive place to live and still an attractive investment,” Taylor said. “We look at COVID and we hear stories about delinquencies in rent and things like that: investors look long term and COVID is temporary. You make real estate investments in multi-family properties thinking long-term.”

The property assessments will now be used in the city manager’s proposed budget presentation scheduled for Feb. 16, and ultimately for a rate adopted by City Council on May 5.

(Updated 2/11) One of the prominent office buildings in the Mark Center, 2001 N. Beauregard, has been sold for $71.7 million to a Mexican real estate investment firm..

The Mark Center is a West End office park that served as a hub for Department of Defense offices before 2005 Base Realignment and Closure forced many of those offices to relocate to more secure facilities.

The press release from real estate company Newmark, which represented seller G8 Capital, didn’t say who purchased the building, but records indicate the buyer is Mexican real estate investment company Grupo Haddad.

“Investors are attracted to Northern Virginia real estate due to the underlying strength of the market as the vaccine begins to roll out and a reoccupation is on the horizon,” said James Cassidy, one of Newmark’s executive managing directors in a press release. “Investor appetite for mid- to long-term leased assets has remained strong throughout the pandemic. With a single tenant and nearly eight years of remaining term on the full building, 2001 North Beauregard attracted significant attention.”

The office is 239,945 square feet over 12 floors and is currently leased to Systems Planning and Analysis, Inc.

Photo courtesy Newmark

Governor Declares State of Emergency — Virginia Gov. Ralph Northam said he is watching how other states are handling COVID-19 testing and that drive-thru testing may be an option. [NBC 4]

ALIVE! Might Shutter Programs, Needs Donations — “We continue to operate as normal, but anticipate that at some point we may advise volunteers to stay home and close programs. We are doing our best to ensure food supplies are adequate and are increasing deliveries to our regular drop off sites while we are able. Donations to support our food reserves are critically important at this time, as we are sending out everything to our regular clients to help them prepare while we are still able to do so.” [ALIVE!]

Fundrise Acquires Carlyle Site For Development — “Fundrise acquired the 14-acre site at 2000 Carlyle Ave. from a joint venture of Perseus Realty and ELV Associates for $75 million… The online platform allows private investors to pool money into a series of funds that invest in residential and commercial properties.” [Bisnow]

Port City Brewing Co. Releases Statement on Coronavirus — “We understand that the recent outbreak of COVID-19 requires extra precautions in public spaces like ours… We strongly encourage friends across our community to use caution when deciding where to visit and what to attend during this pandemic.” [Port City]

Gas Station Offering “White Glove” Full Service — In response to the coronavirus, Yates Service, Inc. on Thursday announced the launch of complimentary white glove vehicle pickup and delivery service and complimentary full-service gas pump attendants at its gas station at Yates Automotive’s Sunoco station in Del Ray/Old Town. [Zebra]

Virginia Young Democrats Convention Postponed — “This is an unprecedented step taken in response to the increasingly concerning developments with COVID-19 here within the Commonwealth and the country. The convention planning committee did not make this decision lightly, but the safety of our members comes above all else.” [Facebook]