This week’s Q&A column, sponsored and written by McEnearney Associates Realtors®, the leading real estate firm in Alexandria, is a bit of a departure from our usual format. To learn more about this article and relevant Alexandria market news, contact us at 703-549-9292. You may also submit your questions to McEnearney Associates via email for response in future columns.

Question: What smart tech are buyers looking for in their next home?

Answer: The 2024 spring housing market has already taken off, with declining interest rates bringing many homebuyers off the sidelines and into the purchasing game. Sellers are preparing their homes for eager buyers and are learning what features will attract the most offers at the highest price. And while fresh paint and gleaming floors will always be pleasing to see in a home, there’s one thing that savvy buyers are asking for more than anything else: convenient, integrated, and affordable Smart Tech throughout the home.

We polled our McEnearney colleagues to find out what the easiest and most popular features are that are mentioned by their clients to make life easier, energy efficient, and, in some cases, fun!

Tom Hallex, a key member of McEnearney’s Digital Resources team, has incorporated many of the most common and inexpensive gadgets in his own home, including a Nest doorbell and door lock which allows for remote access to view visitors to your property and access into your home; a myQ garage-door opener that allows for individualized PIN code access and visual access to confirm activity around the garage entry; smart-outlets like Enbrighten that work with a home’s wi-fi for remote on/off control and customizable adjustments with voice or app commands; and even a wi-fi linked microwave for under $200!

Realtor Sean McEnearney is also a fan of smart-USBs after working with a tech-savvy seller client. “I was selling a townhome for a client a few years ago and there was a lot of work that needed to be done before we put it on the market, especially in the kitchen and master bath,” Sean recounts. “He replaced a few outlets and had the electrician install outlets that included USB receptacles as well as the typical electric outlets. He had them installed in the master bedroom and bath as well. It was a small thing, but a thoughtful add-on that impressed me.”

Rookie Realtor Rachel O has been learning what’s on the Tech Must-Have list for buyers, including her own husband who wanted at minimum a smart thermostat and the aforementioned USB plugs incorporated into the outlets. But it’s understanding what younger buyers, who have grown up with accessibility at their fingertips, want in a home that keeps her alert to tech trends and what makes for a quick sale.

“I’ve seen a lot of new construction homes that have (common tech gadgets) included and my newlywed first-time homebuyers in their early 30s do seem to have an expectation and preference for these inclusions. I believe if an older home had them, they would likely be more inclined to purchase,” O shared. “The best thing I’ve seen thus far is a smart oven that allows you to preheat your oven from your cell phone so that you can start it on your way home from work and then immediately pop in your food to be cooked.”

Moving up the chain to affordable luxury, Top Producer Realtor Susan Tull O’Reilly cited a recent sale that had a built-in wine cooler with select zones for different types of wines, even in a small space: colder on the bottom and less chilled on top. A quick search shows that there are intricate builds for the expert sommelier but even vino neophytes can find tech-enabled options that offer climate-centric options in a small package, ranging from the $200 range to up and above $4,000.

In a sign of must-haves to come, Realtor Christine Robinson is seeing more and more homeowners investing in tech like electric vehicle (EV) chargers — popular in both sales and rentals – that range in price from $300-700. Search recent home listing descriptions and you’re likely to see this feature spotlighted as a selling point and some sellers are willing to add them for on-the-fence buyers. She’s seen clients who both want and loathe solar panels but the trend toward sustainable construction means solar technology will continue to be a factor in home improvements.

One of the tech features mentioned most often by our agents were home generators, both portable generators that sell for an affordable $300 and up, and standby generators which are professionally installed and cost between $5,000-$7,000. Later this month we’ll look at tech features in high-end homes that are most popular with luxury buyers. Be ready to be dazzled! In the meantime, if you would like a tech-savvy agent to assist you with insight into what appeals to buyers and sellers in this busy market, reach out to a McEnearney Associate to get the right home ecosystem for your needs.

If you would like a question answered in our weekly column or to set up an appointment with one of our Associates, please email: [email protected] or call 703-549-9292.

McEnearney Associates Realtors®, 109 S. Pitt Street, Alexandria, VA 22314. www.McEnearney.com Equal Housing Opportunity. #WeAreAlexandria

This week’s Q&A column is written by Rebecca McCullough of McEnearney Associates Realtors®, the leading real estate firm in Alexandria. To learn more about this article and relevant Alexandria market news, contact Rebecca at 571-384-0941 or email [email protected]. You may also submit your questions to McEnearney Associates via email for response in future columns.

This week’s Q&A column is written by Rebecca McCullough of McEnearney Associates Realtors®, the leading real estate firm in Alexandria. To learn more about this article and relevant Alexandria market news, contact Rebecca at 571-384-0941 or email [email protected]. You may also submit your questions to McEnearney Associates via email for response in future columns.

Question: What should I know about real estate appraisals?

Answer: An appraisal is an unbiased professional opinion of the value of a home. An appraisal is needed when a mortgage is involved in the buying, refinancing, or selling of a property. Other reasons you may get an appraisal is to determine value in the case of estate settlement, divorce, or insurance purposes.

It is important to understand the meaning of unbiased which is without prejudice and favoritism. In this case the appraiser has no financial interest personally in the property or transaction. It does not say that the unbiased professional opinion will not be subjective.

What is the process of an appraisal?

For the purposes of the article, we are going to assume the appraisal is being ordered as the result of a ratified contract where the buyer needs to obtain a mortgage to pay for the property

Upon ratification the contract is sent to the buyer’s lender. The lender then requests an appraisal through an independent Appraisal Management Company (AMC). Lenders and buyers cannot choose their own appraiser.

The contract will specify a timeframe to have the appraisal completed. The assigned appraiser will reach out to the listing agent for an appointment to see the property. The appointment usually takes less than one hour.

The appraiser will measure the square footage, take pictures, and attempt to determine the age of appliances, windows, roof, and other systems. They will want to know of any major improvements made in the home and when they were done. They will also take into consideration the surrounding area, schools, transportation infrastructure, and other amenities in the community.

After the physical review they will do the same market analysis that the real estate agent does to determine the market value of the home. They will look through the most recent sales to determine the homes which best compare to the subject house with respect to square footage, number of bedrooms and baths, lot size, age of home, finishes, and condition. Sometimes those are very difficult to find because the areas have been redeveloped over time. There may be brand new homes next to old or even historic homes.

The diversity of homes in our Alexandria communities can make finding good comps very difficult. When this happens, the appraiser often goes to neighborhoods further away. That could lead to the two homes being in different school districts which could impact the value of a home.

Once the appraiser has determined what they feel are the best comps they will make monetary adjustments to the various features of a home to bring the homes into alignment. For example, one has a screened porch the other does not. What value do you add or subtract for this feature? Now do that a few times with other features and it is subjective.

It’s not an exact science, but appraisals are necessary. Flash back to the 2008 housing crisis, when lenders were loaning people more money than the house was worth. We know we don’t want a repeat of that. It’s the appraiser’s job to protect the interests of the lender and the buyer.

Once the lender receives the completed appraisal one of three scenarios can happen:

- The appraisal value is higher than the sales price. Excellent, instant equity!

- The appraisal value equals the sales price. Again, excellent parties move forward.

- The appraisal value is lower than the sales price. Uh-oh.

Low appraisals are everyone’s worst scenario. Depending on the contract, and the type of financing the buyer is applying for, the next steps are different. Let’s lay them out.

Cash or conventional financing that is contingent on appraisal value:

- The buyer and the seller will negotiate. Easy option the seller agrees to lower the sales price to the appraisal. Transaction moves forward.

- The buyer and seller agree on a compromised price, the transaction moves forward. This may mean the buyer has to add money to his down payment to meet loan requirements to preserve rates and conditions. For example, if the amount now puts the buyer’s downpayment at less than 20% they will have to bring more money to closing to avoid paying mortgage insurance.

- The buyer and seller cannot agree to a price, and if the buyer is protected by an appraisal contingency, the buyer can void the contract and walk away with no penalty. If they put an earnest money deposit down, they will receive it back in full.

VA (Veterans) Loan

VA loans are guaranteed by U.S. Department of Veterans Affairs. Veterans can borrow up to 100% of the sales price with no limit. VA loan borrowers CANNOT waive the appraisal. Even if they do waive their right in the contract documents, it can’t be enforced. This is very complicated, yet simple too when submitting contracts. There’s a lot of misunderstanding regarding this issue in the industry.

With respect appraisals coming in over, at, and under the sale price, the scenarios are all the same as above. However, the veteran does not need a Finance Contingency Addendum to be protected. They are protected by statue.

Understanding this, you can appreciate that it can especially trying for veteran’s who want to take advantage of the great rates and terms VA Loans can provide and get a VA loan. However, because they cannot waive appraisal, or the right to void based on a low appraisal, sellers are sometimes hesitant to accept offers with VA loans. This is especially frustrating in multiple offer situations. But understanding each contract is critical, and not making blanket assumptions regarding the offer because it’s a VA loan is important.

Honestly, this is one of the key scenarios where a knowledgeable agent can make or break a deal for a seller and/or buyer. Understanding and navigating a successful contract with a VA Loan can be tricky.

We are expecting another seller’s market in the spring of 2024 with inventory still very limited. Buyers are tired of waiting on the sidelines and with the slight decrease in rates they are out looking for houses to buy. The contingencies and terms that a buyer includes in their offer are critical. Please make sure you are working with a knowledgeable agent if listing or buying a home this spring, and always!

Rebecca McCullough has built a successful real estate business in Alexandria and Northern Virginia by providing excellent service to her clients. If you would like more information on selling or buying in today’s complex market, contact Rebecca today at 571-384-0941 or visit her website RebeccaMcCullough.com.

If you would like a question answered in our weekly column or to set up an appointment with one of our Associates, please email: [email protected] or call 703-549-9292.

McEnearney Associates Realtors®, 109 S. Pitt Street, Alexandria, VA 22314. www.McEnearney.com Equal Housing Opportunity. #WeAreAlexandria

This week’s Q&A column is written by David Howell, Executive Vice President and Chief Information Officer, of McEnearney Associates Realtors®, the leading real estate firm in Alexandria. To learn more about this article and relevant market news, contact David at 703-855-5089 or email [email protected]. You may also submit your questions to McEnearney Associates via email for response in future columns.

This week’s Q&A column is written by David Howell, Executive Vice President and Chief Information Officer, of McEnearney Associates Realtors®, the leading real estate firm in Alexandria. To learn more about this article and relevant market news, contact David at 703-855-5089 or email [email protected]. You may also submit your questions to McEnearney Associates via email for response in future columns.

Question: How did the Alexandria real estate market for 2023 compare to 2022?

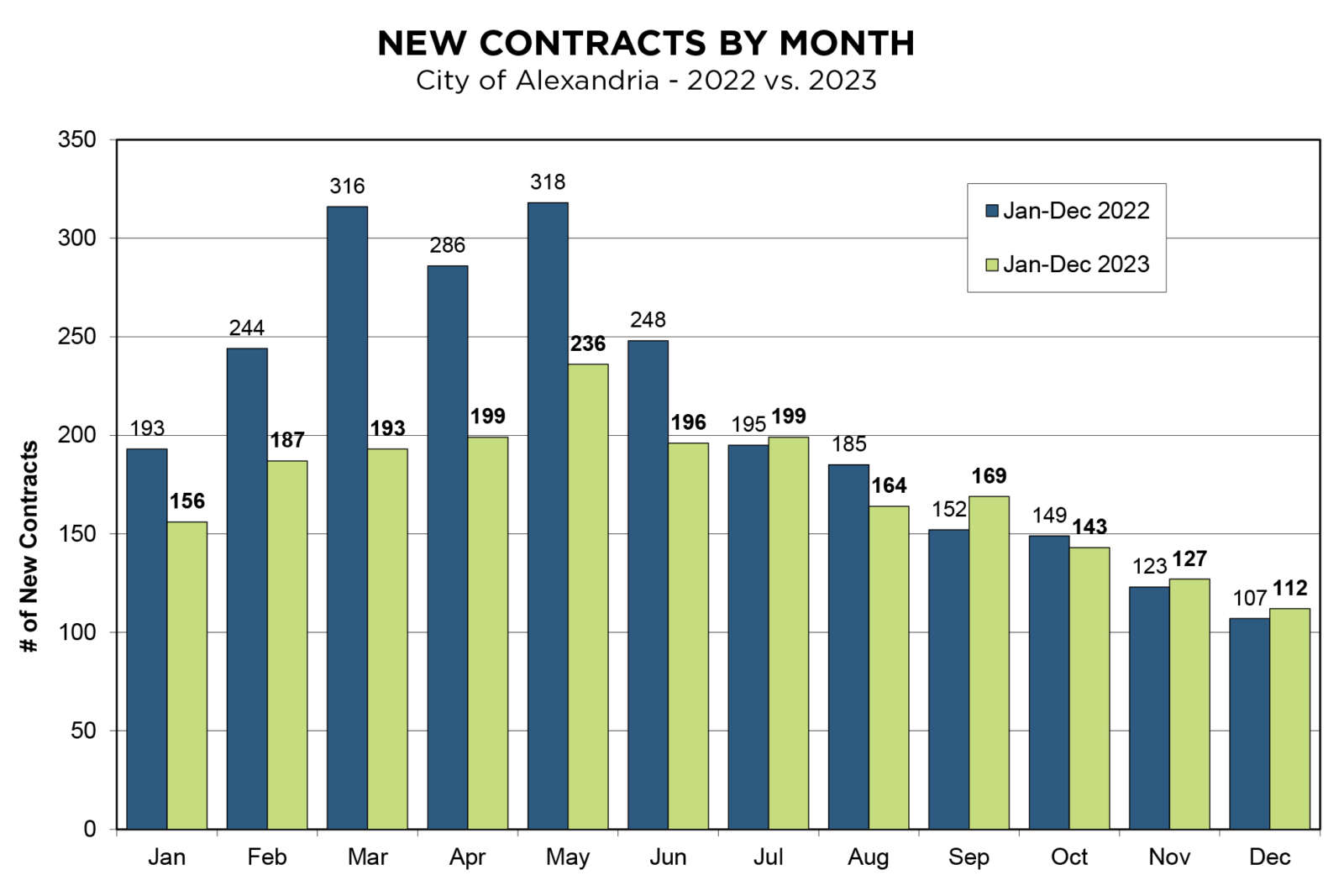

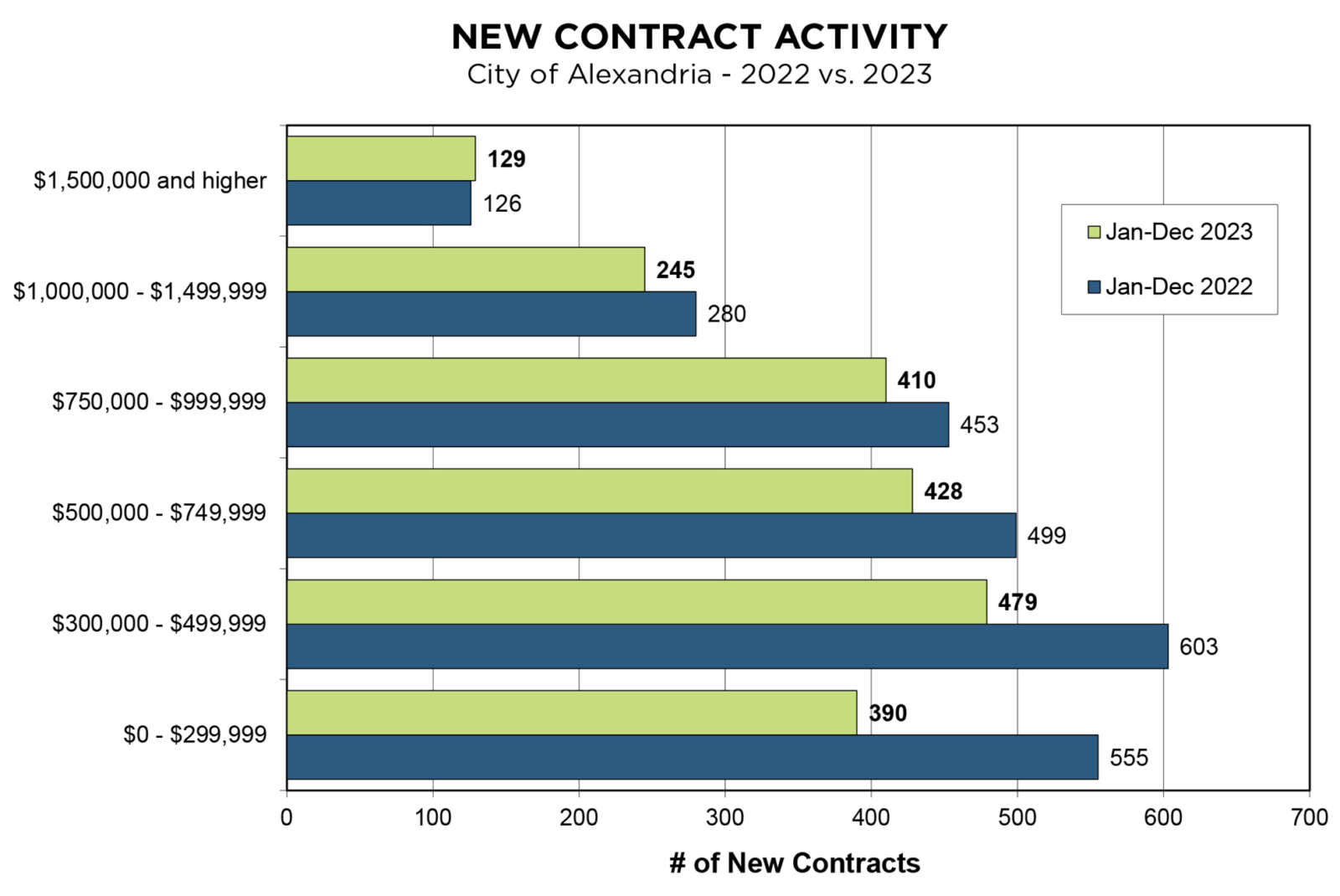

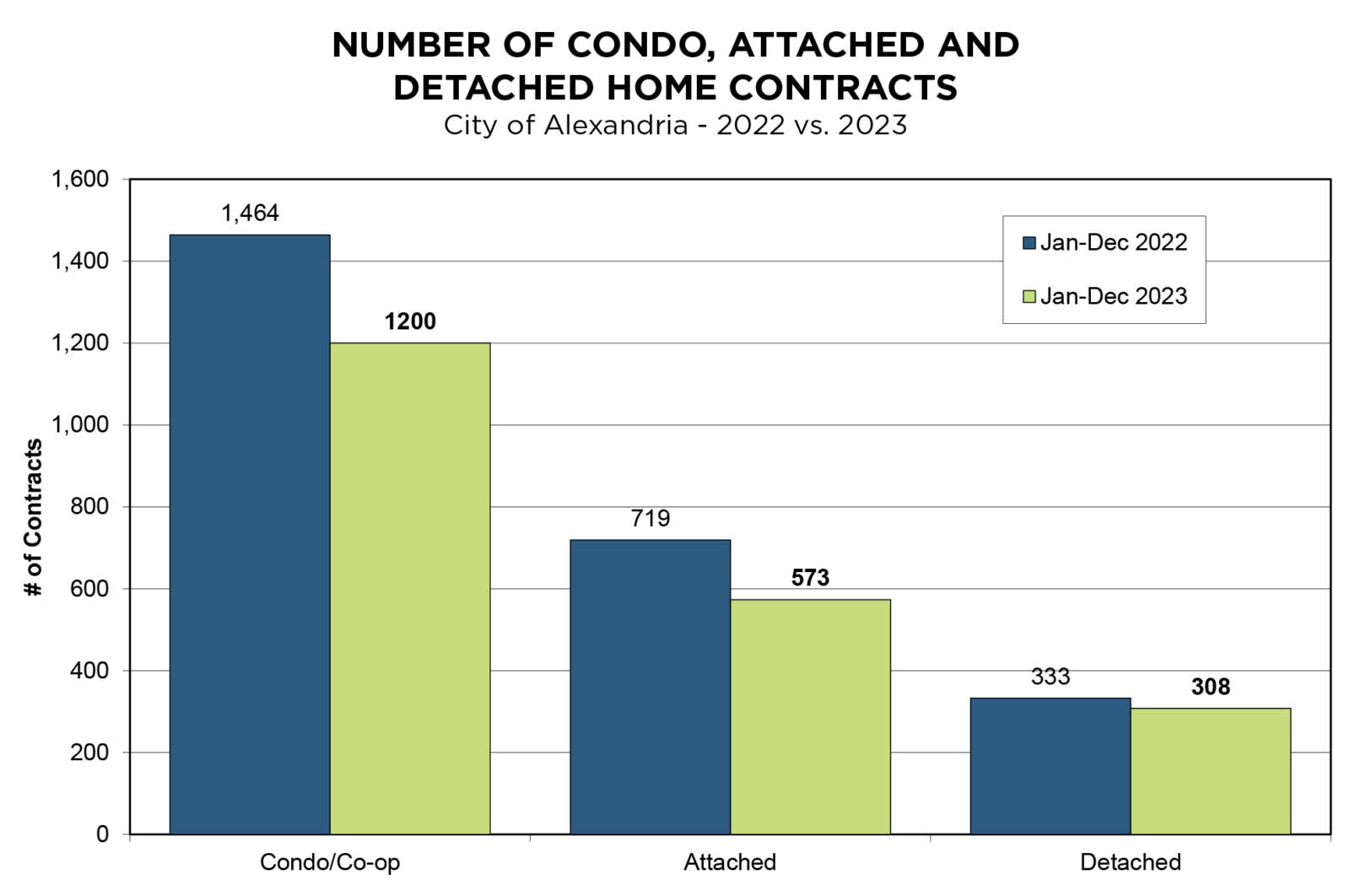

Answer: This week we look at contract activity for all of 2023 compared with 2022 for the City of Alexandria and South Alexandria (Fairfax County portions of Alexandria). The charts below show contract activity by month, price range, and by property type (condos, attached homes, and detached homes). We have often discussed the continuing pressures of low inventory on our local market. As interest rates are gradually coming down, there will be an increase in buyer activity. And the same will be true for sellers who will be more willing to give up their current low-rate mortgage. 2024 will see more activity than we had in 2023.

If you are interested in more information, every month on our website we profile the most important market indicators for Northern Virginia — contract activity, interest rates, inventory, affordability, and the direction of the market — in an easy to read and digest summary followed by supporting charts and data.

City Of Alexandria

New Contract Activity by Month

- The seasonal nature of the real estate market is evident as activity increases through the spring and decreases through the fall months in both 2022 and 2023.

- Activity in 2023 did not vary as much from spring to fall. And even improved in the last few months of the year compared to 2022.

New Contract Activity by Price Range

- Contract activity in the City of Alexandria decreased 17.3% for 2023 compared to 2022.

- Contract activity was slightly higher for the highest price category, but significantly lower for the lowest price categories.

This week’s Q&A column is sponsored and written by Hope Peele of The Peele Group and McEnearney Associates Realtors®, the leading real estate firm in Alexandria. To learn more about this article and relevant Alexandria market news, contact The Peele Group at 703-244-6115 or email [email protected]. You may also submit your questions to McEnearney Associates via email for response in future columns.

This week’s Q&A column is sponsored and written by Hope Peele of The Peele Group and McEnearney Associates Realtors®, the leading real estate firm in Alexandria. To learn more about this article and relevant Alexandria market news, contact The Peele Group at 703-244-6115 or email [email protected]. You may also submit your questions to McEnearney Associates via email for response in future columns.

Question: How long does it take to get a home on the market for sale?

Answer: There are many steps to selling a home. However, if you are somewhat prepared, an experienced Realtor can launch your listing as active in a matter of days. How prepared are you? I would suggest that you leave it to your expert Realtor to assess and advise on whether your home is truly show-ready. In addition to the condition of your home, there are also some important pre-marketing activities that should be done for the best and most lucrative outcome for you, as a seller, and it’s best not to speed through the process too quickly. In our business, we provide each seller with a customized timeline.

If you are interested in a personalized and realistic timeline for your own home, don’t hesitate to reach out for a no-obligation consultation and you are also invited to our first “Downsizing & Planning for the Future” event on January 20th at James Duncan Library. I’ll share more details below.

In this article, I’ll break down the key steps in getting ready for a sale, with an idea of how long each step may take.

- Preparation (2-8 Weeks):

Before listing your home, it’s super important to make sure that it’s ready for buyer viewings. An outside opinion is crucial, so that you don’t waste time and money painting less than ideal colors or doing things that aren’t necessary, Most importantly, you need to declutter, make necessary repairs, and enhance curb appeal. This stage depends on your current condition, and whether you do it yourself or use one of our trusted and often speedy contractors to accomplish the task list quickly. Homes in better shape may require even less than 2 weeks for preparation.

- Setting the Right Price (1-2 Weeks):

Getting the list price is a very important step, and involves your Realtor assessing the market, comparing recent sales within a close distance of your home, and considering your homes features and the ages of the systems, such as the roof, HVAC, windows and more. This process requires thorough research and consultation with real estate professionals. It’s also important to reassess the price, just before going active, in case there have been any new sales.

- Listing Your Home (1-2 Week):

Once your home is prepared and you have decided on the list price, launching your home as active can happen very quickly. Your Realtor will need to schedule a photo shoot for high-quality pictures, produce top-notch marketing materials, and write a compelling and informative description of your home. Your Realtor’s marketing plan should include a social media campaign, a great online presence and lots of exposure for your listing.

- Showings and Open Houses (Varies, ideally 7-14 days):

This stage begins the minute your home becomes active and will last as long as it takes for your home to get an acceptable offer. If your home price is right and the photos show well, you will likely start getting requests for showings within a day or two. Usually, your Realtor will hold an open house the first weekend, and then again fairly regularly throughout the listing period until you are under contract. Hosting open houses and making it easy for buyers to schedule visits are essential for showcasing your property.

- Receiving and Negotiating Offers (Varies, ideally quickly!):

The time frame for this stage will vary depending on how many other homes are currently on the market, whether your home is priced to attract buyers (too high is a deterrent) and whether the offers received will work for you, as the seller. This is where you ideally have more than one offer and can weigh out the best options for you — price, how quickly they can close, whether they will allow you to stay for a period of time after closing (if needed), and what types of contingencies the buyer wants to include in the contract. It’s essential to work closely with your Realtor to structure the best deal for you.

- Under Contract period and closing (3-6 Weeks typically):

After accepting an offer, the home goes under contract. During this period, various tasks, including inspections, appraisals, and paperwork will take place. The timeline for these processes can be done quickly, or can take longer, depending on the contract agreement and the complexity of the sale. Unless you have an agreement to occupy the property for a period of time after settlement, you will have to be completely moved out, usually by the day before closing. The actual closing usually takes place at the settlement company, where the seller and the buyer sign all the documents (often separately) and the settlement company processes the final sale and records it with the local courthouse.

As you can see, selling a home is a multi-step process with varying timelines at each stage, and some of these steps can happen concurrently. It can be accomplished in just a few weeks or could take several months. It’s important to stay organized and to work with an experienced real estate professional for the best results and easiest process.

Ready to start your own timeline! Join us on January 20 at our Downsizing & Planning For The Future event for expert tips from Professional Organizer Terry Barlow, Estate Sale Guru Daniel Sanders, local Moving Expert Ben Frakes, Junk Removal Expert Collin Wheeler, and The Peele Group at McEnearney Real Estate — Kim and Hope Peele & Nancy Smith!

This will be an informative session on how to get started and accomplish your goals, with time for Q&A.

When: Jan. 20 from 12-1:30 p.m. with extra time for Q&A.

Where: James Duncan Library, 2701 Commonwealth Avenue. Space is limited. RSVP required — on the library website (alexlibraryva.org/event/9926105) or email [email protected].

Hope Peele is a licensed real estate agent with McEnearney Associates, Inc. in Alexandria, Virginia. She grew up in Old Town and currently lives in Del Ray. As a partner with The Peele Group, Hope is dedicated to guiding her clients successfully through the many-faceted process of buying or selling a home. Contact Hope at 703-244-6115.

If you would like a question answered in our weekly column or to set up an appointment with one of our Associates, please email: [email protected] or call 703-549-9292.

McEnearney Associates Realtors®, 109 S. Pitt Street, Alexandria, VA 22314. www.McEnearney.com Equal Housing Opportunity. #WeAreAlexandria

This week’s Q&A column, sponsored and written by McEnearney Associates Realtors®, the leading real estate firm in Alexandria, is a bit of a departure from our usual format. To learn more about this article and relevant Alexandria market news, contact us at 703-549-9292. You may also submit your questions to McEnearney Associates via email for response in future columns.

Question: How important is pricing strategy in the current market?

Answer: Precise pricing is more important than ever! Even in a white-hot “Seller’s Market,” owners must be careful when pricing for maximum buyer exposure.

It’s a market that can be enticing for sellers and exhausting for buyers: record-low inventory, high interest rates, and competition around every corner.

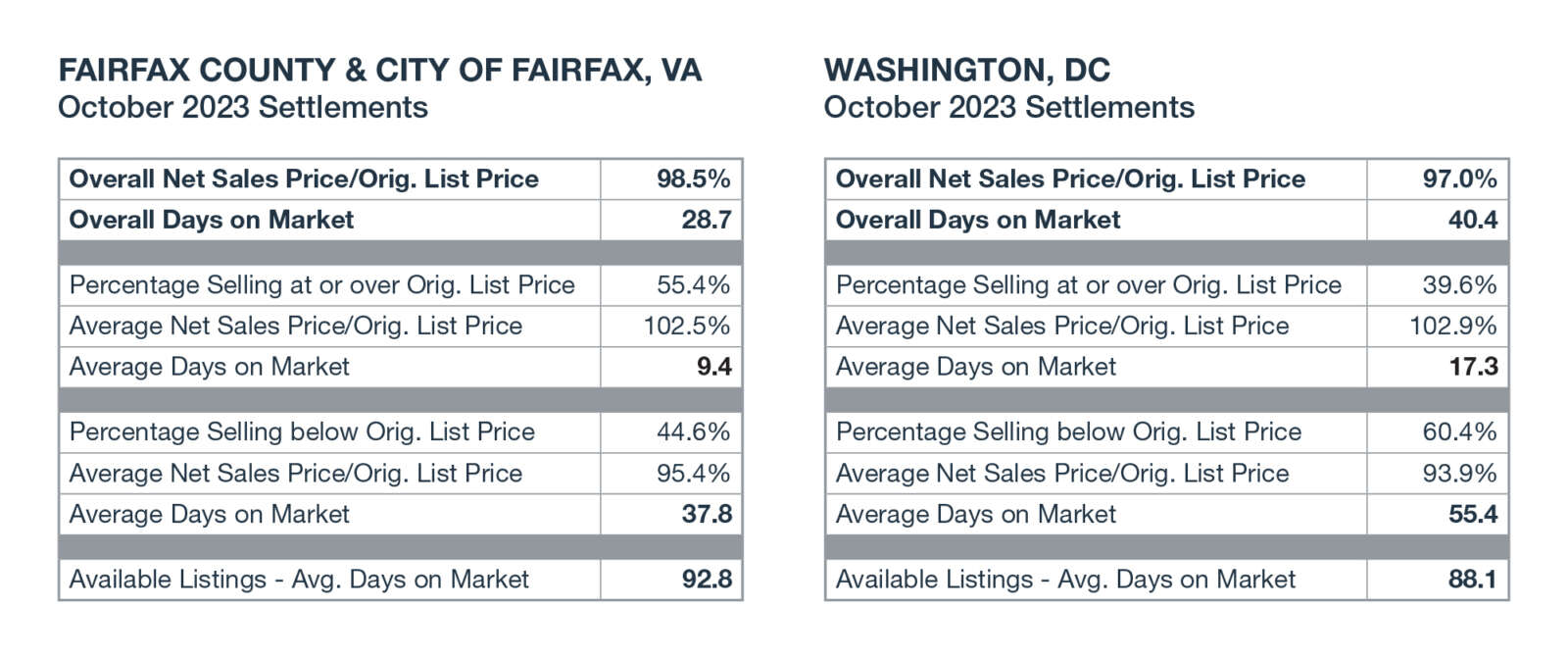

However according to David Howell, McEnearney’s Executive Vice President and Chief Information Officer, sellers still need to be smart and strategic in how they price their property. In fact, in reviewing McEnearney’s most recent statistical research, Howell observes that there are four kinds of sellers in this market — the Very Successful, the Eventually Successful, the Hopeful, and the Failures.

Let’s examine who has the numbers on their side.

The Very Successful Seller:

This is what every seller aims for but only about half of properties actually meet that goal. The “very successful” are those who sell at or above their original list, and those folks usually see a quick sale. For example, in October 2023 in Fairfax County and City of Fairfax, 55% of all homes sold fell into that “very successful “category, and those properties sold in an average of just 9.4 days and 2.5% above list.

The “worst of the best” in the metro area was Washington, D.C., where 40% of homes sold at or above list, and sold in an average of 17.3 days. That’s still pretty darn good.

The Eventually Successful Seller:

These homes sold, but below their original list price and with longer days on the market (DOM). In the City of Alexandria, about 48% of homes fell into this category in October, selling in an average of 30.7 days at 3.6% below the list price. In comparison, 52% of homes sold in six days and 1.6% above list.

The differences are significant — those “eventually successful” sellers took a month longer to sell (that’s another mortgage payment, insurance, and HOA or condo payment!) and sold for much less money. Those homes weren’t priced correctly at the outset, and the significant majority had to reduce their price before getting a contract.

The Hopefuls:

The third category of sellers are the “hopefuls.” Those are homes on the market that haven’t yet accepted an offer. In every jurisdiction we track, the average DOM for these “hopefuls” is at least twice as much as the average days on the market for homes that sold. This is where “testing the market” is at a seller’s peril. Buyers are scouring inventory for the right home and if a listing comes to market and isn’t attracting offers, holding out longer for “That One Perfect Buyer” is not going to solve that problem.

In fact, buyer mindset can affect even normally-priced homes that haven’t yet sold. If the average DOM is 7 days and your listing is at 14 DOM, some buyers may assume something is wrong with the property, even if there isn’t. This in turn brings lower offers — if any.

The Failures:

That brings us to the final category of sellers: the “failures.” We know that sounds harsh, but roughly one in every eight homes that go into the MLS expires or is withdrawn before it sells. This could be for any number of reasons — inflexible seller, significant property damage, distressed sale — but the end result is the same: no buyers were interested.

So, if most of the Washington metro area is in a seller’s market, why aren’t these homes selling? As shown, even with so many market advantages, 3 out of 4 sellers won’t sell their home right away. In most cases, this is because they simply aren’t priced in line with the reality of today’s market where many buyers have been slammed by higher mortgage interest rates.

What can a seller do to ensure they land in the “Highly Successful” camp? The first step is to work with a licensed Realtor® who will provide local market insight and guide your pricing strategy. The second is to prepare your home to attract the most qualified buyers: fix, remodel, and paint for the best first impression, and consider offering credits for buyers.

Finally, have a plan to make a pricing adjustment if the home hasn’t sold within 21 days, which appears to be the local “tipping point” when sales prices drop. In a recent study by the National Association of Realtors, a listing that is 30 DOM without an offer is likely 3-5% overpriced. Be ready to make a pricing decision that keeps you within a competitive time-and-pricing window that keeps buyers interested.

As we have noted before, there are still buyers actively engaged in the market, but they make their decisions based on value. And they don’t see value in an overpriced home. So, heed the warnings of three out of four kinds of sellers who learned the hard way: price matters and time kills.

If you would like a question answered in our weekly column or to set up an appointment with one of our Associates, please email: [email protected] or call 703-549-9292.

McEnearney Associates Realtors®, 109 S. Pitt Street, Alexandria, VA 22314. www.McEnearney.com Equal Housing Opportunity. #WeAreAlexandria

This week’s Q&A column is sponsored and written by Hope Peele of The Peele Group and McEnearney Associates Realtors®, the leading real estate firm in Alexandria. To learn more about this article and relevant Alexandria market news, contact The Peele Group at 703-244-6115 or email [email protected]. You may also submit your questions to McEnearney Associates via email for response in future columns.

This week’s Q&A column is sponsored and written by Hope Peele of The Peele Group and McEnearney Associates Realtors®, the leading real estate firm in Alexandria. To learn more about this article and relevant Alexandria market news, contact The Peele Group at 703-244-6115 or email [email protected]. You may also submit your questions to McEnearney Associates via email for response in future columns.

Question: What are the most important things I should know about caring for my home during the winter?

Answer: Great question! I frequently get reach outs from my buyers about caring for their new (or not so new) homes. After almost no snow last year, many local weather news sources are predicting a winter with lots of snow in the D.C. area. Veronica Johnson, chief meteorologist for 7News First Alert Weather has predicted “17 to 22 inches of snow for the D.C. Metro area this coming winter.”

As we are getting solidly into winter, but not below freezing yet, this is the time to make sure that you are doing some preventative maintenance. Here are a few of the most important things to do to get ready for the winter months.

Check the inside of your home for air leaks. Check all your windows for air leaks, and caulk where needed — both inside and outside. If you have any window air conditioners, this is the time to put them in storage or invest in an insulated cover. Not only will your home be warmer and cozier, but you will also have a more energy-efficient home with a more manageable heating bill.

Check the outside of your home for open entry points and potential water issues. While you are checking for air leaks, look around the exterior of your home, and cover any openings to guard against water intrusion, and also rodents that are looking for a warm hideaway. Make sure to pile fireplace wood away from your home, so that little critters don’t migrate towards the cozy inside of your home. Double check your gutters and downspouts so that rainwater and melting ice can run freely off of your roof and away from your home.

Winterize the pipes. It’s important to make sure that all your outside spigots are protected for the winter. First, turn off the water supply to outside faucets, then unhook hoses, turn on the outside spigots and drain them of all the water. Last, shut them off from the outside only, and cover them with a spigot cover. This can prevent your pipes from freezing and bursting. You should also make sure that any pipes in unheated areas are properly insulated. On particularly cold nights, you may even want to leave your inside faucets on a slow drip, so that the pipes don’t freeze. I grew up in an 1800s home and my parents still use this technique when the temperatures drop below 25 degrees.

Get a fireplace check-up. Speaking of being cozy, there’s nothing better than a lovely fire in the fireplace during the winter. This is a great time to have your fireplace inspected and cleaned, for both heat efficiency and for the safety of you and your family.

Have your furnace and hot water heater serviced. There’s nothing worse than having a furnace breakdown in the middle of winter, so it’s best to be proactive when it comes to your HVAC system. An easy way to extend the life of your furnace is to change the filter regularly. This keeps contaminants out of the system and keeps your system running smoothly. Have your local HVAC service company service the system in early winter and again in late spring, and get their advice on how often to change the filter for your particular furnace. Have the hot water heater checked while you’re at it, so that you don’t wake up to a cold home or shower.

Change the batteries in smoke and carbon monoxide detectors. These batteries should be changed once a year, so if you haven’t done it already, do it now. And if your detectors are more than 10 years old, change them out completely. There should be smoke detectors on every level of your home, including the basement.

Be ready for snow removal. Stock up now on ice melting products and grab a snow shovel or two if you don’t already have them. The worst time to be looking for these things is the day or two before a storm. Put your gloves and hat near the front door, too, while you’re at it. It’s best to be ready for snow and sleet.

It’s best to address these maintenance tasks ahead of time, so that you protect your home, keep your energy costs down, and don’t have major repairs during the coldest time of year. For lots more great information on taking care of a home, we frequently recommend a couple of home maintenance books to our new buyers. “Home Maintenance for Dummies” by James Carey is an oldie but a goodie. Another good book is “The First-Time Homeowners Survival Guide” by Sid Davis.

If you need advice, or recommendations on local contractors, don’t hesitate to reach out. Proactive maintenance not only protects your investment, but also contributes towards a stress-free winter and a cozy home. And if you need help finding your dream home, please get in touch!

Hope Peele is a licensed real estate agent with McEnearney Associates, Inc. in Alexandria, Virginia. She grew up in Old Town and currently lives in Del Ray. As a partner with The Peele Group, Hope is dedicated to guiding her clients successfully through the many-faceted process of buying or selling a home. Contact Hope at 703-244-6115.

If you would like a question answered in our weekly column or to set up an appointment with one of our Associates, please email: [email protected] or call 703-549-9292.

McEnearney Associates Realtors®, 109 S. Pitt Street, Alexandria, VA 22314. www.McEnearney.com Equal Housing Opportunity. #WeAreAlexandria

This week’s Q&A column, sponsored and written by McEnearney Associates Realtors®, the leading real estate firm in Alexandria, is a bit of a departure from our usual format. To learn more about this article and relevant Alexandria market news, contact us at 703-549-9292. You may also submit your questions to McEnearney Associates via email for response in future columns.

Question: What are the real costs of renting?

Answer: Homeownership is not for everyone. Is that a bad thing and what does it cost in the long run?

There are times when homeownership makes sense, but is this one of those times? For many, the combination of inflation, high interest rates, and steadily increasing home prices has put homebuying plans on hold, especially for Millennials and Gen Z buyers who have less purchasing power due to lower incomes, more debt, and less equity.

In a pricey area like ours, the pinch is even worse. The D.C. area’s cost of living was reported this spring to be 53% higher than the national average, while the housing portion of overall costs was a whopping 144% higher. Combined with a growing population that hasn’t kept pace with housing inventory, the supply-and-demand pressure continues to keep rents high, although there are some signs the climb may be leveling. In August it was reported that the average monthly rent in D.C. was $1,901/month, Virginia was $1,594, and Maryland was $1,741.

About 40% of the D.C.-metro area is made up of renters and a growing number of them report spending more than half of their monthly income on rent. A November report from Virginia Association of Realtors showed that compared with homeowners, renters are carrying more than two times higher housing costs. Data from the Census Bureau indicates that as of 2022 about 50% of renters were housing cost burdened in Virginia, while only 20% of homeowners were housing cost burdened (meaning 30% or more of monthly income was going toward housing costs).

But even with the financial burdens that renting can bring, it may actually be better for some in the long run to stay in tenancy. Because while rental prices have climbed, so have purchase prices. High list prices coupled with high interest rates means it now costs 52% more to own a home than to rent.

The podcast The Daily from The New York Times covered this recently and reviewed the financial paths that buyers and renters take on the way to building wealth. On one path, renters hold off on buying and invest what would have been a down payment in another way; as the investment grows the renter can increase their buying power for a time when overall housing costs may be lower. On the other path, homeowners navigate the initial high costs of buying a home and are rewarded (eventually and hopefully) with equity that grows over years of ownership.

Here are a few things to consider when deciding which is the better path for you right now. Because the market can and will shift, and “timing the market” is almost never a successful strategy.

How long do you plan to stay in the home? If it’s less than 5-7 years, it makes more sense to rent and invest cash elsewhere. Use a rent ratio calculator to determine your relative cost of renting versus buying.

How steady is your income? Annual rent increases can be unpredictable and plenty of tenants have been surprised by a sudden unexpected hike. For the most part, mortgage payments are consistent over the term of the loan (allocating for increases in taxes, insurance, and amenity fees) and easier to budget around in the long term.

What is your budget (or patience!) for home repairs? As a renter, home maintenance costs are borne by the landlord. If something goes wrong, you pick up the phone and someone else takes care of it. As a homeowner, you can expect to pay about 1% of the home’s purchase price every year toward home maintenance. But there are also big-ticket repairs — like a new roof, appliance upgrades, and systems repairs — that will unexpectedly take a bite out of your budget.

What is your lifestyle? Do you like exploring new neighborhoods? Are you a traveler and want the flexibility of trying on a new city for a while? Could a major life milestone be on the horizon? Do you simply want a low-maintenance living situation? Renting offers many benefits for people who don’t want to be tied to the responsibility of paying for and maintaining a home.

The National Association of Realtors has many resources to help decide if homeownership is the right move and where to find first-time homebuyer assistance, as well as reporting relevant data to understand current market dynamics.

And, when you’re ready to find a fantastic new rental or take the first step toward homeownership, be sure to connect with an amazing agent at McEnearney Associates.

If you would like a question answered in our weekly column or to set up an appointment with one of our Associates, please email: [email protected] or call 703-549-9292.

McEnearney Associates Realtors®, 109 S. Pitt Street, Alexandria, VA 22314. www.McEnearney.com Equal Housing Opportunity. #WeAreAlexandria

This week’s Q&A column is written by Rebecca McCullough of McEnearney Associates Realtors®, the leading real estate firm in Alexandria. To learn more about this article and relevant Alexandria market news, contact Rebecca at 571-384-0941 or email [email protected]. You may also submit your questions to McEnearney Associates via email for response in future columns.

This week’s Q&A column is written by Rebecca McCullough of McEnearney Associates Realtors®, the leading real estate firm in Alexandria. To learn more about this article and relevant Alexandria market news, contact Rebecca at 571-384-0941 or email [email protected]. You may also submit your questions to McEnearney Associates via email for response in future columns.

Question: Should I list during the holidays?

Answer: At this time of year, we get many people asking if they should list their home now, or hold on until after the new year? As always, if you need to sell, list it. However, sellers are often inclined to wait until the new year. But should they? Serious buyers are still out there looking. They are still waiting for the right home to come on the market.

It is true we often see an influx of listings and buyers in January. Holidays have a way of making people evaluate their home. We need more room! We need to downsize so we don’t have to host any more. They got engaged or for many other reasons. So, with more buyers, comes more competition. Smart buyers who are looking now will gobble up good listings coming on the market before the new year.

What does demand look like now? Even though interest rates just reached a 20-year high (fortunately they softened slightly), we still have significant demand for good houses priced well. The need to sell isn’t always something that can be timed. Jobs change, people can no longer take care of their homes, families grow, and lifestyles change.

What we saw during the COVID market was opportunity. With interest rates so low, it seemed like everyone wanted to move, and many did. Now they are happily sitting on very low interest rates and are no longer motivated to go anywhere. Even those who didn’t move took advantage of the low rates and refinanced.

So, if the timing is such that you do need or want to sell now, know there are still many frustrated buyers out there still looking for a home. There may not be as many buyers at this time of year, but the ones out there are motivated!

Great, you’ve decided to list (thank you!), what do you do about holiday décor? Do you go Christmas Vacation style to bring in lots of interest, or keep the holiday décor packed away? The answer lies somewhere in between. Nobody expects sellers to hide the season just because you’re selling, but this might not be the year to go for the neighborhood decorating award.

Keeping decorations simple, and understated, while still honoring your family customs, is perfectly acceptable. Subtle and understated is the way to go, always keeping the guidelines of staging in mind. Accent the best features in your home. Don’t put the Christmas tree in front of the window with the best view or cover up beautiful mantles and railings with too much greenery. Use decorations to accent areas of the home you want the buyer to see.

This time of year, it’s fabulous to play up the warmth in a home. The smell of fresh baked cookies, glowing flameless candles, and seasonal floral arrangements create the ambience to make buyers want to stay.

Also keep in mind if you are launching your listing during the holidays when your home is decorated, photographs will include the seasonal items. If your home does not sell before the holidays are over, you may want to consider having new pictures taken to promote the property in the new year. Even if the decorations brought out the best of your home during the holidays, seeing them in mid-January will remind buyers the home has been on the market for a while and may create red flags.

When it comes to photographs, consider a twilight photoshoot. The images taken at this time of day create a charming glow from the inside of the house. They can really show off some of the best features of your home. Large bay windows, fabulous front doors, spacious patios. Now that the trees are bare and the grass is brown, daytime photos may appear bland, but some carefully hung white outdoor lights accenting a patio or pathway lighting highlighted in a twilight photoshoot can really make the drab appear fab!

In Summary

Outside lights? Think accent lighting and bows, and less endless light strings row-on-rows.

Inside decor? Tasteful displays in selected places, not every last bobble in all of your spaces.

Gramma’s traditional home-made wahovit? Maybe keep a space in the closet to move it!

So, is selling now, during the holidays, a good idea? This year, absolutely. Buyers are looking, and there’s not much to look at. Be careful, and sensible with the decorations, and you can still blend your holiday highlights with the needs of a staged home. Make sure there are booties and hand sanitizer and know like any other time of year flexibility will be important.

Wishing you a successful selling holiday season!

Rebecca McCullough has built a successful real estate business in Alexandria and Northern Virginia by providing excellent service to her clients. If you would like more information on selling or buying in today’s complex market, contact Rebecca today at 571-384-0941 or visit her website RebeccaMcCullough.com.

If you would like a question answered in our weekly column or to set up an appointment with one of our Associates, please email: [email protected] or call 703-549-9292.

McEnearney Associates Realtors®, 109 S. Pitt Street, Alexandria, VA 22314. www.McEnearney.com Equal Housing Opportunity. #WeAreAlexandria

This week’s Q&A column is written by David Howell, Executive Vice President and Chief Information Officer, of McEnearney Associates Realtors®, the leading real estate firm in Alexandria. To learn more about this article and relevant market news, contact David at 703-855-5089 or email [email protected]. You may also submit your questions to McEnearney Associates via email for response in future columns.

This week’s Q&A column is written by David Howell, Executive Vice President and Chief Information Officer, of McEnearney Associates Realtors®, the leading real estate firm in Alexandria. To learn more about this article and relevant market news, contact David at 703-855-5089 or email [email protected]. You may also submit your questions to McEnearney Associates via email for response in future columns.

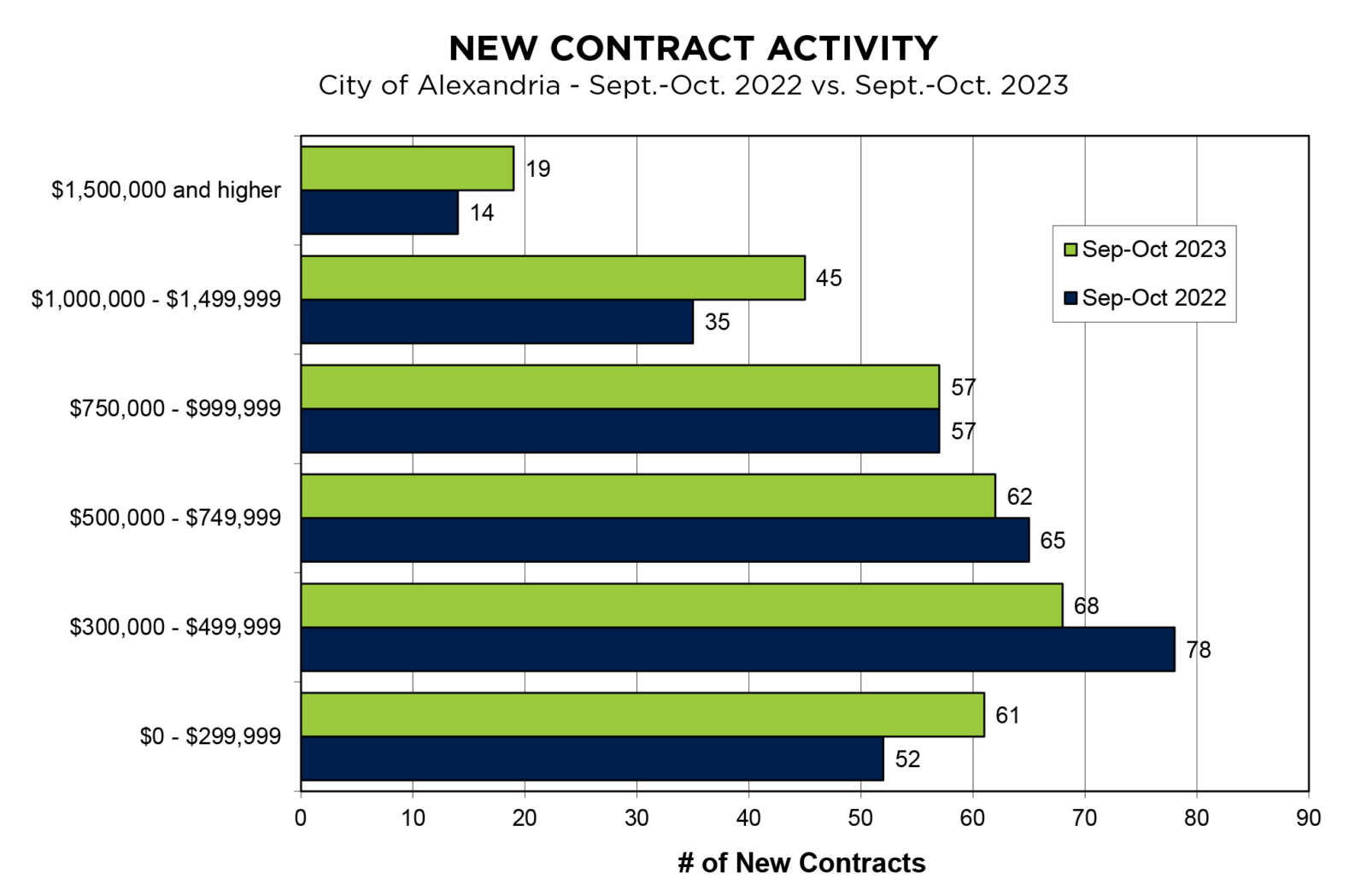

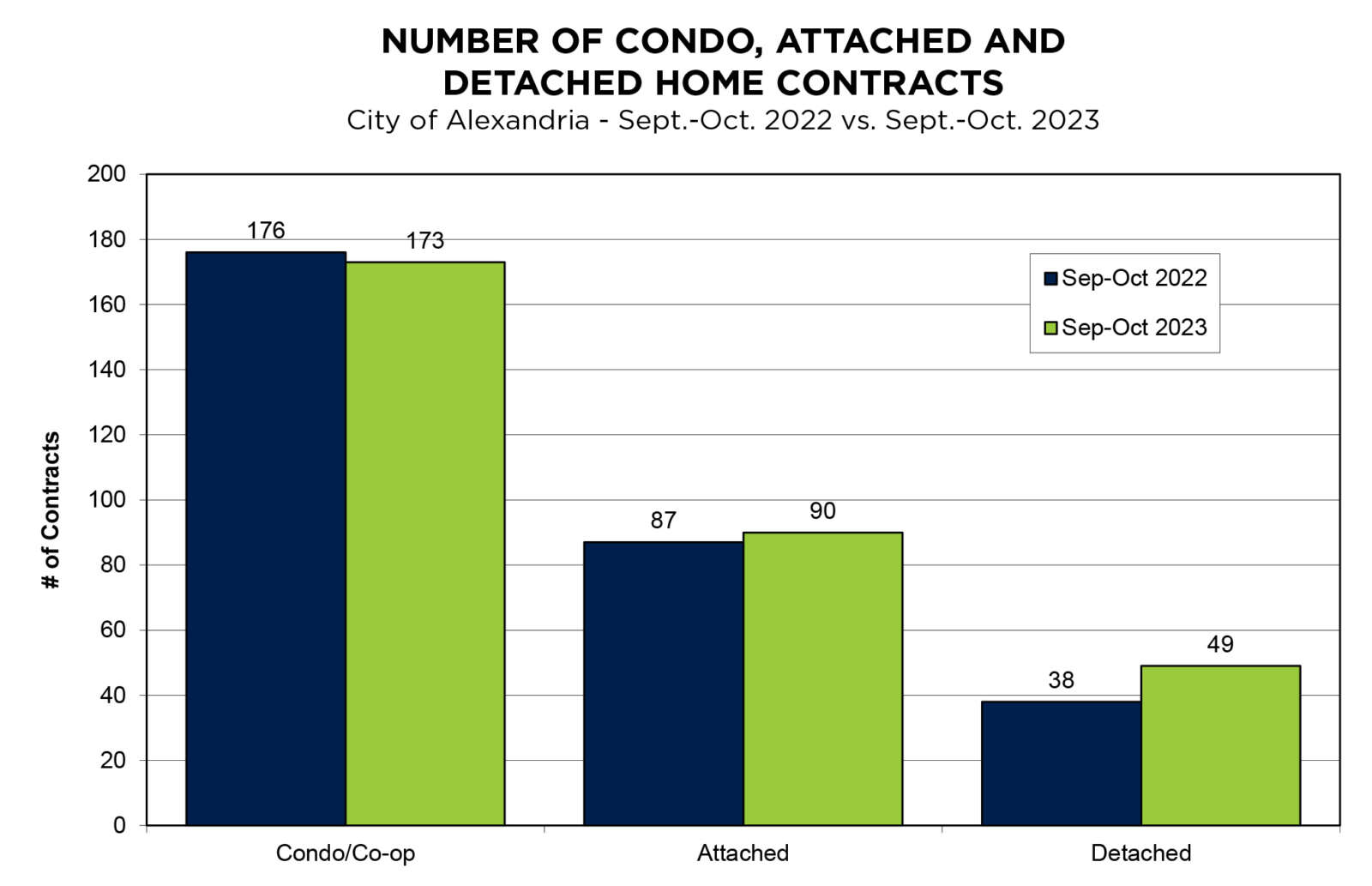

Question: What’s been happening with the local real estate market?

Answer: This week we look at contract activity for September and October of 2023 compared with the same time in 2022 for the City of Alexandria and South Alexandria (Fairfax County portions of Alexandria). The charts below show contract activity by price range and by property type (condos, attached homes, and detached homes) as well as the average days on the market.

If you are interested in more information, every month on our website we profile the most important market indicators for Northern Virginia — contract activity, interest rates, inventory, affordability, and the direction of the market — in an easy to read and digest summary followed by supporting charts and data.

City Of Alexandria

New Contract Activity

- Contract activity in the City of Alexandria increased 3.7% for September and October 2023 compared to September and October of 2022.

- Contract activity was higher for the lowest and two highest price categories.

This week’s Q&A column is sponsored and written by Hope Peele of The Peele Group and McEnearney Associates Realtors®, the leading real estate firm in Alexandria. To learn more about this article and relevant Alexandria market news, contact The Peele Group at 703-244-6115 or email [email protected]. You may also submit your questions to McEnearney Associates via email for response in future columns.

This week’s Q&A column is sponsored and written by Hope Peele of The Peele Group and McEnearney Associates Realtors®, the leading real estate firm in Alexandria. To learn more about this article and relevant Alexandria market news, contact The Peele Group at 703-244-6115 or email [email protected]. You may also submit your questions to McEnearney Associates via email for response in future columns.

Question: What’s my first step when thinking about selling the home that I’ve lived in for decades?

Answer: Selling a home can be challenging under the best of circumstances but selling a home while having to downsize can be even more daunting. Not only are you facing years of accumulated possessions with strong memories attached — for both you and for your family — but you are also trying to get your home show-ready, so that you get the best price possible. It can be difficult to know where to even start.

Many of my friends’ parents have recently started to downsize — even my own parents! In addition, I have guided many clients through the process and have witnessed firsthand how overwhelming this process can be.

My #1 recommended first step would be to plan early and #2 is to engage the expertise and support of an experienced Realtor. Your Realtor’s input and guidance will make the process go much more smoothly. Here are my top tips for navigating both downsizing and the home sale process.

Assess Your Needs

Before diving into the selling process, start with planning and soul searching. I like to tell my clients to KNOW WHERE YOU ARE GOING! Assess your needs and your preferences. Consider factors like moving into a smaller space, closer to family, or transitioning to a more manageable living situation. Understanding your goals will help you make informed decisions throughout the process. Knowing where you are going helps you to stay focused on the end goal.

Seek Professional Assistance

Hiring a real estate agent experienced in working with clients who are selling their family home can be invaluable. A knowledgeable agent can guide you through the legalities, market trends, and negotiation processes, and make sure that you get top dollar when selling your home. If you are staying local, they can facilitate the sale of your current home and the purchase of your new home, making sure that all the details line up.

Understand the Market

Stay informed about the real estate market in your area. Ask your Realtor to set you up on reports for homes selling in your current neighborhood, and to run a report on all recent sales. Having a clear understanding of the condition of those recent sales will help you know your home’s worth and will enable you to set a competitive, yet realistic price and attract the most potential buyers. Your real estate agent can guide you on how to interpret all the data.

Prepare Your Home

First impressions matter! Invest time in decluttering, cleaning, and staging your home to make it appealing to potential buyers. Every step of this process will pay off! Consider small repairs or upgrades that can enhance your property’s value and attractiveness. Fresh paint is a good place to start — not only does it brighten your home, but it also gives a nice fresh feel! Your Realtor can help you come up with a list of things to complete before going on the market, as well as help to coordinate getting things done. They have amazing contacts, because they do this every day, and they insist on quality services for their clients. Realtors have professional organizers, estate sale companies, packers, movers, stagers, and contractors who are vetted and known to be reliable and reasonably priced. You can choose some or all these services, depending on your unique needs — for your move-out or for your new home.